Income from Shares

Home » Income from Shares, Futures & Option

Income from Shares, Futures & Options

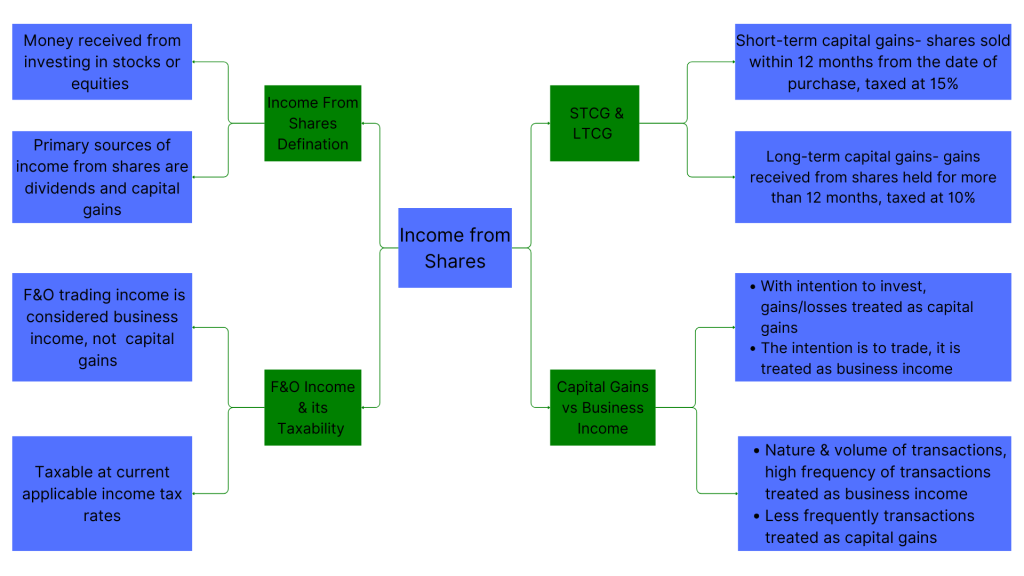

Income from shares refers to the money one gets through investing in stocks or equities. The two primary sources of income from shares are dividends and capital gains. Dividends are periodic payments made by companies to shareholders as a way for the company to share its profits. Capital gains are acquired from selling shares at a price that exceeds the cost of their purchase. The income taxability and treatments are varied, depending on factors such as the duration of investment, or if held as investments or frequently traded shares. These will greatly affect how a person needs to structure his or her financial planning.

Types of Income from Shares

Income from shares usually falls under two categories:

- Dividends: Dividends received from shares of domestic companies were fully exempt in the hands of shareholders till 31 March 2020. From this date onwards, the dividend is subject to taxation at taxpayers’ applicable tax rates.

- Capital Gains on Share Sale: Capital gains from selling shares are subject to tax. Capital gains on shares are taxed based on the holding period:

This means that gains-in case of shares listed on a recognized stock exchange and sold within 12 months from the date of purchase-are considered as STCG and are taxed at 15% under Section 111A.

- Long-Term Capital Gains (LTCG): In case the shares are sold after holding them for more than 12 months, such a gain is called LTCG. Section 112A provides that any LTCG of more than Rs. 1 lakh attracts 10% without getting the indexation benefit.

Whether income from equity shares is to be treated as capital gains or as income from business depends upon factors like:

- Frequency and volume of such transactions

- Purpose of transactions (investment or trading).

- Accounting treatment followed by the assessment.

Treatment for Tax Purposes as Business Income

Share trading may sometimes be treated as business income. However, if trading is regular, especially intraday or large volume, then the income will be taxed as “business income” under the slab rate.

Futures & Options (F&O) Income: Taxability and Classification

F&O trading income is considered “business income” and not capital gains. This does not matter whether F&O is speculative or non-speculative.

- F&O business is considered non-speculative business income under the Income Tax Act since it is settled without delivery.

Tax Treatment

- Business Income: Income or loss resulting from trading in F&O is considered business income and is taxed according to the current applicable income tax slabs.

