Non-Resident Income

Home » Non Resident Return

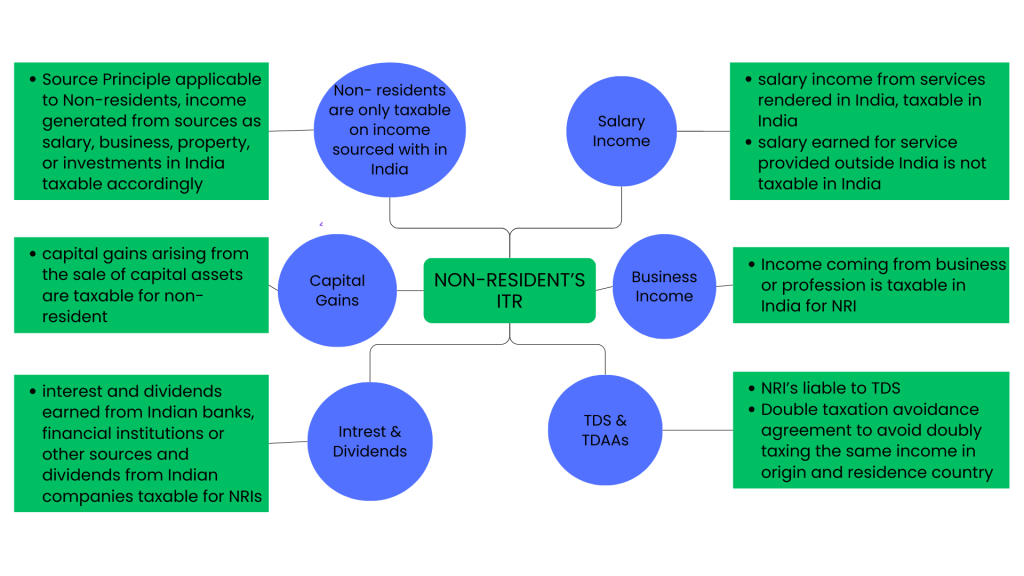

Non-Resident's Income Tax Return

In the complex landscape of income tax, the classification of income and residency status of taxpayers determine significantly the liability of taxes. For individuals earning income from India, their residential status becomes imperative in determining the scope of taxable income. This is particularly true for non-residents because when it comes to filing income tax returns (ITR), they are subjected to distinct rules and procedures. A person working or investing in India from abroad must understand the taxation of non-resident income, as well as compliance with the Indian Income Tax Act.

Understanding Residential Status in India

Residency is regarded as the basis on which liabilities on income tax are determined by the individual. According to the Indian Income Tax Act, a person’s residency status would be computed by reference to the number of days he has spent in India in a particular year and also the cumulative period of four years spent in India. Generally, there are three distinct categories: resident, non-resident (NR), and resident but not ordinarily resident (RNOR).

A non-resident is someone who has spent fewer than 182 days in India during a particular financial year or has been in India for fewer than 365 days during the preceding four years. Non-residents are only taxable on income that is sourced within India. This is in contrast to residents, who are liable to pay taxes on their global income, including any income earned abroad.

Non-Resident Taxation in India

For non-residents, the Indian tax system follows the source principle, that is, what has its origin in India is subject to tax. The Indian source of income, consequently, applies to taxation only among non-resident Indians, what with their incomes generated from sources such as salary, business, property, or investments made within the country. Income foreign earnings, likewise, by NRIs, for example, income received for work abroad or abroad investments, is not taxable in India.

Incomes that have been earned by a non-resident are taxed at applicable rates, which could vary based on the source of income. Thus, for instance, for salary income, the tax would be charged according to the applicable income tax slabs. Income through property or capital gains is to be charged as per specific tax rates. An exemption and deduction also applies to the income of a non-resident, though it is with certain restrictions, as in the case of a resident.

Types of Income Taxable for Non-Residents

Non-residents in India are taxable on the income earned in India and can broadly be classified under several categories. These include income from salary, house property, capital gains, business, profession, and other sources like interest and dividends.

Salary Income

If a non-resident has earned salary income for any services rendered in India, such income is taxable in India. However, if the salary is earned for services provided outside India, it is not subject to Indian taxation. For example, if an NRI is employed by an Indian company but works from a foreign country, their salary may not be taxable in India unless the employer has a permanent establishment in India and the work is related to that establishment.

Income From House Property

Rental income from property located in India earned by a non-resident is also taxable in India. The taxation on rental income for a non-resident is the same as that applicable to residents, and various deductions are available on property-related expenses on maintenance, repairs, and municipal taxes.

