Input Tax Credit (ITC)

Home » Understanding Input Tax Credit (ITC)

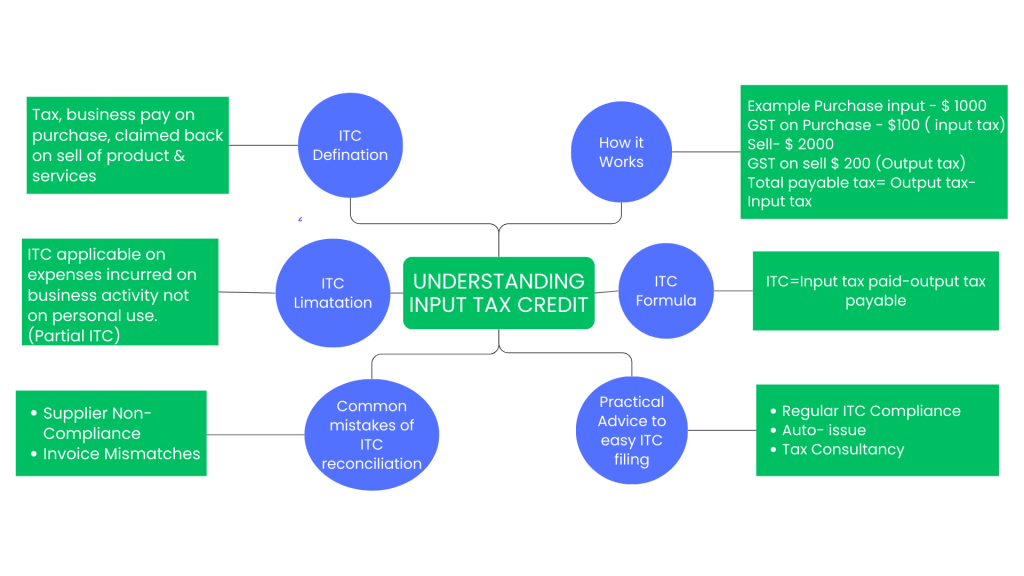

Understanding Input Tax Credit

In the domain of indirect taxes, the Input Tax Credit (ITC) is one of the most beneficial provisions for businesses. It enables businesses to reduce the tax they’ve paid on purchases, thereby avoiding the cascading effect of taxes, where tax is paid on already-taxed goods or services. In this system of Goods and Services Tax, ITC provides business entities with an option of adjusting their input tax incurred on purchases against the liability of output tax on sales. Why is ITC Important?

This, with the ITC mechanism, the end customer carries all the tax burden as borne by businesses who also saw their tax costs arising out of inputs decrease significantly. ITC is inevitable for manufacturers, retailers, and even service providers to pass the benefit to reduce their total cost of production as a whole, encourage clarity, and achieve compliance with the GST structure.

How Does Input Tax Credit Work?

ITC at its very root is the mechanism through which a credit facility takes place. It’s because when a firm acquires goods or services, paying GST on that amount is called input tax. At a later time, if the firm sells those goods or services and charges GST from the buyer, this is called an output tax. The firm may subtract the amount of the output tax incurred by the firm as an offset to the amount of the input tax paid by the firm. Hence, the amount of the value of goods and services need not be charged as tax twice.

For example, a manufacturer purchases inputs of $1,000 in raw material and pays $100 GST on the same input tax. He can recover this input tax amount of $100 paid on inputs as ITC when he sells his finished product for $2,000 and collects $200 GST as output tax. Now, his net tax payable to the government is $100 ($200 output tax – $100 input tax).

Eligible and Non-Eligible Items under ITC

The few allowable expenses under ITC for GST are as follows: Business activity-linked eligible expenses, covering raw materials, machinery, and direct expenses in business operations.

Ineligible: Motor vehicles, as used for personal use, goods consumed by the person himself/herself, and particular construction materials are some of the inelastic categories for ITC. That’s because these restrictions are meant to ensure that such ITC is claimed only for business expenses.

Conditions for Availing ITC

Avail of ITC is subject to certain conditions under the GST law, which a taxpayer has to meet-

- Registration of Taxpayer: The buyer should be a registered GST taxpayer.

- Use for Which the Goods or Services are Being Acquired: The goods or services are to be used only for business.

- Tax Invoice of Supplier: The tax invoice issued by the supplier must be issued with complete and accurate details.

