Section 8 Company Registration

Home » Section 8 Company Registration

Section 8 Company Registration: A Comprehensive Guide

A Section 8 company, under the Companies Act, 2013, is a nonprofit organization established to promote social welfare, education, charity, religion, environmental protection, and other similar causes. These companies can be undertaken without the intention of generating wealth to give profits to the shareholders, and the profits realized are automatically re-invested into the company for furtherance of its charitable or social objectives. Section 8 companies are highly advantageous for social entrepreneurs and nonprofit organizations because they have exemptions from certain taxes and compliance requirements. In this article, we explore the registration process, the advantages offered by a Section 8 company, eligibility criteria, and much more.

What is a Section 8 Company?

Section 8 of the Companies Act, 2013 deals with the formation of companies that operate to promote charitable, religious, scientific, literary, or educational objectives. Unlike other companies operating to generate profit, Section 8 companies are specifically designed to promote welfare and not distribute profits to the members or directors. These companies may raise funds to carry out their activities, but all profits must be utilized for achieving social objectives in order not to accrue personal gains.

A Section 8 company can be formed by an individual or group of people who want to promote social welfare activities. Such a company need not have shareholders because it has active members; also, there is scope for applying tax exemptions, making the sector highly attractive for organizations that want to make their presence in the nonprofit sector. Moreover, a Section 8 company enjoys credibility as it is a registered entity under the Companies Act, which adds to its legitimacy in the eyes of donors, government bodies, and the public.

Eligibility Criteria for Section 8 Company Registration

Before applying for registration as a Section 8 company, it is necessary to understand the eligibility requirements. The following are the conditions that must be met to form a Section 8 company:

- Purpose of the Company: The predominant objects of the company must be to promote activities such as charity, education, social welfare, environment protection, or any similar objective for which the members cannot expect dividends.

- Application of Dividends: A Section 8 Company needs to ensure that its profits, if any, must only be applied towards the promotion of its objectives. Such companies cannot distribute dividends or profits to their members.

- Incorporation as a Company: A Section 8 company is required to be incorporated as a limited company, under the Companies Act, 2013, which grants it a statutory body to operate as a nonprofit organization.

- License Application: The company needs to apply with the MCA to obtain a license under Section 8 of the Companies Act. The license is necessarily obtained for a company that has to be set up as a Section 8 company. Without having this license, a company cannot be registered.

- Promoters or Members: The promoters or members of a Section 8 company should be individuals or entities who have a genuine interest in the charitable cause of the organization. The company must have at least two members and two directors for registration.

Key Features of Section 8 Companies

Section 8 companies have quite a few unique features that differentiate them from other types of companies. These are as follows:

- Non-Profit Nature: The hallmark of a Section 8 company is that it cannot have a profit motive. Any surplus generated by the company has to accrue to further the purposes of the company, and cannot be distributed as profits to shareholders or members.

- Limited Liability: The Section 8 company, like any other company, also offers limited liability to its members and directors. This means the member’s or director’s personal assets are not at risk in case of liabilities on behalf of the company.

- Governing by the Ministry of Corporate Affairs (MCA): Section 8 companies are governed by the Ministry of Corporate Affairs and are subject to the rules and regulations of the Companies Act 2013.

- No Bar on the Minimum Limit of Capital Required for Registration: Section 8 companies do not have any stipulated minimum limit of capital requirement for registration. It is easier for individuals or groups to form a nonprofit company without investing significant initial capital.

- Tax Benefits and Exemptions: Section 8 companies are exempted from income tax under the Income Tax Act provided they fulfill specific requirements. They are also eligible for tax benefits that include 12A and 80G registrations, facilitating donation intake, and offering tax deductions to donors.

- No Dividend Distribution: Unlike profit-driven companies, Section 8 companies are not allowed to distribute dividends to their members. All the profits earned by the company would need to be plowed back to its activities that would further the objectives.

Advantages of Section 8 Company Registration

The registration of a Section 8 company has a wide range of advantages that can help organizations achieve their social and charitable goals. Some of the key benefits include:

- Legal Recognition: Section 8 company is considered a legal body with its own identity separate from members, may enter into any contracts, owns property, or performs other legal activities. It offers credibility and enhances the organization’s fundraising ability, grant applications, and partnership formations.

- Tax Exemptions: Section 8 companies are eligible for various tax exemptions under Indian law. These may include exemptions from Income Tax, GST, and other relevant taxes, provided the company fulfills the prescribed conditions. This allows the organization to allocate more funds to its charitable activities.

- Limited Liability Protection: The liability of the members and directors of a Section 8 company is limited to the extent of their shares or guarantees, protecting their assets in case of legal issues or financial liabilities.

- Fundraising Opportunities: A Section 8 company can raise funds through donations, grants, and partnerships with other organizations, both public and private. The reason donors are much more confident in donating to it is that it is a registered company.

- Trust and Credibility: As a company registered under the Companies Act, a Section 8 company enjoys a higher level of trust and credibility compared to unregistered nonprofits. Thus it can be promoted in front of the government, private sector, and even the public for support.

- Opening of Bank Account and Accessing Financial Products: A Section 8 company incorporated under this section can open any bank account in its name and have access to a host of other financial products like loans, lines of credit, and grants that can help them increase their activities.

