Home » PF Registration

The Provident Fund, or PF, is a contributory saving scheme under the Government of India that provides financial security and retirement benefits to employees. Management of this PF is carried out by the Employees' Provident Fund Organization, or EPFO. This PF enables the employer as well as the employee to save parts of their salary for developing a retirement fund. One of the compliance requirements for the labor laws laid by the government is PF registration to achieve long-term security through financial provisions for its employees.

All businesses with an employee strength of 20 or more have to register under the PF. This brings a business in line with Indian labor law and provides employees with basic benefits like retirement savings and pension, along with adequate insurance coverage. If PF registration installs savings, then the accumulation will be monetary when needed or in retirement. Such financial security increases one's sense of trust and employee satisfaction.

1. Retirement Savings: Under PF, the employees are encouraged to have a fixed amount when they retire, thus a more secure financial future.

2. Pension Benefits: Apart from savings, the PF scheme offers pensions to employees after retirement under the Employee Pension Scheme (EPS).

3. Insurance Benefits: The Employees’ Deposit Linked Insurance Scheme (EDLI) provides life insurance to employees who have enrolled themselves under the PF scheme.

4. Tax Benefits: The employer’s contribution to the PF account, as well as the employee’s contribution, are allowable deductions from the gross taxable income of the employee and the employer, respectively.

5. Emergency Withdrawals: PF lets employees withdraw some of their savings during events like medical expenses, educating their children, or any other necessity.

Provident Fund (PF) registration is mandatory for businesses with a specified number of employees. The documents required for PF registration may vary depending on the business structure. Below is a general list of required documents for PF registration:

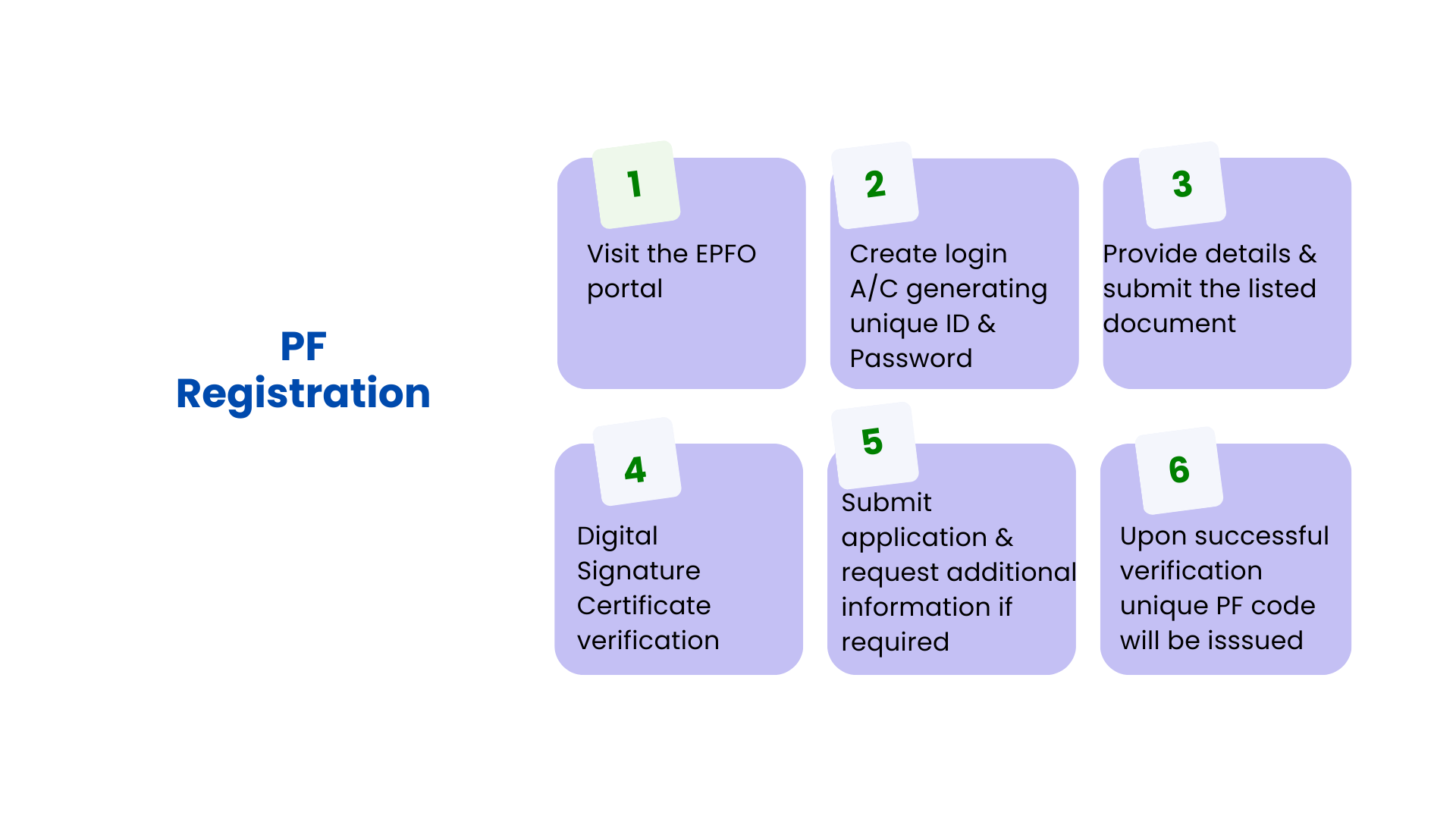

1. Visit the EPFO Registration Portal:

● Access the Employees’ Provident Fund Organisation (EPFO) website for PF registration.

2. Create a Login Account:

● Register on the portal using the employer’s details and generate a unique ID and password for future access.

3. Complete the Employer Registration Form:

● Fill out the online registration form, providing details such as the business name, address, type, and date of establishment.

4. Upload Required Documents:

● Attach the relevant documents based on the type of business structure (proprietorship, partnership, or company).

5. Digital Signature Verification:

● Verify the application with a Digital Signature Certificate (DSC), which is mandatory for online submissions.

6. Submit the Application:

● Review the details and apply. Authorities may request additional information if required.

7. Receive the PF Registration Certificate:

● Upon successful verification, a unique PF Code Number will be issued, which enables the employer to manage PF contributions for employees and submit returns.

The procedures for registering for a PF scheme may look complicated to most businesses, especially newly established ones. But with TaxDunia, you need not worry about it because here, you can count on us to help you through these processes. That is why, with the help of our specialists, your business PF will be registered, and all the requirements of the legislation will be taken into account. Please contact us today and let us help you get on with the PF registration process or clarify your doubts.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.