Income from Other Sources

Home » Income from Other Sources

What are Other Sources of Income & Its Tax Implications?

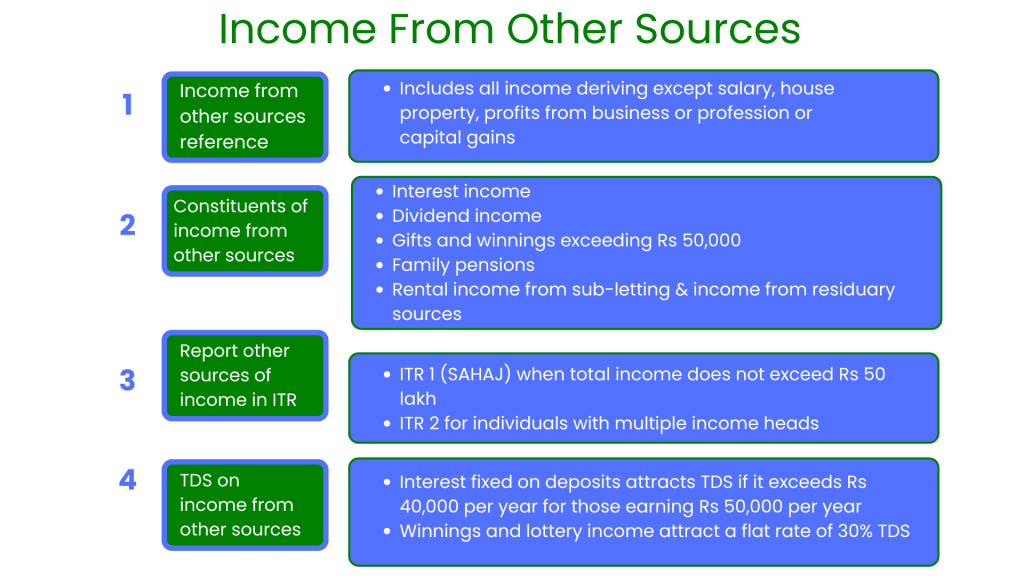

Income tax returns can be quite a nightmare if it involves multiple sources of income. The Indian tax system categorizes income into five heads, and “Income from Other Sources” is one of the common categories that remains greatly misunderstood and overlooked. It includes all the income except under other heads like salary, house property, profits from business or profession, or capital gains. This article explains in detail how to collect, tax, exemptions, and filing procedures about income from another head of sources.

Constituents of Income from Other Sources

Income under this head includes a wide variety of earnings. Some common examples are:

Interest Income:

- All savings account earnings, fixed deposit earnings, recurring deposit earnings, and bond interest are charged under this head. The interest under Section 10(15) is partially exempt from post office savings but within specific limits.

Dividend Income:

- Under Section 115BBDA, income by way of dividends from shares or units of mutual funds more than ₹10 lakh in a financial year is taxable. Previously, DDT had excluded such income, which was a beneficiary in kind. However, recent amendments have shifted the tax burden to recipients.

Gifts and Winnings:

- Monetary or non-monetary gifts exceeding ₹50,000 from non-relatives are taxable. Additionally, winnings from lotteries, games, or competitions are taxed at a flat rate of 30% under Section 115BB.

Family Pension:

- Regular pensions received by dependents of deceased employees are taxable, with certain deductions under Section 57(iia).

Rental Income from Sub-letting:

- If the property is sub-let and not owned, rental income received is taxed under this head after deducting related expenses like rent paid to the owner.

- Income from Residuary Sources: Other examples include royalty, interest on delayed tax refunds, or casual income that doesn’t fit into other heads.

Tax Implications and Deductions

A tax on other sources of income is variable based on its nature and specific provisions under the Income Tax Act. Some deductions are permitted, which reduce the assessed amount:

Section 57 deductions:

- Under this section, the taxpayer has deductions on expenses incurred to earn income, including:

- Commission or remuneration for realizing dividends.

- Rent paid for hiring machinery or furniture.

- General deductions on family pension.

- Exemptions by Way of Specific Sources:

- Interest income from bank savings is exempted up to ₹10,000 under Section 80TTA.

- For senior citizens, the exemptions related to interest income of deposits are increased up to ₹50,000 under Section 80TTB.

