MSME Registration

Home » MSME Registration

Start MSME Registration

The Government of India provides MSME certificates to enterprises classified as micro, small, and medium. MSME Registration in India is of great importance for business ventures, as this registration offers several facilities the Indian government has granted. The benefits list includes government subsidies, tax benefits, and easy credit. Enterprises having annual turnover and investments ranging from Rs 1 crore to Rs 250 crore can go for the MSME Certificate. The MSME Registration is also called Udhyam Registration.

Why Opt for an MSME Registration?

To get an MSME Registration is not obligated by law but it has several benefits. To get additional tax benefits, based on investment and annual turnover businesses can get an MSME registration. You need to have an MSME Registration to secure free ISO certificates. Apart from that, You can save a lot of taxes imposed on your business just by getting registered under the MSME. The Government-sponsored MSME Programs promote trade and encourage entrepreneurs, so businesses need registration for proper categorization under the government of India. MSME Registration also ascertains timely recovery from debtors.

Benefits of MSME Registration Under the Government of India

Government Benefits: This will offer the chance for subsidies, tax rebates, and availing of other governmental schemes tailored for MSMEs. Easy Finance: The MSME registration would give the applicants access priority to lending schemes and government loan schemes from the government with concessionary interest rates. Tax Relief: MSMEs are given direct tax exemptions and also have extra monetary assistance and other facilities. Market Platform: MSMEs are given preference on various trade platforms such as Gem portal, which provides a better edge in the competitive market field. Timely Recovery: MSME Registration provides better financial benefits and offers enhanced working capital management.

Required Document List for MSME Registration

The documentation relating to MSME registration is not very complex. The requirements may, however, differ from one business entity to the next. Below is a general list:

- Aadhaar Card of the applicant or business owner

- PAN Card of the applicant or business

- Business Address Proof (electricity bill or lease agreement)

- Bank Account Details (cancelled check or passbook copy)

- Proof of Business Activity (partnership deed, certificate of incorporation, etc.)

Specific document requirements based on the type of business entity:

Proprietorship:

- Owner's Aadhaar and PAN

- Business registration proof

Partnership Firm:

- Partnership deed

- PAN and address proofs of partners

Limited Liability Partnership (LLP):

- LLP agreement

- Certificate of incorporation and PAN of partners

Private Limited Company:

- Certificate of incorporation

- Business registration proof

- PAN and address proof of directors

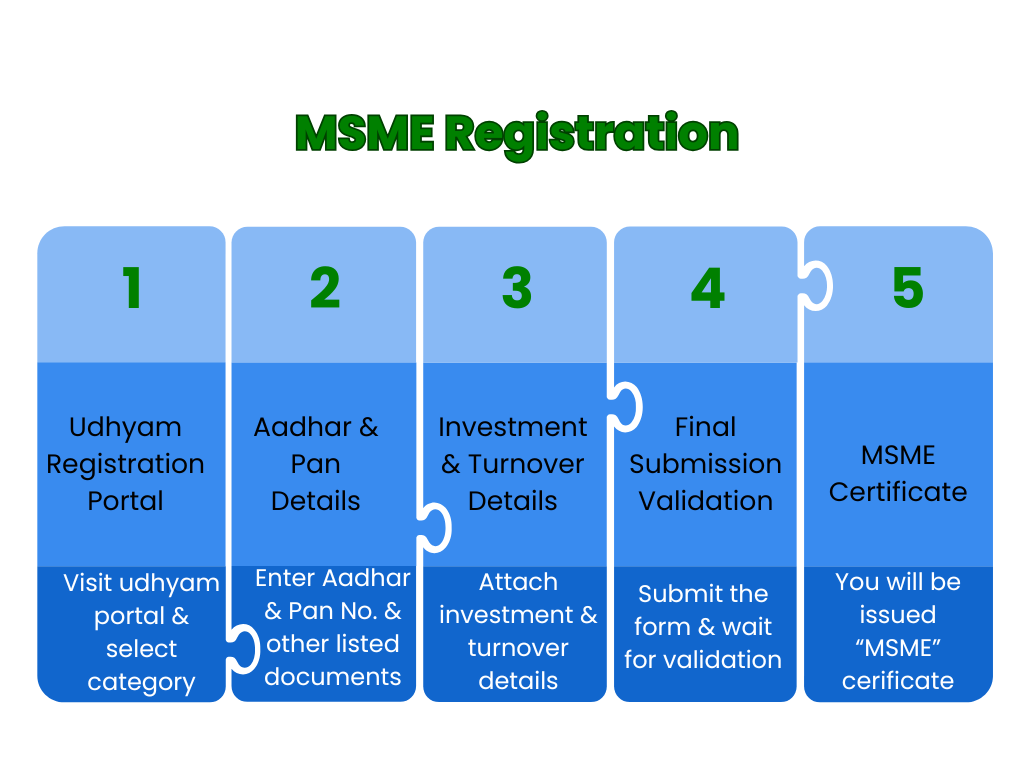

Key Steps for MSME Registration

1. Udyam Registration Portal: Visit the Udyam Registration website and click on ‘For New Entrepreneurs who are not Registered as MSME’ or ‘For Those Having EM-II or UAM’.

2. Enter Aadhaar and PAN details: Enter the Aadhaar number and verify it through an OTP to be sent to the registered mobile number. PAN information will also need to be linked.

3. Fill out the application form: Fill in your business details, like type of organization, address, bank details, and business activity.

4. Select Category & Submit Investment & Turnover Details: Select the appropriate category MSME (Micro, Small, or Medium) and provide accurate information on investment and turnover of your business.

5. Final Submission and Validation: Ensure that all information is validated, accurate, and the application is submitted. An Udyam Registration Number, or URN, shall be received.

6. Obtain an MSME Certificate: When the application for registration gets validated, then an MSME registration certificate will get automatically generated along with the email ID and the email ID submitted in the process of MSME registration.

Get Started with TaxDunia Today!

No need to make MSME registration a chore. We will take care of the paperwork, compliance, and follow-ups so you can focus on business growth and stay confident in the support and credibility that MSME registration brings. Begin today with TaxDunia and unlock the full potential of your business with government-backed benefits.