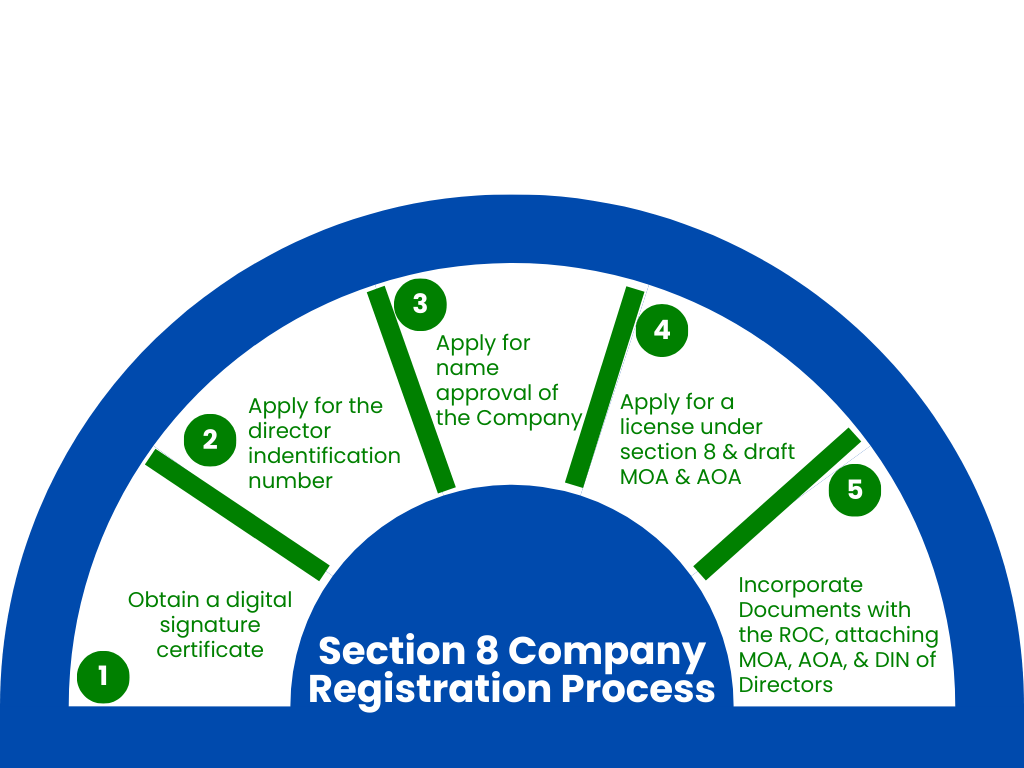

Process of Registration Under Section 8

The procedure for registering a Section 8 company involves several steps that must be carefully followed to ensure compliance with the legal requirements. Below is the step-by-step guide to the registration process:

Step 1 Obtain a Digital Signature Certificate (DSC)

Then the first step towards registering a Section 8 company is to obtain a DSC, that is, a Digital Signature Certificate of the proposed directors of the company. It is required to sign the electronic documents during the registration process.

Step 2: Applying for Director Identification Number (DIN)

Each director in the company shall obtain a Director Identification Number. A Director Identification Number is an identification number provided to those individuals who intend to become directors of a company.

Step 3: Name Approval

Before the incorporation process can be proceeded with, the proposed company name needs to be approved by the Ministry of Corporate Affairs, or MCA. It ought to relate to the charitable or social objective of the company, and it cannot be similar to an existing company name or trademark. An application for name approval is submitted through the MCA portal.

Step 4: Apply for a License under Section 8

Once the name is finalized, an application for a license under Section 8 of the Companies Act is to be made. Such a license is to be obtained from the Ministry of Corporate Affairs before incorporating the company. Form INC-12 is used to make an application for the license.

Step 5: Drafting of Memorandum and Articles of Association (MOA & AOA)

The Memorandum of Association and Articles of Association are the two primary documents that have defined the aims of a company, its governance structure, and operational procedures. These must be framed after giving careful attention to the charitable objectives to ensure compliance with all provisions of the Companies Act.

Step 6: Filing Incorporation Documents

After attaining the Section 8 license, the final procedure is the incorporation documents with the Registrar of Companies (RoC), which includes submitting the MOA, AOA, DIN of directors, and the relevant forms needed by the MCA. The RoC issues the Certificate of Incorporation once the documents are verified.

Step 7: Post-Incorporation Compliance

Once registered, the Section 8 company is subjected to various ongoing regulatory requirements like making annual returns, maintaining books of accounts, and fulfilling obligations related to tax returns. Non-compliance will result in penalties or revocation of the license of the company.

Conclusion

Section 8 registration is an extremely effective way for individuals as well as a group to incorporate a non-profit organization under a very healthy legal framework. Such benefits from tax exemptions, limited liabilities, and credibility provide the company with reasons to achieve its charitable objectives. Although such a process includes a series of steps, follow-up legal and regulatory norms, and compliance, the long-term benefits of operating as a Section 8 company pave the road for those looking towards making a positive impact on society. Understanding the process of registration, eligibility criteria, and requirements for continued compliance is critical in ensuring the success of a Section 8 company and maximizing its social value.

Get Started with TaxDunia Today

If you're looking to start a nonprofit organization or need assistance with Section 8 company registration, TaxDunia is here to help! Our expert team can guide you through every step of the process, ensuring that your registration is smooth, compliant, and hassle-free. Reach out to TaxDunia today for personalized support and professional advice on your Section 8 company registration and other tax-related matters. Let us help you turn your charitable vision into a registered reality!