PAN Registration

Home » PAN Registration

Begin PAN Registration Today

The Permanent Account Number (PAN) is a ten-character alphanumeric identity assigned to Indian citizens. The Indian Government, under the Indian Income Tax Department, issues PAN. The PAN is required for operating a business, filing income taxes, opening a bank account, etc. It serves as a valid ID proof for Indian citizens and is a unique number; therefore, no two persons can have the same PAN Number. It records all the tax-related information of individuals. This article will help you get your Permanent Account Number. Follow the steps for PAN Registration.

When do You must have a PAN Card?

Before beginning with PAN Registration, know when you need to have a PAN. To get your business registered under the GST, you need to hold a PAN. It serves as identity proof and can be used in place of an Aadhaar, Voter ID, or more. To maintain a record of financial activities and avoid tax evasion, a PAN is required in banking and accounting operations. All Indian citizens and Non-resident Indians can have a PAN. Companies, firms, association persons, and Hindu Undivided families are eligible for it. Indian taxpayers are obligated to have a permanent account number.

What are the Benefits of Holding a Permanent Account Number or PAN?

- Income Tax Return: PAN is a prerequisite for filing income tax returns in India; hence, it ensures that individuals and organizations do not breach the Indian Income Tax laws and Regulations.

- Financial Transaction: It is used for thousands of financial operations, such as opening a bank account or purchasing a property. Besides that, it conducts high-value transactions.

- Tax Deductions: PAN aids in tracking and preventing tax evasion by maintaining an open and transparent record of income and tax deductions.

- Legal Proof of Identity: PAN is a government-acceptable proof of the identity of people and entities all over India.

Required Document List for PAN Registration

The documentation for PAN (Permanent Account Number) registration is straightforward, although specific requirements can vary depending on the type of business entity or individual. Below is a general list:

- Identity Proof (Aadhaar Card, Passport, or Voter ID for individuals)

- Address Proof (Utility bill, bank statement, or lease agreement)

- Date of Birth Proof (Birth certificate or school leaving certificate for individuals)

- Photograph of the Applicant

- Incorporation Certificate (for companies or registered entities)

- Registration Certificate of Business (for businesses such as firms and LLPs)

- Business Entity's Bank Account Details (Cancelled check or bank statement)

Specific Document Requirements Based on Applicant Type:

Individual Applicant:

- Aadhaar Card or Passport

- Proof of address and date of birth

Partnership Firm:

- Partnership deed

- PAN and address proofs of partners

Limited Liability Partnership (LLP):

- LLP agreement

- Certificate of incorporation and address proof of partners

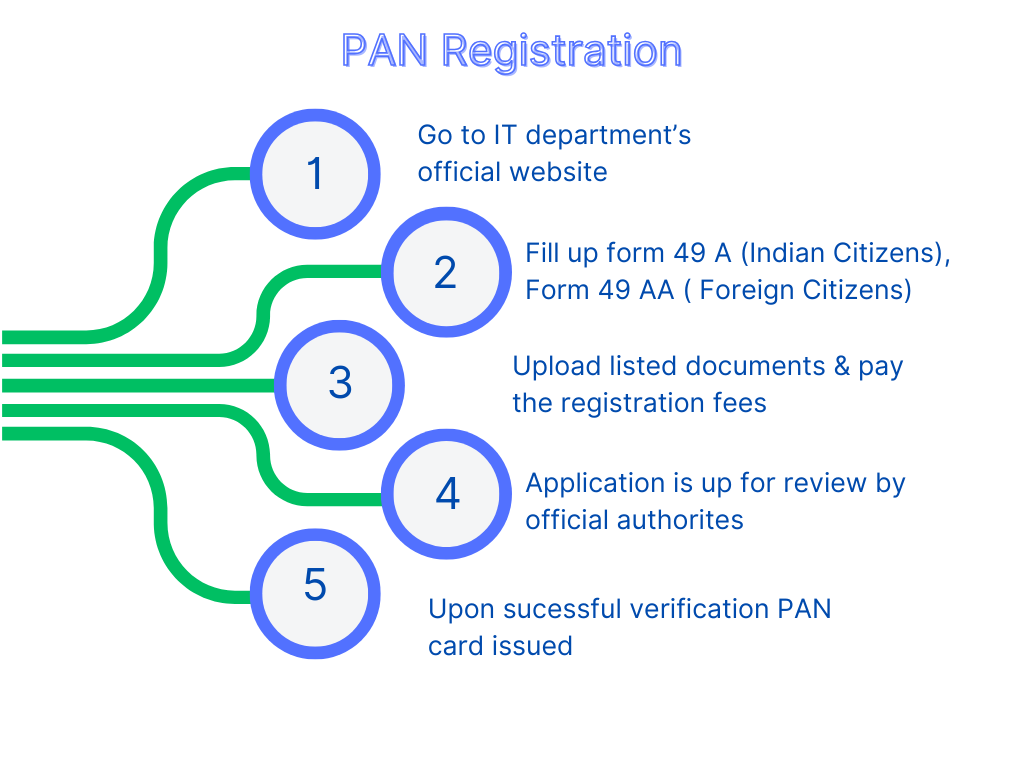

Key Steps for PAN Registration

- Visit the Official PAN Registration Portal:Access the Income Tax Department’s official website for PAN registration.

- Complete the Application Form:Fill out Form 49A for Indian citizens or Form 49AA for foreign citizens, providing details such as name, address, and business type.

- Upload Required Documents:Attach the necessary documents as per the entity type (individual, firm, LLP, or company).

- Pay the Registration Fee:Pay the applicable fee, which varies based on the applicant’s residential status and location.

- Submit the Application:Once submitted, the application will be reviewed, and additional information may be requested if required.

- Receive the PAN Card:Upon successful verification, the PAN card will be issued and sent to the applicant’s registered address.

Get Started with TaxDunia Today!

Start with your PAN Registration today with TaxDunia. We have a team fully dedicated to helping you out with PAN Registration. Our Professionals Will simplify the process of registration so that you can get your PAN card quickly without going through much hassle.