Reverse Charge Mechanism

Home » Reverse Charge Mechanism (RCM) Under GST

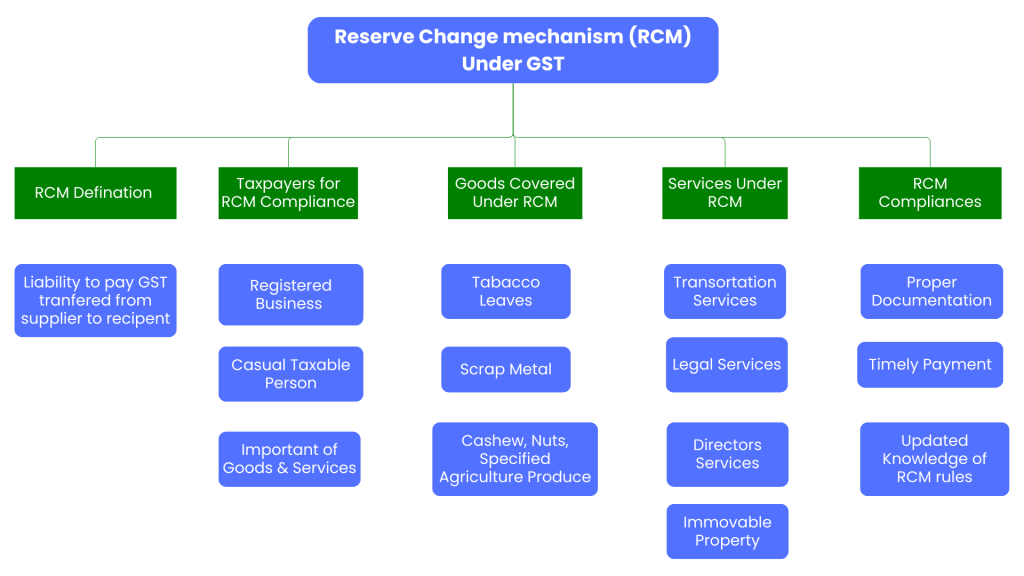

Reverse Charge Mechanism (RCM) Under GST

The Reverse Charge Mechanism (RCM) is one of the most prominent features of the Goods and Services Tax law. Normally, in the case of a supply of goods or services, the supplier collects GST and pays it to the government. In RCM, the liability to pay GST is transferred from the supplier to the recipient of goods or services. In this mechanism, the recipient pays GST directly to the government, instead of the supplier. Here is a complete guide on Reverse Charge Mechanism (RCM) under GST.

Purpose and Importance of RCM

RCM focuses on tax compliance and responsibility, especially in cases of non-registered suppliers and a few specific supplies and services. The government can save from losses due to non-compliant suppliers since the recipient pays GST under RCM. Import, too, comes under the purview of RCM, which would ensure proper taxation of imported goods and services in India.

Who Needs to Comply with RCM?

Taxpayers Categorized for RCM Compliance

Under the GST law, the following categories of taxpayers will pay RCM:

- Registered Business: A business that accepts any of the specified supplies, to which RCM has attached, shall pay GST directly from their account, even though the supplier is not registered.

- Casual Taxable Person and Non-Resident Taxable Person: These taxpayers may be liable for GST on certain transactions under RCM.

- Importer of Goods or Services: Import transactions are generally subject to RCM, and the importer would be liable to pay GST on such transactions.

Legal Implications of Non-Compliance

Noncompliance under RCM can invite penalties, fines, and audits may be scrutinized. In addition, the business that fails to remit the GST under RCM may forfeit the ITC claim on such transactions and will incur a higher cost.

List of Goods and Services Under RCM

Categories of Goods and Services Covered Under RCM

The government has a set list of goods and services considered under RCM, such as high-risk industries, unregistered suppliers, and imports. These lists do change with time as the concerned authorities may change some laws and regulations, so it’s always best to check from the GST portal for updated lists.

Goods Covered Under RCM

Some common goods that fall under RCM include:

- Cashew Nuts and Other Specified Agricultural Produce: Supply by an agriculturist to a registered dealer.

- Tobacco Leaves: Supply by an agriculturist.

- Used Vehicles and Other Used Goods: Sale by unregistered dealer.

- Scrap Metal: Purchase of scrap from unregistered dealers.

- Supplies from Unregistered Suppliers: Supplies by registered dealers from unregistered dealers in specific circumstances.

Services under RCM

Some of the examples of RCM services

- Transportation Services: GTA service is offered to a registered business

- Legal Services: Advocate firm or advocates offering their services to the business

- Sponsorship Services: Sponsorship to sports events etc. paid to unregistered suppliers

- Director Services: Payments to the directors of the company who are not employees of that company.

- Hiring of Immovable Property: Where an immovable property is given on rent from a nonregistered person to a registered business.

- Services from NR Suppliers: Import of service from outside the country from other NRs.

- Insurance Agents and Recovery Agents: Service given by an insurance agent to the insurance company and recovery agents given to the banks and Finance.

Special Cases in RCM

Inter-State Transactions: If the goods or services fall under RCM and the transaction is inter-state, then IGST is charged instead of CGST and SGST.

