TDS on Immovable Properties

Home » TDS on Immovable Properties

TDS on Immovable Properties: An In-depth Analysis

India’s taxation system utilizes several mechanisms to collect taxes promptly, and one of them is the TDS mechanism. TDS is deducted at the time of payment of various sources of income, such as salary, professional fees, interest, and rent. The Finance Act of 2013 brought about a significant change concerning immovable properties deduction of tax has now become mandatory for buyers while making payments for the purchase of the property. This provision was mainly made to bring more transparency and make sure that the government receives taxes on transactions related to immovable assets. The understanding of the applicability of TDS on immovable properties, conditions that apply to it, and procedural aspects plays an important role for both a buyer and seller of property in India.

This article details the provision made by the TDS towards immovable property, along with the requisite rates, exemptions, and the procedure for filing TDS in such transactions. This piece further throws light upon how this provision would affect the buyer and the seller’s overall scenario, to give a nuanced understanding of the TDS involved in property sales within the Indian taxation framework.

1. Introduction to TDS on Immovable Properties

TDS from immovable properties is governed by Section 194-IA of the Income Tax Act, 1961. There is a provision according to which TDS has to be given by the buyer when the consideration paid towards the purchase of immovable property is over ₹50 lakhs. The law applies to all sales of land, residential or commercial properties, or other immovable assets.

The rationale for this provision was to curb the underreporting and concealing of actual values in property transactions, which often led to tax evasion. Ensuring the deduction of TDS at the time of payment by the buyer ensures an upfront payment of some tax. This provision is beneficial not only to the government but also to the seller, as it ensures that the sale transaction is transparent and recorded with the tax authorities.

2. Who can deduct TDS on Immovable Properties?

TDS on immovable property is to be deducted by the buyer. It is one of the essential components of the provision because it puts the onus of tax compliance upon the buyer rather than the seller. In other words, the buyer shall reduce TDS before making payment to the seller for the property. In other words, if a buyer is paying ₹60 lakhs for a property, they must deduct 1% (₹60,000) as TDS before making the payment to the seller. It is also worth noting that TDS on immovable properties applies only to the buyer. The seller has no obligation to deduct or pay TDS. The buyer must, therefore ensure that the TDS is deposited with the government and that the relevant paperwork is done.