- Losses: Losses from F&O trading can be set off against other business income or carried forward for a maximum period of eight years to be set off against future business profits.

- Audit Requirement: If the turnover of F&O trading is more than Rs. 10 crore in a year from FY 2023-24, one may have to undergo a tax audit u/s 44AB. One will have to undergo a tax audit when the turnovers do not cross Rs. 10 crore and income is declared below presumptive rates (6%/8% u/s 44AD) or losses are immense.

Capital Gains vs. Business Income: Determining Factors

Which of the income is to be considered as capital gains and which is business income? This depends on a variety of factors:

- Intention: If there is an intention to invest, the gains/losses will be treated as capital gains/losses. If the intention is to trade and change hands frequently, then the same will be treated as business income.

- Nature and Volume of Transactions: High frequency in terms of transactions could be considered business income, while less frequently, they resemble capital gains.

- Holding Period: A short holding period is generally treated as business income. Conversely, a longer holding period may amount to capital gain.

- Judgments and CBDT circulars also infer that taxpayers treat all their transactions as capital gains or business income, as the case may be.

Capital Gains and Business Profits: Taxation

Capital Gains

STCG

- STCG: Taxed at 15%.

- There is a minimum period of 12 months.

- It is on equity shares sold.

LTCG

- Taxed at 10% on the surplus amount above Rs. 1 lakh, for listed shares held more than 12 months.

- Indexation is not available.

Business Income

- Is taxed at individual or corporate tax rates, depending on the tax rate applicable to the taxpayer.

- Intraday trading income is considered business income as it is speculative, and losses are available for set-off only for four years.

- The business income that is not speculation, such as F&O allows losses to carry forward eight years.

Deductions Permitted for Business Earnings

F&O and frequent share trading attract assessment and tax on business earnings, but some of the expenses can be claimed, such as:

- Brokerage and Commission: The commission paid to the brokers regarding the trading activities.

- STT or Securities Transaction Tax: Though not deductible, it will be taken in the computation of net business profit.

- Internet and Connectivity Expenses: This may be deducted for traders with active trading.

- Advisory or Subscription Fees: trading platforms or financial advisory fees may be claimed as deductible.

ITR Forms:

- ITR-2: Capital gains from shares if treated as an investment.

- ITR-3: Business income, including F&O, speculative, and non-speculative income.

- Audit Requirements: The F&O, being business income, may lead to a tax audit if any of the turnover limits are crossed or presumptive taxation is not available.

- Advance Tax: The clients who have business income from F&O or regular trading have to pay advance tax for it to prevent the penalties.

Practical Scenarios and Examples

- Scenario 1: A person has bought shares with the intention of long-term wealth creation and occasionally sells them. The income would be normally capital gains.

- Scenario 2: A trader who trades in F&O regularly; for him, it could be a business full-time. In such cases, the same income will most likely be taxed as business income.

- Scenario 3: An employed person regularly trades shares as a supplementary business. Whether it will be treated as taxable or not would depend upon the nature and the frequency of the transactions. If it is regular, then it can be treated as business income; otherwise, it would fall under capital gains.

Record Keeping and Reporting

- Keep regular records of all transactions, bank statements, or brokerage statements, and all the expenses incurred.

- Generate capital gains statements from brokers to track gains and losses.

- Maintain open and closed positions’ details, besides turnover computation of F&O as the same would be involved in the tax audit assessment process.

Conclusion

The income derived from shares, futures, and options may be considered as capital gains or business income. This depends on whether the transactions were recurrent, voluminous, and made with a business intent. Consistent treatment, records, and compliance with tax filing and audit requirements are imperative parts of proper tax reporting by taxpayers.

Get Started with TaxDunia Today

TaxDunia is a financial services platform offering expert solutions in tax planning, filing, and compliance. It helps individuals and businesses navigate tax regulations, ensuring accurate returns and maximizing tax savings. With user-friendly tools and professional guidance, TaxDunia simplifies complex tax processes for clients across various sectors.