TDS/TCS Returns

Home » TDS/TCS Returns

TDS/TCS Returns

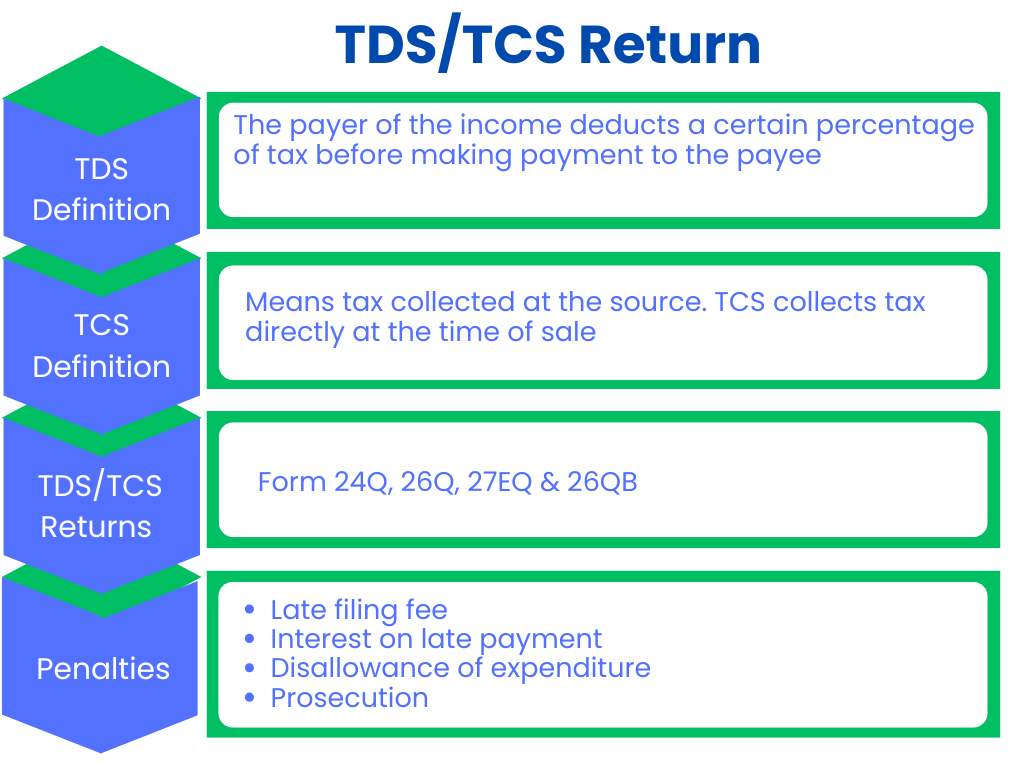

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are instruments provided by the Indian government for the efficacious collection of taxes. They act as a means to lighten the burden of tax payments on the taxpayer and help collect taxes at the earliest stage that would arise in the process of income generation or business transactions. The filing of TDS and TCS returns on time is an essential compliance requirement for any individual or business entity that deducts or collects tax at source.

In this article, we are going to discuss in detail the process of filing TDS and TCS returns; the respective forms; deadlines for submitting; required documents; and the consequences of non-filing. Understandably, whether a business person, a salaried person, or an investor, it is extremely important to know how to file TDS and TCS returns in order not to incur penalties and interest charges and for proper record-keeping.

1. What are TDS and TCS?

TDS is a scheme under which tax is deducted at the source of the income. That is to say, the payer of the income (e.g., employer, bank, or company) deducts a certain percentage of tax before making payment to the payee (employee, contractor, or professional). The tax so deducted is deposited with the government. The objective of TDS is to collect tax at the source of income generation so that the incidence of tax evasion is minimized.

TCS, on the other hand, means tax collected at the source. It is similar to TDS, but instead of TDS, which collects tax from others and retains it in the account, TCS collects tax directly at the time of sale. TCS is usually levied on specific goods and services sold, like scrap, minerals, or alcohol, from the seller or service provider. The collected tax is then remitted to the government by the seller or service provider.

TDS as well as TCS is regulated by the Income Tax Act of 1961, and the rules under this Act do contain procedures, rates, and conditions regarding its implementation.

2. Who has to file TDS/TCS returns?

TDS and TCS returns are to be filed by the persons or organizations that are liable to make a deduction or recovery of tax at source. These are:

- Employers, who deduct TDS from salaries.

- Businesses and companies that deduct TDS on payments made for services, rent, professional fees, interest, etc.

- Government agencies or any organization that is required to deduct or collect income tax paid to others.

- Sellers or service providers who collect TCS on specified transactions like the sale of timber, scrap, or liquor.

- The requirement to file TDS and TCS returns also extends to non-corporate entities if they meet the threshold criteria for TDS/TCS deduction or collection. Even individual taxpayers who engage in certain specified transactions may be required to file TDS/TCS returns.

3. Types of TDS/TCS Returns

Forms for filing TDS and TCS returns are different depending on the nature of payment and whether the deductor or the collector is natural or artificial. The income tax department has prescribed specific return forms for various types of payments as listed below:

- Form 24Q: This form is used for filing TDS returns related to salaries. The form, the returns relating to taxes deducted by employers from salary, must be filed.

- Form 26Q: Used for filing TDS returns related to non-salary payments like interest, rent, commission, and professional charges.

- Form 27Q: This form is filed for TDS returns on payments to non-residents or foreign companies.

- Form 27EQ: This return form is used for filing TCS returns. It covers situations where tax is deducted at source by the seller or service provider.