3. The TDS Rate on Immovable Properties

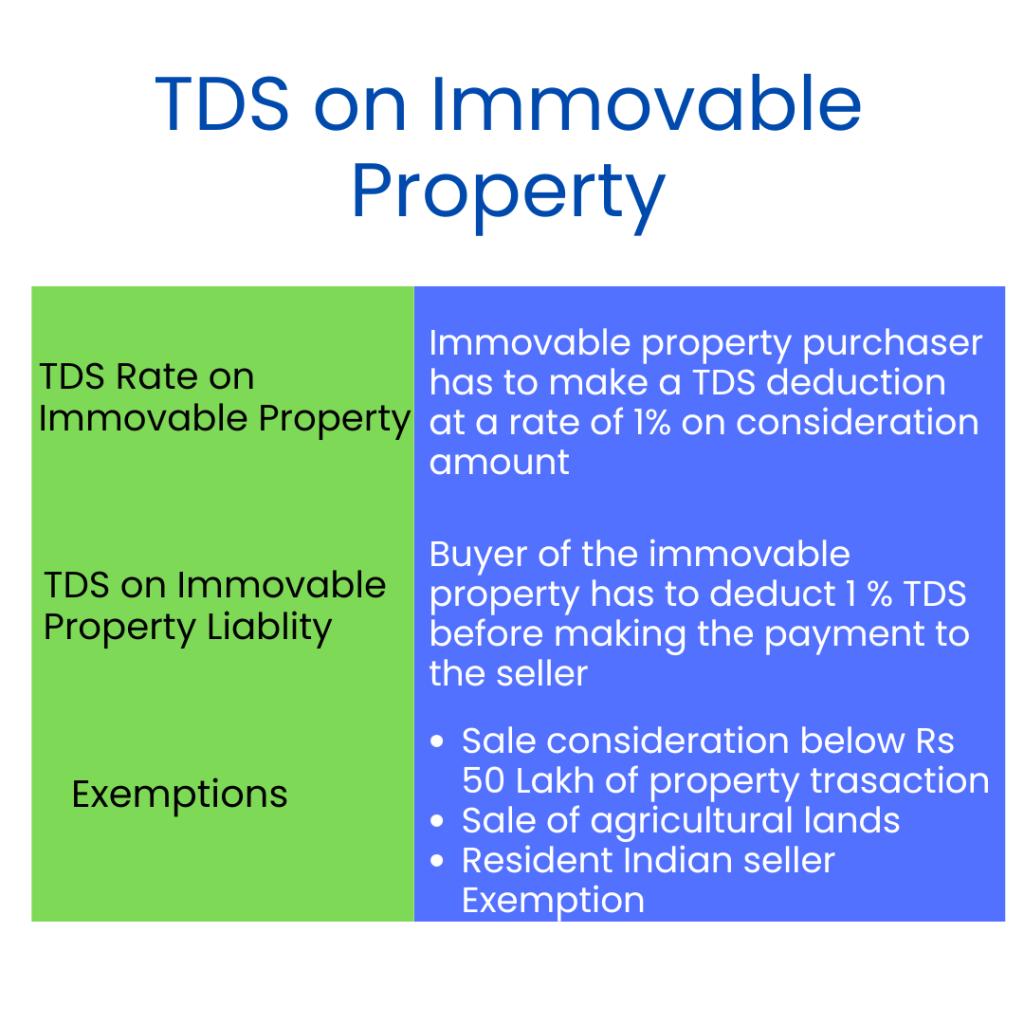

According to Section 194-IA of the act, the purchaser of immovable property has to make a TDS deduction at a rate of 1% on the amount of consideration paid for the immovable property. This rate is to be followed for individuals and entities making the purchase. It should be pointed out that the TDS rate is static at 1% irrespective of the residential status of the buyer, whether the buyer is an individual, a company, or some other type of taxpayer.

The important thing to remember is that the 1% TDS will apply to the total sale consideration of the property. Sale consideration comprises not only the price for which the property is sold but also all other expenses incurred by the buyer to acquire such a property, including stamp duty, registration fees, etc. Even though these additional costs may not be sometimes specifically mentioned in the sale agreement, they should be taken into consideration while calculating TDS.

4. Exemptions from TDS on Immovable Properties

While the general rule is to deduct 1% TDS on property transactions of above ₹50 lakh, there are some exemptions or conditions under which TDS does not apply. These are as follows:

- Sale Consideration Below ₹50 Lakhs for Property Transactions: In cases of immovable property, if the sale consideration is less than ₹50 lakh, TDS is not applicable. That means, if the property transaction value is ₹49 lakh or less, there is no requirement for the buyer to deduct TDS.

- Sales of Agricultural Lands: If the immovable property to be sold is agricultural land, TDS under Section 194-IA is not levied, regardless of the value of the consideration. This is exempt because agricultural land is specifically exempted under Indian law.

- Resident Indian Seller Exemption: When a seller is a resident Indian and the property is being sold below its market value, or the transaction falls under specific provisions of the Income Tax Act, wherein the capital gains tax is exempted, no TDS would be applicable. The exemption is relatively onerous and is available only if the conditions for such exemption are satisfied.

- Non-resident Sellers: In cases where the seller is a non-resident, the buyer may need to deduct TDS under a different section of the Income Tax Act, such as Section 195, which deals with payments to non-residents. The TDS rate may vary based on the nature of the payment and the provisions of any applicable Double Taxation Avoidance Agreement (DTAA).

