Income Tax Forms Under Income Tax

Home » Income Tax Forms Under Income Tax

What are Different Types of Income Tax Forms & Their Structure

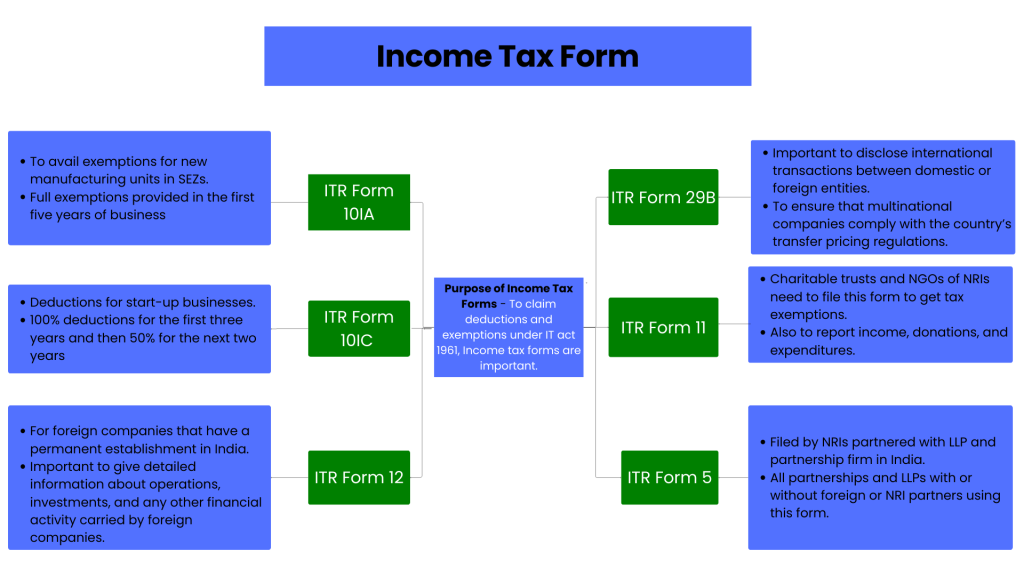

Income tax in India is governed by a set of rules and regulations under the Income Tax Act, of 1961. Most of us are aware of various ITR forms, namely ITR-1, ITR-2, and others. However, there are several other Income Tax Forms designed for specific exemptions, deductions, and other provisions. These forms are very important for individuals, businesses, and entities wanting to avail of specific benefits such as tax holidays, exemptions for new industries, or deductions for start-ups.

In this article, we see some of these forms, for example, ITR Form 10IA, ITR Form 10IC, ITR Form 12, and many more. These forms are not used to file returns but are necessary to claim benefits and stay in line with the specific provisions of tax. These forms are an important part of lessening tax burdens and making sure that taxpayers comply with the Indian tax system in the most efficient ways possible.

Learn About Forms 10IA, 10IC, and More

While the filing of ITR forms is required for annual tax returns, there are several other forms designed for specific purposes that a taxpayer may need to file, depending on the nature of their income, business, or investments. These forms are generally designed for specific sections of the Income Tax Act and enable individuals or entities to claim exemptions or deductions that can result in significant tax savings.

ITR Form 10IA: Exemption for New Manufacturing Units in SEZs

ITR Form 10IA is used by companies or individuals establishing new manufacturing units in Special Economic Zones, SEZs. Section 10AA of the Income Tax Act grants exemption on income sourced from export activities undertaken by units located in SEZs. This exemption permits the business to exclude taxes on profit generated from the export of goods or services. What is essential here is that tax exemption shall be available for a certain period starting upon the opening of the unit’s operations, whereby full exemptions would be provided in the first five years, while partial exemptions would follow for the next five years.

Form 10IA would then be used for an entity to claim its exemption under Section 10AA. Form 10IA asks in detail about the operation of the unit, the nature of the exports, and all kinds of financial data. The non-resident investors carry out such operations and, if they are eligible for the tax benefits to be provided by the Indian government to set up manufacturing units in SEZs, must also file this form. It ensures that a reduction in tax liability happens for businesses, and at the same time, they would be supporting the economy through exporting activities.

ITR Form 10IC: Deduction for Start-ups

Another very important form utilized by the business is Form 10IC, especially in start-up businesses, to claim deductions under Section 80-IAC of the Income Tax Act. In this provision, there is a motive to encourage entrepreneurship that encourages 100% deductions on the profit for three years and then 50% for the next two years.