Capital Gains

Capital gains arising from the sale of capital assets like property, shares, or bonds in India are taxable to non-residents. The tax rates on capital gains are held to depend on the type of asset and the holding period. For example, long-term capital gains (LTCG) on assets held for more than 24 months attract a concessional rate of 20% with indexation, whereas short-term capital gains (STCG) attract a higher tax rate of around 15% when assets are held for less than 24 months. Doubled taxation avoidance agreements: Non-residents may enjoy double taxation avoidance agreements between India and their country of residence, which may therefore reduce the burden of taxes.

Business Income

If a non-resident earns income from any business or profession exercised in India, that income would be assessed to tax in India. Non-residents carrying out any business through a PE situated in India will be assessed to tax on all profits of that business attributable to that PE. The income arising or accruing from independent professional services rendered in India by a non-resident, such as consultancy or technical services, would also be taxable in India.

Interest and Dividends

Interest income earned from Indian banks, financial institutions, or other sources as well as dividend income from Indian companies is taxable in India for a non-resident. However, interest on some types of bonds and savings accounts could qualify as exempted or reduced tax under DTAA. The dividend income, though liable to tax, attracts lesser withholding tax under the Double Taxation Agreement, depending upon the country with which India has entered into a taxation treaty.

Filing Income Tax Returns for Non-Residents

Filing income tax returns as a non-resident in India is almost identical to filing for the residents except in a few respects. While there are three types of ITR Forms, viz., ITR Form 1, 2, and 3, a non-resident shall make use of Form 1, 2, or Form 3, depending on the character of income derived.

If the non-resident has only a salary or pension income and the total income does not exceed the basic exemption limit, a return need not be filed. However, if there are earnings from more than one source or in case the individual wants to claim a refund of taxes deducted at the source, they do have to file an income tax return.

There are also income tax requirements for non-residents in their returns to report their income from India with the taxes already paid via TDS. In India, certain percentages of income need to be deducted from various payments like salary, rental income, interest, and dividends. This TDS is usually deducted by the payer (such as an employer, bank, or tenant) before payment to a non-resident and the non-resident can claim a credit for this sum while preparing his returns.

TDS and Double Taxation Avoidance Agreements (DTAA)

Of all the critical factors to the non-residents, it’s the system of TDS. TDS is a mechanism under which a part of the payment made by the payer of the income is withheld, and this amount, vide a process known as TDS collection, is credited to the government account as tax paid on behalf of the recipient. Non-residents are liable to TDS for a whole gamut of sources of income; the respective rates vary with the nature of the source and any relevant DTAA in force.

DTAA agreements between India and other nations are designed to avoid doubly taxing the same income in the country of origin, that is, India, and the country of residence, such as the US or UK. Such DTAs commonly offer a lower TDS rate or exemptions on specific kinds of income, such as dividends, royalties, or interest. Even if their residence status is different, foreigners must then consult relevant provisions of the DTAA to know which rate(s) of TDS applies to their situation and claim available benefits thereon.

The availing of these reduced TDS rates may require non-residents to file additional documents, like a Tax Residency Certificate (TRC) issued by the tax authority of their home country, to be able to avail of the reduced rate under the DTAA. In its absence, one may have to rely on the standard TDS rates, which are generally higher compared to the cases of non-residents.

Deductions and Exemptions for Non-Residents

The non-residents of India can deduct certain exemptions and allowances at the time of filing income tax returns, but particular rules apply to them. Non-residents, for instance, cannot claim certain exemptions available to residents. For example, one would not get an exemption under section 80C on account of house rent allowance (HRA), or investment towards life insurance premium or public provident fund. However, non-residents can still claim deductions for specific expenses related to their Indian-sourced income, such as expenses for managing rental properties, capital gains exemptions, and more.

Further, non-residents also benefit from the exemptions given by section 10 of the Income Tax Act for income derived from foreign sources to the extent those are not taxable in India. They can further reduce their tax liability under the applicable DTAA between India and their country of residence, where respective exemptions or reduced tax rates apply to different categories of income.

Conclusion

The taxability of the Indian income of a non-resident is an important subject for those who operate or invest in India from abroad. Non-residents are generally taxed only on income that arises in India, and they enjoy significant tax rebates, deductions, and relief under the laws of India. Nevertheless, one needs to be more cautious about his or her residency status, source of income, and TDS rates applicable. In addition, knowledge about the provisions of the Double Taxation Avoidance Agreement can serve to reduce tax liability significantly and ensure compliance with Indian tax law. Accurate records concerning Indian income and taxes paid should be maintained, and professional services be availed of as needed, to navigate the intricacies of the Indian tax filing procedure.

Get Started with TaxDunia Today

TaxDunia is here to simplify the complexities of non-resident taxation for you. We can help you file your returns, help you understand TDS, and provide all kinds of information you want to know about DTAA. With TaxDunia's expert team by your side, you are sure to ensure compliance, maximize your deductions, and minimize your tax liabilities. Reach out to us today to make the tax filing hassle-free. Let TaxDunia take care of the rest while you worry only about what matters the most.