5. The Process of Deducting and Depositing TDS

The process of deducting and depositing TDS on immovable properties is relatively straightforward but involves a series of steps to ensure that the Income Tax Act is adhered to. The following is a step-by-step guide on how the TDS should be deducted and deposited:

Step 1: Deduction of TDS

The buyer has the obligation to withhold 1% of the gross sale consideration while paying the amount to the seller. It is the duty of the buyer to calculate TDS on the entire sale amount along with any other extra costs like stamp duty, registration fees, etc.

Step 2: Payment of TDS

Now, the buyer needs to deposit the tax amount to the government through Challan 26QB after deducting TDS. This challan can be filed either online on the NSDL website or through the Income Tax Department’s e-filing portal. It should be paid within 30 days from the end of the month in which TDS has been deducted.

Step 3: Issuance of TDS Certificate Form 16B

After the TDS is paid, the buyer must issue a TDS Certificate Form 16B to the seller. The certificate is one proof of having deducted and deposited TDS with the government. The seller would subsequently use this certificate to claim the credit for paying the tax while filing his or her income tax return.

Step 4: TDS Details

To do all this, he must, under step 4 file of TDS return detail, the amount of TDS deducted and deposited for each transaction filed quarterly, in form 26 QB detailing the TDS deducted and the amount deposited online. It must be done within the prescribed deadline through the TIN portal.

Step 5: Seller’s tax filling

Once the Form 16B is received, the seller must use it to claim credit for TDS while filing their return. This is because a seller can offset the TDS deducted from his sale of property against the seller’s overall tax liability.

Form 26QB: Challan Cum Statement

Form 26QB is a statement cum challan form and individuals buying immovable property worth more than Rs 50 lakhs have to file this form. When these buyers make payment to the seller, they deduct TDS on the total amount and submit it to the government by filing the form 26QB within 30 days.

The buyer does not need to deduct TDS on payments below Rs 50 lakhs, and the rate of TDS for payments worth above Rs 50 lakhs is to be 1%. To file the Form 26QB. visit the official portal of TIN NSDL.

Penalties for Non-Compliance

A buyer who has not complied with the TDS provisions about immovable properties will incur a variety of penalties under the Income Tax Act and consequences. These consequences may include, among others:

- Late Filing Fee: Under Section 234E, if the buyer delays filing of TDS returns (Form 26QB), the assessee will have to pay a late filing fee. The late payment fee is ₹200 per day for each delayed day, subject to a maximum limit that is applicable to the TDS amount payable.

- Interest for Delayed Payment: In addition to the late filing fee, under Section 201 and Section 234A interest is levied upon delay in payment of TDS. It is 1% percent a month or part of the month for every delay.

- Disallowance of Expenditure: If TDS is neither deducted nor paid on time, the buyer may not have the payment on that property accounted for in his taxable income.

- Prosecution: In the case of willful negligence or deliberate non-compliance, Section 276B may be invoked and the buyer might even face prosecution, which may result in some imprisonment or additional penalties.

TDS on Immovable Property: Impact on Buyers and Sellers

It has been having a large impact on buyers and sellers since TDS was introduced on immovable properties. For the buyer, the onus of deducting tax will lie in their hands, and hence, their compliance with relevant provisions of the Income Tax Act is crucial. Though seemingly an added hassle, it safeguards the upfront payment of taxes, and there is an added advantage of reducing the risk of encountering disputes at the time of sale.

Requirement of TDS for sellers, TDS ensures that they have a formal acknowledgment of the transaction from the buyer. In addition, it safeguards against tax evasion since the deducted TDS is automatically recorded with the government. However, sellers have to ensure their returns are filed accurately to claim the TDS credit and avoid unnecessary complications in their tax filings.

Conclusion

Understanding and doing TDS provisions on immovable property transactions would be important for any buyer or seller. The right deduction should be made in time along with the payment and filing of TDS returns so that there are no legal issues and transactions follow full transparency.

Get Started with TaxDunia Today

Here, at TaxDunia, there is expert guidance and support for individuals and businesses entrenched in quite complex situations. With professional advice and an easy-to-use platform, TaxDunia helps it easy and smoother. Our TDS filing process will ensure that tax compliance is undertaken seamlessly and effectively.