Best Practices for Using GST Compliance Software

GST is a unified tax system which was introduced in 2017. To make GST compliance smoother and easier, taxpayers file regular GST returns, get registered under the GST, and deduct or collect TDS/TCS respectively. Such compliance and GST liabilities can be met by using GST software or with the help of a professional service provider. Knowing the best practices for using software for GST compliance could be handy. The following are some of the tips to take care of to get optimum outcomes using GST Compliance Software.

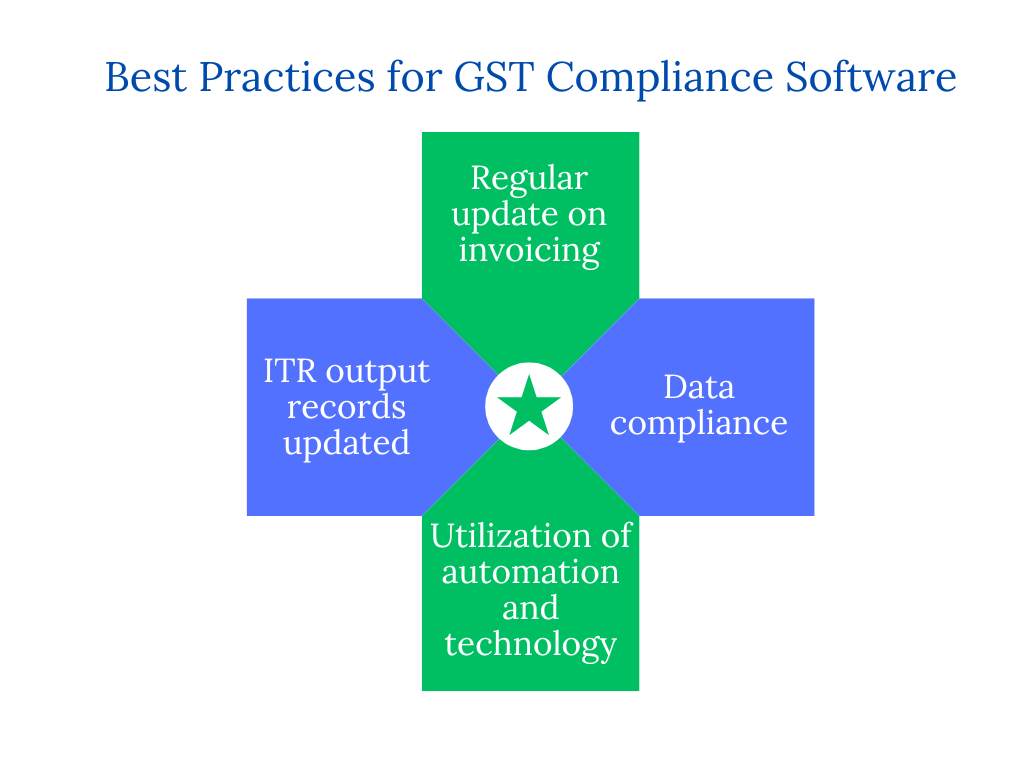

Regular Updates on Invoicing

Accurate and timely updates on invoicing result in the best preparation of reconciliation statements. Containing details like GSTIN, invoice number, date, and taxable value of supplies proves to be helpful for the taxpayers.

Software Data Compliant with Updated Data

Taxpayers should ensure that the data maintained through the GST compliance software matches with the data updated on the GST portal as it promotes transparency and credibility. Reconciling regular accounting books with the GST returns filed opens doors for structured tax compliance.

Utilization of Technology and Automation

Technologically advanced and automated tools are best for entering data, tracking due dates, generating GST-compliant invoices, and filing returns directly. It reduces the risk of human error but it solely depends on automation and requires consistency. Therefore, seeking professional help in meeting the compliance and taking other advice is more lucrative.

Professional help from expert chartered accountants ensures that taxpayers pay the tax on GST-applicable rates as they have to be filled manually with human help. For GST compliance, taxpayers cannot depend solely on software as human interference is required.

Update on Output Records for ITC

A constant record of output supplies that is updated on the official portal and the software enables the person to claim timely Input Tax Credit. The ITC supports businesses in difficult financial times by increasing the cash flow.

Dos Under GST for Compliance

- File regular returns as per the case to meet compliance

- If aggregate turnover has crossed a certain limit, get registered under the GST

- Deducting the liable TDS is a must

- Pay the tax under the appropriate tax slab for goods or services or both

- Avoid categorization of zero-rated supplies as nil rate or vice versa is important

- File the returns even in case of nil returns

- If meeting the criteria, pay tax under the Reverse Charge Mechanism or get registered under the Composition Scheme

- Rightful claim of input tax credit

By meeting compliance and filing timely returns, you can avoid getting notices. It will give your business the due recognition and promote transparency as well. But why splurge your hard-earned money on buying compliance software when you can have the best team of professionals on TaxDunia, Reach out to us now to start with