File Your TDS/TCS Returns

Home » File Your TDS/TCS Returns

File Your TDS/TCS Returns

Tax Deducted at Source and Tax Collected at Source are two important direct methods of the Indian government to ensure tax compliance. These mechanisms are designed to facilitate a timely collection of tax by deducting or collecting a certain percentage of tax on income or transactions at the source before this amount is paid to the recipient. Lodging the return of TDS/TCS is an important step in the tax compliance cycle, especially for business entities, professionals, and others required to deduct or collect tax at source.

The procedures for lodging TDS/TCS returns have been governed under the Income Tax Act of 1961, which has distinct rules and regulations that taxpayers must follow. The timely and correct filing of TDS/TCS returns not only ensures compliance with tax laws but also helps in maintaining a smooth and transparent financial system. In this article, we will explore the process of filing TDS and TCS returns, the documents involved, the deadlines for submission, and the consequences of non-compliance.

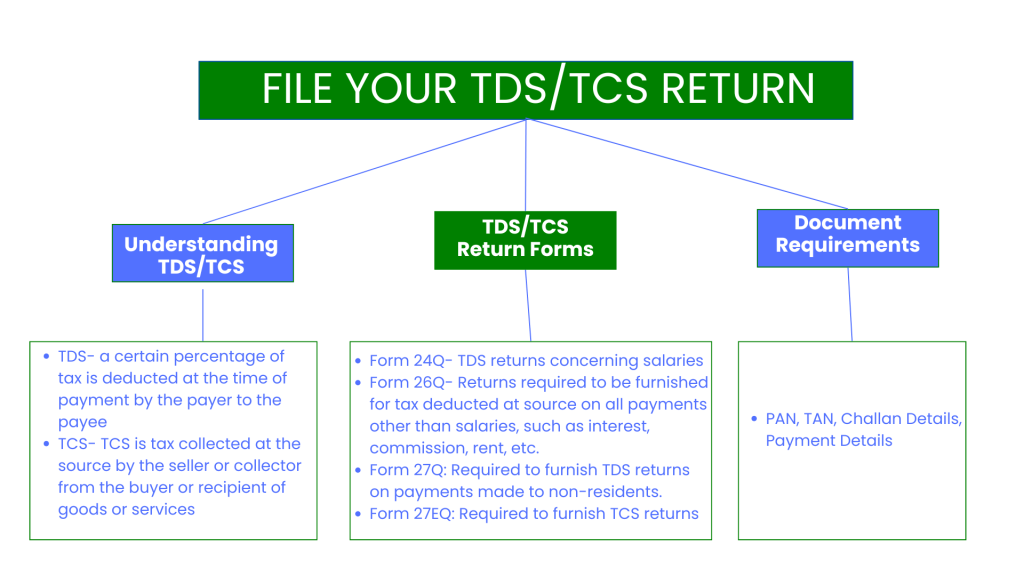

1. Understanding TDS and TCS

Before proceeding into the TDS and TCS filing process, one should understand what TDS and TCS are and how they differ. TDS is a system where a certain percentage of tax is deducted at the time of payment by the payer to the payee. TDS is applied to a range of incomes, such as salaries, interest, dividends, professional fees, and rent. What is deposited with the government is the tax deducted.

TCS is tax collected at the source by the seller or collector from the buyer or recipient of goods or services. It is applied to the sale of certain goods, such as timber, scrap, and minerals, and certain services, like liquor. Here, the seller collects tax at the time of sale and pays it to the government.

2. Who is responsible for filing TDS/TCS returns?

TDS and TCS returns, in general, are filed by persons who are responsible for deducting or collecting tax at source. This includes:

- Individuals or entities that are obligated to withhold tax on payments made to others such as salaries, contractors, or professionals.

- Organized businesses, firms, and commercial ventures through which TDS needs to be collected on payments, including rent, interest, commission, etc.

- Realtors of specified goods are mandatorily required to collect the applicable tax at the time of sale.

Sometimes, a TDS/TCS return may even be mandated for individuals and non-corporate entities if their incomes meet specific conditions, for example, if payments exceed a specified threshold or if they carry out business activities where TDS/TCS is applicable.

3. TDS/TCS Return Forms

The return of TDS and TCS is filed using the prescribed forms of the Income Tax Department. The forms differ according to the type of deductor or collector and to the kind of payment being made. The following forms are used for filing TDS and TCS returns:

- Form 24Q: For TDS returns concerning salaries.

- Form 26Q: Returns required to be furnished for tax deducted at source on all payments other than salaries, such as interest, commission, rent, etc.

- Form 27Q: Required to furnish TDS returns on payments made to non-residents.

- Form 27EQ: Required to furnish TCS returns.

All forms consist of various heads or sections that have to be used to indicate information about the deductor, deductee, and the amount of tax deducted or collected, along with details about payment. Along with this, the forms also seek other details such as the deductor’s TAN and the deductor’s PAN.