- Receipt of Goods/Services: ITC is available only when goods or services are received by the buyer.

- Vendor Compliance: The vendor needs to have paid the GST to the government. This is verified from the filed returns of the vendor.

- Time Bar: ITC generally needs to be claimed before the end of the financial year or in certain cases, by the due date of filing the September return of the subsequent year, whichever is earlier.

Non-Compliance with Conditions

If these provisions are not met, businesses are likely to lose the right to claim ITC or get penalized. Misdeclaration or claims without proper documents attract audits, fines, and in extreme cases, criminal liability.

Partial ITC Example

In cases where an asset has been partially used for business purposes and partially used for personal purposes, then the ITC can be only claimed to that extent of business utilization. For instance, consider the example whereby a car is purchased for business usage with 60 percent being business purpose usage and 40 percent of personal purpose usage. In that instance, GST on such a car would carry ITC to the tune of only 60 percent.

In the case where a business manufactures supplies that are taxable as well as exempted, ITC should be apportioned by the amount of taxable supplies made. In this case, strict tracking and documentation on the exempted sales should be observed to avoid claiming ITC.

This is the process of ITC reconciliation wherein the details of ITC claimed by the taxpayer in his records are matched with those particulars provided in the supplier’s records at the GST portal. In this way, ITC claims will not be in error and also will protect against fraud.

The GST system comes up with three return forms, which are mainly applied to:

GSTR-1: Filed by the supplier, providing details of sales.

GSTR-2A and GSTR-2B:

Those forms are to be prefilled by the supplier and passed on to the buyer disclosing his ITC entitlement based on the filings of his suppliers.

Why Reconciliation be done at regular intervals?

Reconciliation should be done periodically as discrepancies and mismatches occur between the records of the taxpayers and GST portal data. Failure in reconciliation may even lead to fewer ITC claims or increased tax liability for the taxpayers.

Common Mistakes of ITC Reconciliation

- Supplier Non-Compliance: If a supplier did not file returns or has not paid his taxes, then the buyer’s ITC may become affected.

- Invoice Mismatches: ITC claims are rejected if invoice details are not matched (example: invoice no, date, GSTIN).

- In some cases, the problem is due to a delay in invoices on the GST portal; the ITC claim does not match the record.

How to settle ITC differences?

GSTR-2A/2B Comparison at regular intervals: Internal records need to be periodically cross-matched.

Communication with Suppliers: Since suppliers have direct involvement with ITC claims of the buyer party, they have an equal responsibility towards their GST return filing.

Error rectification requests: In case there are differences communicate to the respective suppliers to resolve these errors.

Challenges and Practical Advice to Easy ITC Filing

Problems in Filing of ITC

Complexity in Compliance: Due to variations in the regulatory structure in different states, maintaining compliance at every location is quite challenging.

ITC Reversals: If the supplier is not in compliance, then the ITC claimed needs to be reversed which adds up the tax liability for the buyer.

Portal Glitches: There might be some technical issues at the GST portal, mainly at peak filing periods that would be challenging while filling and reconciling.

- Document capturing: Invoices, GST returns, and payment receipts; all for the ITC claim backup

- Regular ITC Reconciliation: Month by month or quarter by quarter

- Auto-Issue: Use accounting software that captures every ITC issued to maintain error-free reports.

- Tax Consultant: A professional may assist businesses in navigating some pretty knotty regulations if it’s a multi-state operation.

- Training Staff on GST Compliance: The more your team is aware of the GST rules, the lesser the chances of error in ITC claims.

Conclusion

ITC is the backbone of the GST framework, conceived with the aim of avoiding double taxation or otherwise reducing tax incidence on businesses, and thus releasing benefits to consumers. ITC enables smooth flow of credit in supply chains, thus reducing costs and enhancing economic efficiency.

Though the benefits are huge, claiming ITC is a very rigorous and long process under the GST regime. Businesses need to check compliance conditions, monitor paperwork, and reconcile ITC claims regularly. Of course, the process could be quite complex for multi-state or diversified business houses, but by best practices, technology, and professional help, one can streamline the management of ITC.

Get Started with TaxDunia Today

TaxDunia is your one-stop solution for tax and financial services, customized to meet the needs of both individuals and businesses. With services like GST filing, income tax returns, bookkeeping, and compliance management, TaxDunia simplifies complex financial tasks.