This is an option for start-ups in India if recognized by the DPIIT and eligible under various conditions. Here, for eligibility under Section 80-IAC, ITR Form 10IC is required to be filed by such start-ups to avail deductions available under the said section. This form requires proof of recognition from DPIIT along with the financial data of a start-up, profits, turnover, and capital expenditure. Non-resident investors in Indian start-ups can also use this form to claim tax deductions if they meet the necessary criteria.

The right to claim tax deductions via Form 10IC draws the attention of non-residents toward this form, particularly in India’s booming start-up ecosystem. This helps ensure that companies save as much as possible while being in compliance with tax regulations; this makes way for more innovation and entrepreneurship.

ITR Form 12: Foreign Companies

This ITR Form 12 is particularly for foreign companies that source their income from India. This form is to be filed by foreign companies that have a Permanent Establishment (PE) in India or have income according to their business operations, investment, or any other financial activity. The tax laws of India apply to a non-resident company that has a transaction with Indian entities or some kind of investment in India.

Form 12 ITR: Indian Income, Deductions, and Taxes Paid by Foreign Entities. To report the income, deductions, and taxes paid in India, foreign companies utilize Form ITR-12. Companies that have a Permanent Establishment in India are required to report their income attributed to such a PE while at the same time giving detailed information about cross-border transactions, profits, and capital gains. On the other hand, foreign entities can claim tax credits for taxes paid in other countries, provided the applicable DTAA is there

Filing ITR Form 12 ensures that foreign companies comply with the Indian tax system and accurately report their income derived from India, which is crucial for non-residents engaged in business activities in the country. The form also helps mitigate any tax-related issues by ensuring that tax payments are correctly accounted for, allowing foreign companies to avoid potential disputes with Indian tax authorities.

ITR Form 29B: For Companies with International Transactions

ITR Form 29B is another widely used form by businesses, including non-resident companies. Companies must have foreign transactions involving related parties because the major hurdle would be ensuring those transactions are performed at arm’s length and by transfer pricing regulations. India’s transfer pricing rules require that transactions carried out between closely related domestic or foreign entities must be made at market prices to prevent tax avoidance.

Non-resident companies conducting business activities in India must prepare and file Form 29B to disclose details on the international transactions made with related parties. It contains a report of the transfer pricing study conducted by the company along with supporting documentation whereby the entities justify the prices charged for goods, services, or intellectual property. The Indian tax authorities require this form to ensure that multinational companies comply with the country’s transfer pricing regulations and pay the appropriate taxes based on their Indian operations.

ITR Form 11: Charitable Trusts and NGOs

When dealing with charitable activities in India, the input of non-resident individuals or entities, ITR Form 11 is used. The form was essentially put forth for charitable organizations such as trusts and NGOs since they are eligible under Section 11 of the Income Tax Act for tax exemptions. Such charitable organizations need to file this form to report their income, donations received, and expenditures.

Non-resident entities that establish charitable foundations or make donations to charitable causes in India can utilize ITR Form 11 to comply with tax laws in India. This form allows charitable organizations to claim exemptions on income used for charitable purposes while ensuring compliance with the requirements of the Income Tax Act. It further helps non-residents engaging in charity work in India to achieve maximum savings in terms of tax benefits while providing social good.

ITR Form 5: For Partnerships and LLPs

ITR Form 5 is filed by non-resident individuals who are partners in a firm of partnership or which is an LLP in India. The form is used by partnerships as well as LLPs for reporting income and availing of tax deductions for their business. All types of partnerships and LLPs, with or without foreign or non-resident partners, would be using this form.

Non-residents should hence file Form 5 in order to report their share of the income and claim corresponding deductions, which include all expenses related to the operation of the firm. This form also enables them to declare the income from the house, wealth tax, and interest, among other sources.

Conclusion

This demands a proper comprehension of not only the standard forms of tax return filings such as ITR-1, ITR-2, and others but also the specific forms intended for availing exemption, deductions, and other benefits. Forms such as ITR Form 10IA, ITR Form 10IC, and ITR Form 12 are all crucial in shaping non-residents and businesses into one that complies with the revenue laws and prevents tax liabilities. For non-residents and foreign companies, handling these forms can be complex and requires expert guidance to ensure that all the necessary documentation is submitted correctly.

Get Started with TaxDunia Today

Whether you’re an entrepreneur looking to set up a start-up, a foreign company doing business in India, or a non-resident involved in charitable activities, TaxDunia offers expert tax advisory services tailored to your needs. Apply with TaxDunia today to make the most out of your tax return and to ensure compliance with India's tax regulations. Let us handle the trouble and daunting complexity of India's tax system with ease and efficiency so you may focus on further growing your business or investment portfolio.