4. Rates of TDS

These are the rates of TDS on certain specified payments

TDS Sections List | Nature of Payment | Threshold (INR) | Rates Individual/HUF (%) | Rates Others |

192 | Salary | 2.5 lakhs | Slab rates | Slab rate |

192A | PF withdrawal | 50k | 10 | 10 |

193 | Interest on securities, listed debentures, and other securities | 10k | 10 | 10 |

194 | Dividends by domestic companies | 10k | 10 | 10 |

194A |

|

|

|

|

194B | Winnings of lotteries, puzzles or games | 10k in a single transaction | 30 | 30 |

194BA | Winnings from online games | – | 30 | 30 |

194BB | Winnings from horse races | 10k in a single transaction | 30 | 30 |

194C |

|

|

|

|

194D |

|

|

|

|

194DA | Maturity of a life insurance policy | 1 lakh | 2 | 2 |

194EE | Payment received from NPS | 2500 | 10 | 10 |

194G | Payment from the sale of lottery tickets | 20k | 2 | 2 |

194H | Commission or brokerage fees | 20k | 2 | 2 |

194I |

| 50k in month or 6 lakhs a year |

|

|

194IA | On transfer of immovable property, excluding agricultural land | 50 lakhs | 1 | 1 |

194IB | Rent payment made by an individual or HUF is not covered under section 194I | 50k monthly | 2 | Not applicable |

194IC | Payments under a joint development agreement to an individual or HUF | No limit | 10 | 10 |

194J |

|

|

|

|

194K | Income from units of mutual funds, such as dividends | 10k | 10 | 10 |

194LA | Compensation for acquiring certain immovable property | 5 lakhs | 10 | 10 |

194LB | Interest on infrastructure bonds to non-resident Indians | Not applicable | 5 | 5 |

194LBA | Distribution of certain income by a business trust to its unit holders | Not applicable | 10 | 10 |

194LD | Interest payment on rupee-denominated bonds, municipal debt security, and government securities | Not applicable | 5 | 5 |

194M | Payment made for contracts, brokerage, commission, or professional fees exclusive of sections 194C, 194, 194J- Individuals/HUF | 50 lakhs | 2 | 2 |

194N |

|

|

|

|

194O | Amount received from the sale of products/services by e-commerce service providers through digital platforms | 5,00,000 | 0.1 | 0.1 |

194P | Senior citizen above 75 years of age with salary and interest income, ITR not filed | Not applicable | Slab rate | Not applicable |

194Q | Payments made on the purchase of goods | 50,00,000 | 0.10 | 0.10 |

194R | Perquisite provided | 20,000 | 10 | 10 |

194T | TDS on payments made by firms to their partners | 50,000 (specified person) 10,000 (others) | 1 | 1 |

206AA | TDS is applicable in case of non-availability of PAN | Not applicable | 20 | 20 |

5. Documents Needed for Filing Returns of TDS/TCS

A few essential documents to file a TDS or TCS return are as follows, providing all the information of the amount deducted or collected as tax:

- TAN (Tax Deduction and Collection Account Number): This is a unique number assigned to every entity or individual who deducts or collects tax at source. Mandatory for TDS/TCS return.

- PAN (Permanent Account Number): The return must contain the PAN of both the deductor and the deductee. The PAN of the deductee is critical because it is used to credit the deducted tax to the proper account.

- Challan Details: The challans are the receipts for tax payments made by the deductor. Provide the details of the challan utilized to deposit the TDS/TCS with the government.

- Details of Payments: The information regarding the payments rendered to the deductees, and the consideration amounts along with the nature of payment and the corresponding TDS/TCS rates.

The other important documents that need to be ready before submitting the TDS/TCS return are TDS certificates, which are issued by the deductor to the deductor about the tax deducted at the source.

All these documents will be required at the time of filling up the TDS/TCS returns for reporting and verification accurately.

6. Filing Deadlines of TDS/TCS Returns

The deadlines for filing TDS and TCS returns are prescribed by the Income Tax Department, and these deadlines vary depending on the quarter of the financial year. Typically, TDS/TCS returns are filed every quarter. The deadlines for filing the returns are as follows:

For TDS:

- First quarter (April–June): 31st July

- Second quarter (July–September): 31st October

- Third quarter (October–December): 31st January

- Fourth quarter (January–March): 31st May (of the next financial year)

Instead of writing it like this only:

For TCS

- First quarter (April–June): 15th July

- Second quarter (July–September): 15th October

- Third quarter (October–December): 15th January

- Fourth quarter (January–March): 15th May (of the next financial year)

Meeting these deadlines is important in order to avoid penalties and interest charges. Section 234E of the Income Tax Act imposes a penalty on non-filing of returns, and interest will be charged for late payment of taxes.

