Start-Up registration

Home » Start-Up Registration in DPIIT

Begin Your Start-Up Registration with DPIIT

Registering with the Department for Promotion of Industry and Internal Trade (DPIIT) enables start-ups in India to avail of certain government schemes and benefits. Through DPIIT registration, start-ups can avail themselves of many resources, tax exemptions, and compliance for their business growth, which becomes simpler. Start-ups who meet the eligibility criteria limit, such as being less than 10 years old and having a turnover of less than Rs 100 crore, can have this registration. This article is a step-by-step process for the easy registration process, whether you are a lone maverick or a small business partner.

Why Does One Need Start-Up Registration?

It is intended to provide support to new and innovative businesses at their inception stage. Though not all business entities are compulsorily required to get this registration, having this registration brings along a lot of strategic benefits that can dramatically influence the growth path of a start-up.

All these help registered start-ups to establish and scale their operations easily. For instance, the government has allowed the companies to receive grants from it, exempted them from taxes, and got as many support programs for innovation and entrepreneurship as exist in the world.

Who Qualifies for Start Up Registration with DPIIT?

The start up must be incorporated as a private limited company, partnership firm or limited liability partnership.

- The entity is to be considered as a start up to 10 years from the date of incorporation

- The start up should be working towards innovation or improvement of existing products, services and processes and should have the potential to generate employment, create wealth.

- An entity formed by splitting up or reconstruction of an existing business shall not be considered as "startup"

Qualification criteria are that the business is less than ten years old and has an annual turnover of not more than ₹100 crores. In doing so, the government would be able to provide the right kind of support and resources to the business enterprises that are most likely to generate growth in the economy and jobs.

Benefits of DPIIT Registration for Start-ups

- Tax Exemptions: Start-ups recognized by DPIIT are allowed a three-year tax exemption, which would help the business reinvest increased profits back into the business.

- Funding Opportunities: Getting registered under DPIIT is a government recognition program that helps in the mobilization of funds and investments towards the start-up.

- Ease of Compliance: Timelines and procedures on the application for government contracts and patents and trademark registrations are much less complicated for DPIIT-registered startups.

- Networking and Collaboration: Apart from these facilities, the DPIIT provides opportunities for networking and availing of other government schemes, mentorships, and incubation facilities.

- IP Protection and Funding: Start-ups can seek probable fast-tracking of intellectual property rights protection as well as funding for patent care.

Required Document List for Start-Up Registration with DPIIT

The documentation relating to startup registration with DPIIT is not very complex. The requirements may, however, differ from one business entity to the next. Below is a general list:

- Certificate of Incorporation or Registration

- PAN Card of the Start-Up

- Memorandum of Association (MoA) and Articles of Association (AoA)

- Business Plan or Project Report

- Details of Bank Account (canceled check or passbook copy)

- The Aadhaar Card of the applicant or authorized signatory

- Proof of Business Address (electricity bill or lease agreement)

Depending on the type of business entity, additional documents may be necessary:

