Home » One Person Company Registration

OPC is a single-person company, and whoever is looking forward to starting a sole proprietorship business in the single-person form can opt for OPC Registration. The unique combination of its structure merges the aspects of limited liability with the essence of easy running of the business like a sole proprietorship. The registration provides legal recognition but also adds confidence for customers, investors, and suppliers. After registration of an OPC, avenues open up for the schemes offered by the government, financial support, and various business opportunities that pave the way toward growth and sustainability.

OPC registration formalizes your business. Thereby you become legally capable of working within the framework of law laid by India. This gives protection in signing contracts over goods, helps get permission for borrowing capital, enhances credibility among stakeholders, and entitles some tax benefits along with government incentives. Hence, OPC is a very important legal procedure that needs to be followed by businesses aspiring to survive in the long run.

1. Legal Identity: It forms your business as a separate legal entity.

2. Limited Liability: As a business, all personal assets stay safe from liabilities.

3. Easy Funding Access: Increases probabilities of loans and investments

4. Tax Benefits: lower tax liabilities

5. Simplicity of Operation: Flexibility of making decisions as there is a single owner

6. Government Support: People can come out for various government schemes that exist only for registered entities.

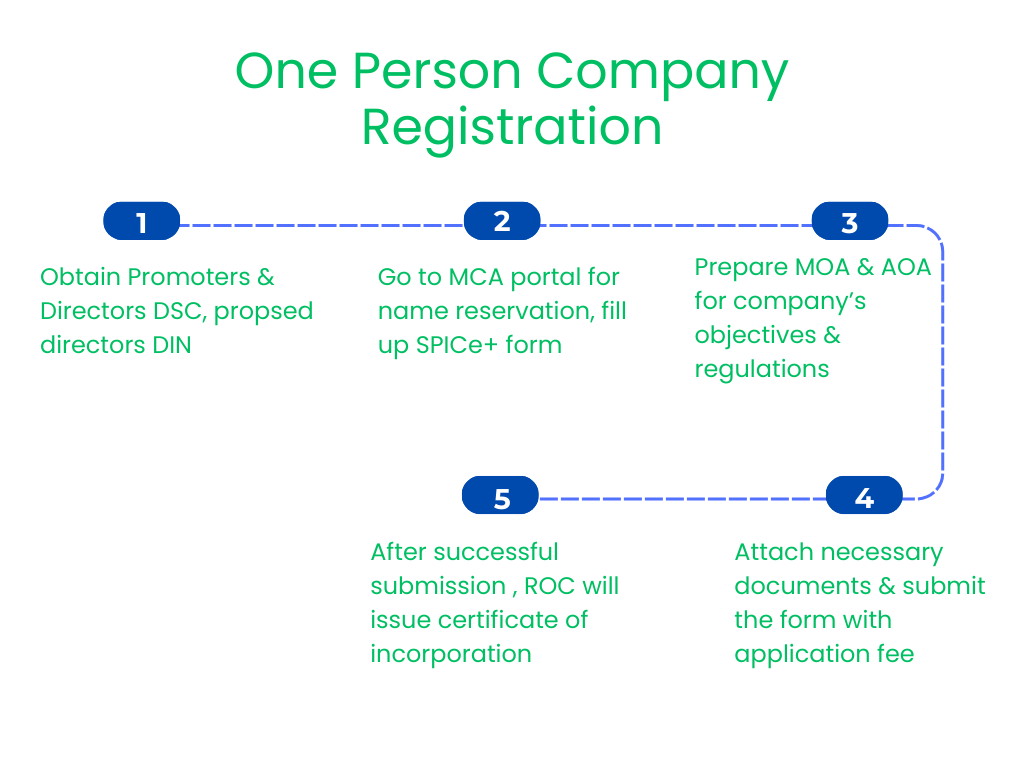

1. Visit the Official Firm Registration Portal:

begin the registration process by visiting the official portal of respective department

2. Collect Partner’s details and Business details:

collect above listed documents and details of partners

3. Complete the Application Form:

Fill out the application form provided on the portal, including details like the firm’s name, business address, and partner information.

4. Prepare and Upload Required Documents:

Attach the necessary documents based on the chosen structure (proprietorship, partnership, or LLP).

5. Pay the Registration Fee:

Pay the applicable registration fee, which may vary based on the firm type and location.

6. Submit the Application:

Submit the completed application and documents for review. Authorities may request additional information if required.

7. Receive the Registration Certificate:

Upon successful verification, a registration certificate will be issued and sent to the firm’s registered address. This certificate serves as legal proof of the firm’s existence and allows the business to operate officially.

It is not complicated to register a firm, and TaxDunia facilitates your registration process. Our team of professionals guarantees your firm is compliant with all the laws. Regardless of whether you are a departmental trader or intend to be a partnership firm, we are available to assist you. To start your firm registration with us or to address your questions, call us today.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.