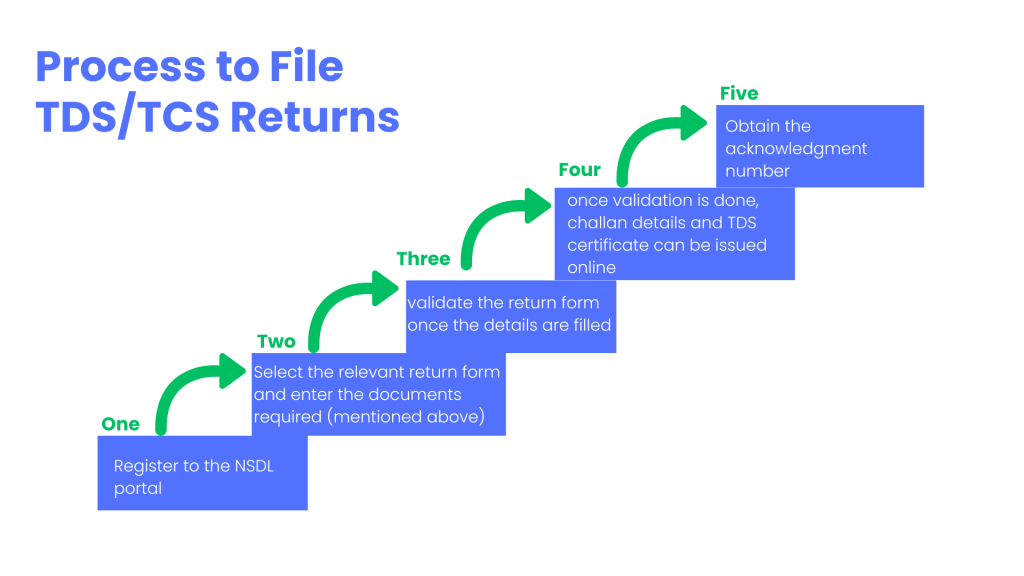

7. Process Related to Filing of TDS/TCS Returns

Filing a TDS/TCS return involves several steps. The general steps involved in filing for TDS/TCS return are as follows:

- Step 1: Registration on the NSDL Portal: The very first step involved in the return filing process is registering on the official portal available with the National Securities Depository Limited, which deals with the TDS/TCS returns filing. To do this, a TAN is required.

- Step 2: Filling the Return Forms: Once registered, log onto the portal with your user ID and password, fill in the relevant return form (24Q, 26Q, 27Q, or 27EQ) based on your nature of business and type of TDS/TCS. Enter the required details such as the TAN, PAN, challan numbers, deductee details, and tax amounts.

- Step 3: Validation of Return Once the return form has been filled, the next step is to validate the return using the NSDL portal validation tool. This will authenticate whether the details entered are all correct and in the right format.

- Step 4: Furnishing the Return: Once validated, the return can be furnished online. The following forms must be uploaded – challan details and TDS certificates in Excel.

- Step 5: Obtaining the Acknowledgement Number: After furnishing the return, you will be provided with an acknowledgment number. You must preserve this number for further use because it forms evidence of filing.

- Step 6: Payment of Tax (if applicable): Any balance tax payable needs to be paid before filing the return. Payment can be made either through online challans on the NSDL portal or the website of any of the designated banks.

8. Consequences of Not Filing TDS/TCS Returns

If TDS and TCS returns are not filed, it may attract various consequences. These include:

This entails a late filing penalty. Section 234E of the Income Tax Act states that there would be a penalty of Rs200 for every day if the return is filed late for TDS/TCS. However, this does not exceed the amount of tax deducted or collected.

- Interest on Late Payment of Tax: If the TDS or TCS amount is not paid on time, interest under Sections 234A, 234B, and 234C will be levied at the rate of 1% per month or part of the month.

- Disallowance of Expenditure: In case TDS is not deducted or deposited within due dates, Section 40(a)(i) and Section 40(a)(a) of the Income Tax Act may also disallow such expenditure.

- Prosecution for Non-Compliance: In extreme cases, prosecution under Section 276B of the Income Tax Act may be initiated to even go with imprisonment.

9. What is Form 16A?

The Form 16A is referred to as the TDS Certificate, which the tax deductor has deducted at the source from the deductee. It is a fundamental form that the Income Tax Department asks when the deductee files Income Tax Returns.

It gives a complete summary of the taxes deducted at the source as to facilitate reducing the total tax amount. The deductor should sign and issue the Form 16A within 15 days of filing the returns for a quarter. The form 16A is applicable on all payments other than the following ones

- Salary u/s 192

- Sale of immovable property u/s 194-IA

- Property rental u/s 194-IB

10. TDS/TCS Correction and Revisions

In case of errors or omissions in the filed TDS/TCS return, a correction or revision can be filed to correct the mistakes. For this, the “Online Correction” option is provided on the NSDL portal. In this process of correction, the erroneous details are updated and the return is re-submitted. Corrective measures need to be filed as soon as possible to avoid penalty or interest for non-compliance.

Conclusion

Filing returns on TDS and TCS is a significant part of tax compliance and ensures that the said tax has been collected at the source and deposited with the government in time. Correct and timely filing prevents various penalties, interest, and other legal consequences for the business and the individual. Get Started with TaxDunia.

Get Started with TaxDunia Today

TaxDunia makes filing the TDS/TCS Returns process easier through expert guidance and simple tools regarding TDS and TCS returns. By partnering with TaxDunia, taxpayers can easily navigate the complexities of tax laws, ensuring seamless compliance and peace of mind.