- LLP agreement

- Certificate of incorporation and address proof of partners

- Certificate of incorporation

- PAN and address proof of directors

- Business registration proof

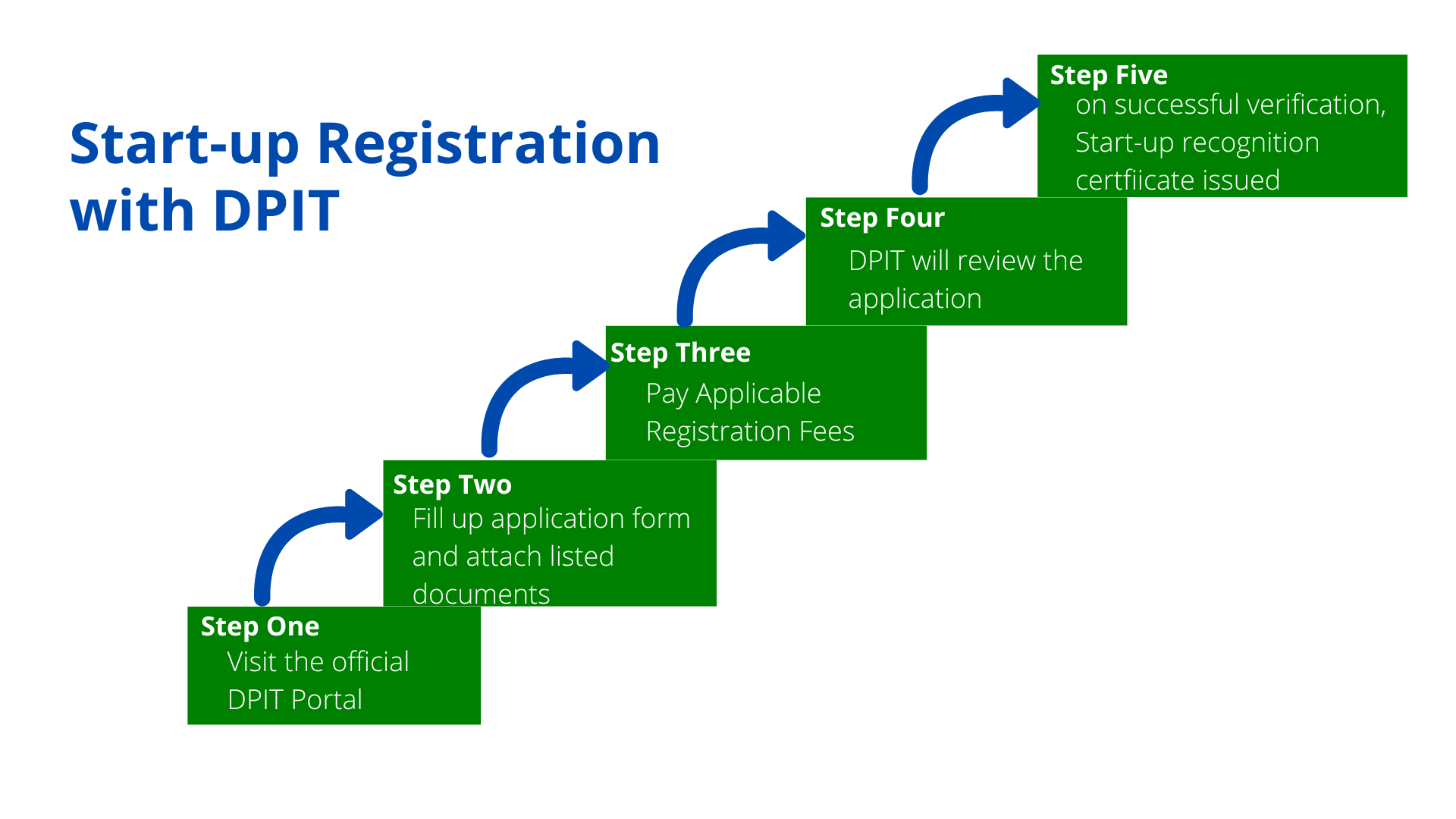

Key Steps for Start-Up Registration with DPIIT

1. DPIIT Start-Up Registration Portal:

● Visit the official DPIIT Start-Up Registration website.

2. Fill Out the Application Form:

● Complete the application form by providing details about the start-up, including the name, type of organization, and business activities.

3. Upload Required Documents:

● Upload all necessary documents as specified in the application guidelines.

4. Pay the Registration Fee:

● Pay any applicable fees as per the instructions on the portal.

5. Application Review:

● The DPIIT will review the application and may request additional information if needed.

6. Receive Start-Up Recognition Certificate:

● Upon successful verification, you will receive a Start-Up Recognition Certificate via email, which should be stored for future reference.

TaxDunia helps you sail through the DPIIT start-up registration process. Our specialists will assist you at every stage, from document preparation to DPIIT recognition certificate issuance. Begin your registration process with TaxDunia today and reap the benefits of being a registered start-up in India.