Calculation of Taxable Income

Under this, taxable income is computed by:

- Consolidating all income falling under “Income from Other Sources.”

- Netting down allowable deductions as per Section 57.

- Applicable income tax rate is based on an individual’s tax slab or special provisions for specified types of income, such as winnings.

- Like lottery winnings, which are taxed flat at 30%, other income is taxed under the slab rate applicable.

Reporting Other Sources of Income in ITR

Filing an ITR requires reporting income from other sources. Taxpayers will report under the appropriate ITR based on income sources.

- ITR-1 (Sahaj): For individuals with income from salary, one house property, and other sources, provided total income does not exceed ₹50 lakh.

- ITR-2: For individuals with multiple income heads, including capital gains or higher incomes under other sources.

- Taxpayers need to report the gross income, deductions, and net taxable amount under the relevant sections. Proper documentation of income details must be ensured and records of bank statements, FD receipts, or TDS certificates should be preserved for future verification.

TDS and Advance Tax

Income from other sources is generally subject to Tax Deducted at Source (TDS). For example:

- Interest on fixed deposits attracts TDS if it exceeds ₹40,000 per year for those who earn less than ₹50,000 per year.

- Winnings and lottery income also attract a flat rate of 30% TDS.

- If the income is high and the TDS is less, then the taxpayer needs to pay advance tax to avoid penalty, and this is especially crucial for the person with high income from other sources.

Avoiding Common Mistakes

Many taxpayers unknowingly commit errors while filling income from other sources. A few common mistakes are:

- Interest earned on bank deposits is not being reported.

- Gift income and interest exempted under the wrong sections

- TDS certificates are ignored and added to net income.

- Such errors may attract a notice or penalty from the Income Tax Department. Proper reporting and consulting with a tax professional can avoid such complexities.

Exemptions and Special Provisions

Most income under this head is taxable; however, specific exemptions apply:

- Agricultural Income: Though exempt as per Section 10(1), agro-related activities such as nursery operations may come under other sources of income.

- Tax-Free Bonds: Interest from certain bonds, for instance, municipal bonds, is exempt under Section 10.

- Knowing these provisions can assist in optimal tax planning and liability cuts.

Importance of Documentation

Proper documentation is significant while reporting income arising from other sources. The taxpayer should:

- Have TDS certificates (Form 16A) issued by banks or employers.

- Preserve receipts for gifts or winnings.

- Document expenses for deductions like commission or pension claims.

- Accurate documentation ensures compliance and simplifies audits or queries from tax authorities.

Special Cases and Emerging Trends

Recent amendments have changed the taxation landscape for certain income types:

Dividend Taxation: The Finance Act 2020 shifted the dividend tax burden to recipients, making it crucial to track income and file accordingly.

Digital Transactions: Interest from digital lending platforms or peer-to-peer transactions is becoming common and must be reported under other sources.

Taxpayers with evolving income patterns need to stay informed about legal and procedural changes.

Penalties for Non-Compliance

Failure to report earnings from other sources might attract penalties under Section 270A of the Income Tax Act. Notice, reassessment, or other issues due to incorrect filing is also possible. Thus, taxpayers should verify all income details, reconcile TDS, and declare all their earnings accurately.

Role of Technology in Managing Income from Other Sources

Tax Software: The interface of the software will make ITR filing easy.

Income Aggregators: Apps can aggregate income from multiple accounts so that the same amount is reported.

Government Portals: The Income Tax Department’s e-filing portal will provide pre-filled data, helping taxpayers cross-check.

Conclusion

Income generated from sources other than employment is significant in tax liability. Accurate reporting in this area is therefore a must. Know the components, claim exemptions where applicable, and follow the necessary protocols in filing returns to ensure compliance and reduce tax burden. These are after all, interests, dividends, gifts, or casual earnings-and knowing the importance of this category can help taxpayers manage their finances better and avoid legal battles.

Proper tax planning and awareness can turn this complex head of income into something that leaves one shining in financial lucidity and compliance.

Get Started with TaxDunia Today

Maximize your tax savings with TaxDunia! Our expert team offers personalized tax solutions to help you file confidently and save more. Whether you're an individual or a business, we simplify the process and ensure compliance. Get started today with a free consultation and discover how we can help you reduce your tax burden.