Foreign Services or Imports: Most import transactions fall under RCM wherein the Indian recipient incurs the GST liability.

How to Compute and Pay GST Under RCM

Calculating GST Under RCM in Steps

The GST calculation under RCM is not quite complex but it still needs to be authentic for computation purposes.

- GST Rate Calculation: The GST rate for the supply of goods or services under RCM is generally the same rate that would have been leviable if the supplier had charged it. The rates vary with each product or service type and are available on the official GST portal.

- Calculate GST Amount: The purchase value is multiplied by the applicable GST rate. For example, a registered business pays for sponsorship services worth $10,000, and the GST rate is 18%. Under RCM, the amount of GST payable would be $1,800 as calculated by multiplying $10,000 by 18%.

- Record GST in Liability Ledger: After calculation, the GST amount should be recorded in the liability ledger of the business as RCM liability.

Step-by-Step Procedure of GST Payment Under RCM

- Declaration of Liability under RCM in GSTR-3B: An obligation under RCM by a business must be stated in the GSTR-3B form of a monthly return. It will require the declaration of both the liability and the tax paid under RCM.

- Payment to the Government: GST is payable only in cash with no ITC and payment is made through the GST portal.

- Input Tax Credit on RCM Payments: As soon as RCM has been paid, the amount can be claimed as ITC subject to the use of those goods and services for business and other conditions being fulfilled.

Examples of RCM Calculation

Suppose a business is getting some legal service because the value of services has been paid at $50,000, which has been sold by an unregistered dealer.

- GST Rate: The legal service attracts 18% tax.

- RCM Liability: $ 50,000*18% = $ 9,000.

- Payment and Reporting: Pay and declare the $9,000 RCM liability in GSTR-3B with the choice of claiming ITC in the same form if available.

Time of Supply under RCM

The time of supply in case of goods can be the following

- The date of receipt of goods

- The date of payment

- Date immediately after 30 days

The of time of supply in case of goods will be the earliest of the above dates. Whether the payment is made first or the receipt is issued, whichever action is done earlier will be the time of supply.

The time of supply in case of services under RCM can be one of the following: the one that is the earliest of these two

- Date of payment

- Date immediately after 60 days

Self-Invoicing & RCM

Self-invoicing, as its name suggests, is the issuance of invoices by the buyer of the services or goods only. If a buyer purchases goods or receives services that fall under the RCM domain from an unregistered supplier, the buyer themselves has to issue self-invoices. This happens because the supplier is not compliant with the GST and cannot issue relevant invoices. Therefore, the need to issue self-invoices arises.

RCM Compliance Check for Businesses

Challenges and Practical Tips on RCM Compliance

Reverse Charge Mechanism is a unique challenge concerning correct presentation of reports on-time payment and efficient maintaining of records for businesses. Here are some practical tips and suggestions for business firms concerning effective management of all RCM-related compliance regulations:

- Updating Knowledge of RCM Rules: GST legislations and RCM rules are constantly changing, some items or services might be brought inside or taken out from RCM. Either refer to the GST portal or tax consultant for updates.

- Proper documentation: All purchase invoices subject to RCM must be adequately documented. The invoice must state that the goods or services are subject to RCM, and records should be kept by businesses for the payment and filing of RCM liabilities.

- Make timely payments: RCM liability is to be paid together with the GSTR-3B return every month. It should be paid on time to avoid penalties late fees and/or disqualification to claim the ITCs.

- Use Accounting Software for Accuracy: There are accounting software that will also help the books of account have GST modules. This software can track RCM liabilities, record RCM payments, and hence put in place proper reporting. Accounting software lessens the element of human error and can also automate such RCM calculations.

- Maintenance of Separate Ledger for RCM Liabilities: Maintaining a separate ledger account for the RCM helps in tracking, reconciling, and auditing procedures on all liabilities and payments on account of RCMs.

- Verify supplier details: Validate for supplies received from non-GSTIN suppliers whether GST is leviable or not. This shall avoid non-compliance as well as ensure that RCM gets applicable only when it should be.

- Claim ITC Effectively: Claim ITC on RCM payments in time. While businesses are eligible to claim ITC on RCM payments, making the claims in time and as per the eligibility conditions will result in maximum tax benefits and avoid lost credit.

- Consult a GST Specialist: The law of GST is much complicated hence the RCM regulation is quite confusing too. Regular meetings with a tax consultant could help in achieving compliance, proper filing, and best tax planning for transactions in RCM.

Conclusion

Reverse Charge Mechanism under GST: An important compliance component for a business that deals in specified goods or services, unregistered suppliers, or imports. RCM prevents tax evasion, provides assurance to tax payments from high-risk transactions, and makes it easy to trace GST payments made on such transactions.

Although RCM provides for clear management of tax on particular transactions, it brings some compliance requirements for businesses that may be more cumbersome. Companies would need to track RCM-eligible transactions, make timely payments, and maintain detailed records.

Get Started with TaxDunia Today

TaxDunia ensures accuracy, compliance, and timely assistance for GST-related concerns, allowing clients to focus on growth without the stress of financial management. Choosing TaxDunia means reliable support, streamlined processes, and peace of mind for all your tax and accounting needs.