Home » TAN Registration

TAN stands for Tax Deduction and Collection Account Number, which is necessary for every business that is required to deduct the tax at source or TDS on payments of salaries, interest, dividends, etc. TAN is required to quote ITD’s Tax Deduction Account Number on TDS/TCS returns, challans, and payments. If individuals fail to obtain a TAN when required, they may face a penalty of ₹10,000. This guide walks you through the TAN registration process, whether you’re an individual, a partnership firm, or a private company.

Individuals, firms, or companies who deduct or collect tax at source for the Income Tax Department need to have a TAN. Non-profit organic. To quote tax deducted by a tenant (for a home, building, or land property) or at source while buying immovable property, individuals can use PAN. Then, they do not have a legal obligation to have a TAN.

The following standard documents are generally required for TAN registration:

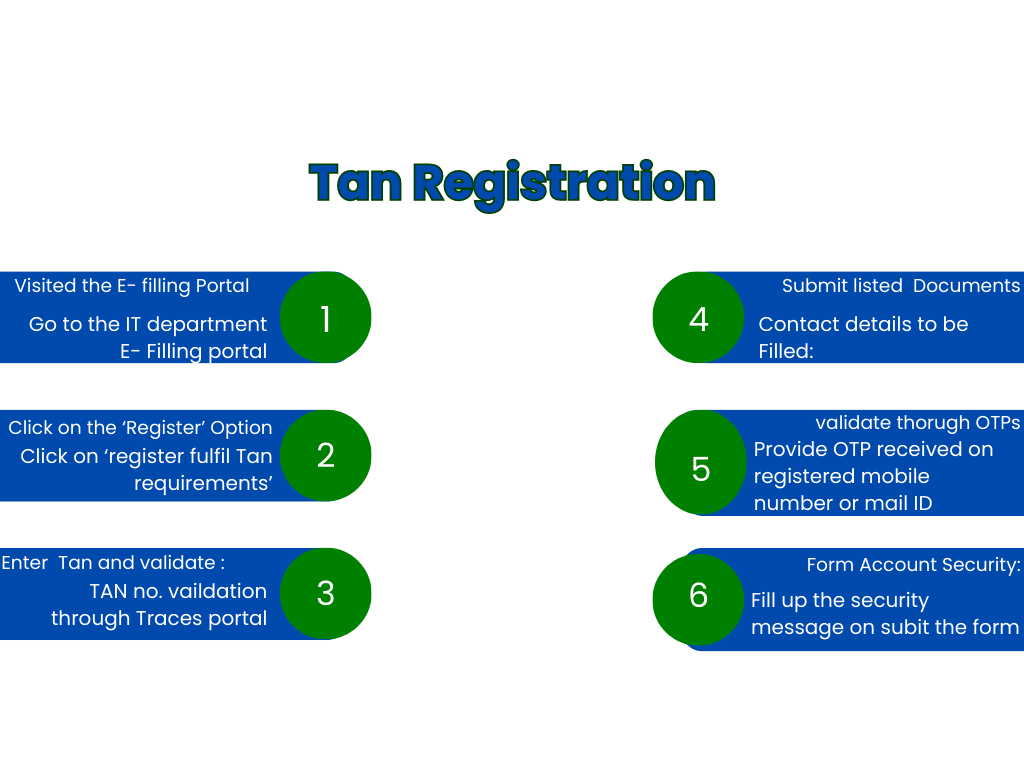

1. Visit the Income Tax E-Filing Portal: The most obvious step is first to visit the official e-filing portal of the Income Tax Department.

2. Click on the ‘Register’ Option: You then click on “Register” on the home page of the portal. Businesses or other entities requiring TAN have to select the “Tax Deductor and Collector” category from the category drop-down.

3.Enter TAN and Validate: You enter the TAN number and validate it; if it’s already registered with the TRACES portal, you can continue. If not, then you may have to do the registration first at TRACES.

4. Contact Details to Be Filled: It fills in your business name, PAN, primary address, email address, and phone number.

5. Validate through OTPs: You will receive OTPs to your registered mobile number and also to your email address. Via these OTPs, your contact details get validated.

6. Form Account Security: Use a password, put a personalized security message you have, and submit the form. Save the transaction ID generated at this step and retain the same.

Let TaxDunia support you in the process of making your business run smoothly while also meeting tax liabilities. Since TaxDunia offers an easy and secure TAN Registration service, tax compliance becomes easier for you. Our tax experts will assist you in the TAN Registration process. You will be offered quick and accurate registration of your TAN. With us, you get professional support and direct communication. Let us handle all that tiring paperwork while you are engaged in other work.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.