All of these forms, show details about the deductor, the deductor, the nature of payment, and the amount of tax deducted or collected. The return form has to be filed every quarter, and the information provided should be perfect and updated.

4. How to File TDS/TCS Returns

The process for filing TDS/TCS returns begins by fulfilling the registration procedure for obtaining a TAN. One needs to follow these steps:

Step 1: Registration for TAN

A TAN (Tax Deduction and Collection Account Number) issued by the Income Tax Department is required to be obtained by the deductor or collector before furnishing TDS or TCS returns. It has an identity of its own and refers to the identification of the entity responsible for deducting or collecting tax at the source. It is an essential mandate that a TAN should be obtained to file TDS/TCS returns.

Step 2 Preparing the Return

Once the TAN is generated, the next step is preparing the TDS/TCS return making use of the relevant form. The return form would need such details as the TAN of the deductor, PAN of the deductee, nature of payment, and amount of tax deducted or collected. Taxpayers may prepare the same manually or with the help of online software that makes it easy.

Step 3: Return Validation

After entering the information, the return needs to be validated using the validation tool available on the NSDL portal. The portal verifies the form for errors to ensure that the information entered is correct and in the prescribed format.

Step 4: Submission of the Return

Having the return validated, it has to be submitted online through the NSDL portal. The return is submitted electronically and will receive an acknowledgment number, which acts as proof of filing.

Step 5: Payment of Tax

If there exists any tax payable, it shall be made and paid by the deductor or collector before filing the return itself. The tax can be paid online using challans and details thereof must be furnished in the return of TDS/TCS.

Step 6: Receipt of Acknowledgment

After filing the TDS/TCS return successfully, an acknowledgment will be obtained. The acknowledgment is called the ‘Filing Acknowledgment.’ The same has to be kept for further reference as proof that the return has been filed.

5. Documents Required to File TDS/TCS Returns

While preparing the TDS/TCS returns, certain documents and information are required to be furnished. They include:

- TAN (Tax Deduction and Collection Account Number): Observe that TAN is an essential document to be used while filing the TDS/TCS returns. Carry all these details readily available during the return-filing process.

- PAN (Permanent Account Number): The PAN of the deductor and the deductee has to be clearly reflected in the return. PAN of the deductee is very essential since his account has to be credited after the deduction of tax.

- Challan Details: Challans are evidence of the tax paid to the government. The details of these challans must accompany the return to ascertain whether or not the deducted or collected taxes have been properly deposited.

- TDS/TCS Certificates: These certificates, such as Form 16 (for salary income) or Form 16A (for non-salary income), are issued by the deductor to the deductee to show the amount of tax deducted. These certificates must be referenced when filing returns.

- Income Details: The type of each receipt, whether in the form of salary, interest, rent, professional fees, or otherwise, shall also accompany the return. This information ensures that the right tax rate applied to each particular payment can be accessed.

6. Filing Deadline of TDS / TCS Returns

The Income Tax Department has fixed deadline dates for the submission of returns about TDS and TCS. They remain typically on a quarterly schedule and need to be followed to avoid penalty charges. The general deadlines for submitting the return under TDS are as follows:

- For Quarter April – June: 31st July

- For Quarter July – September: 31st October

- For Quarter October – December: 31st January

- Fourth Quarter (January – March): 31st May (of the next financial year)

The due dates of TCS returns are broadly akin to TDS returns but then again can vary slightly based on whether it is a TCS return or a TDS return.

7. Penalties for Non-Compliance

Delayed or non-filing of TDS/TCS returns can attract several penalties and interest levies under the Income Tax Act. Some common penalties include:

- Late Filing Fee: As per Section 234E of the Income Tax Act, there is a penalty of ₹200 per day liable for any delay in filing the TDS/TCS return. As such, the payable amount should not be more than the total TDS/TCS for the said period.

- Interest on Late Payment: If the tax paid is delayed, interest on account of Section 234A, Section 234B, and Section 234C is levied. The general rate of interest is 1% for each month or for part of the month on the amount of tax payable.

- Disallowance of Expenditure: If the TDS is not deducted or deposited within the time specified under the Act, the exemption of expenses under Section 40(a)(a) of the Income Tax Act may be denied to the deductor. This would likely raise the tax liability of the business or individual.

- Prosecution: As punishment for wilful non-compliance or evasion of the requirement of TDS/TCS, the deductor or the collector may suffer imprisonment as a prosecution under Section 276B of the Income Tax Act.

8. Amendments and Corrections of TDS/TCS Returns

In case an error is found in a filed TDS/TCS return, the return can be revised. This can be done online through the NSDL portal using the “Correction Statement” feature. The revised return should include the correct details, and a new acknowledgment number will be generated. If a discrepancy is identified after the return has been filed, it is essential to make corrections as soon as possible to avoid penalties and ensure accurate tax reporting.

Conclusion

In other words, TDS and TCS returns are a part of tax compliance filing, and getting it done on time is a critical exercise to record correct tax deductions and collections with the government. It saves the taxpayer from rigorous litigations along with interest and other legal consequences. Start with expert guidance.

Get Started with TaxDunia Today

TaxDunia's experienced guidance and resources would help one navigate through the return preparation process of TDS/TCS, making it free from hassle and drama. This platform through taxdunia.com simplifies the return filing process, thus offering professional support in making the entire return filing process smoother and more efficient. Therefore, by partnering with TaxDunia, taxpayers can be assured that their returns are being filed correctly and on time to avoid the risk of errors and non-compliance.