Income from House Property

Home » Income from House Property

Income from House Property under Income Tax

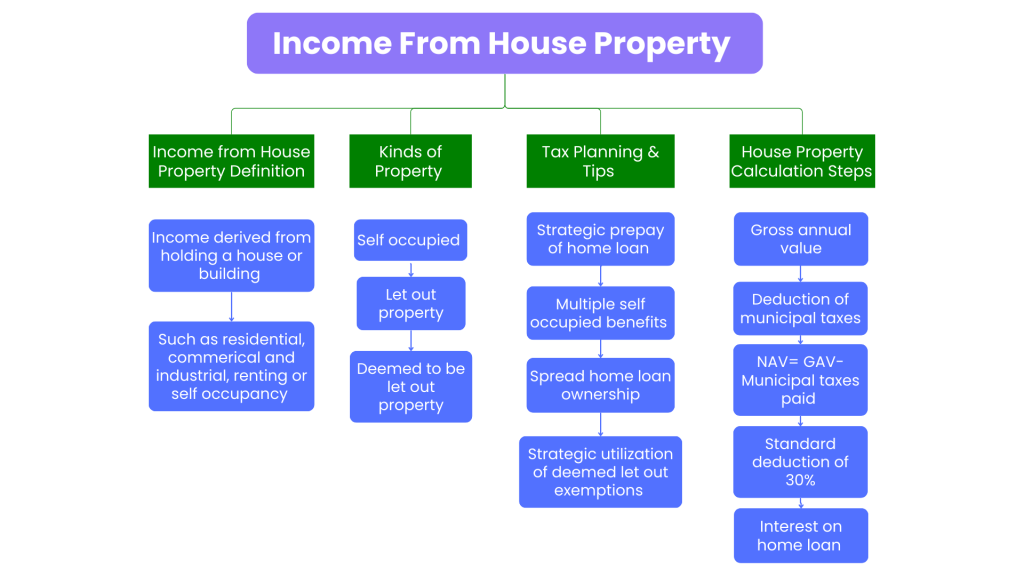

Income from House Property refers to the income one earns on holding a house that he can rent or has as self-occupied. Income from house property is one of the five heads of income as contemplated under income tax laws. In simple terms, this source of income is taxed but the same has specific deduction and exemptions that reduces one’s tax liability. What does this guide have in store for you? It introduces income from house property, along with its computation, taxation, and allowable deductions.

1. What is Income from House Property?

Income from house property is all the income that arises from buildings or land owned by a person which he has let out or keeps unlet in the hope of his future own use, and it encompasses income from residential, commercial, and industrial properties if such properties are not used by the owner for business or professional purposes.

Points to Know What House Property Income Is:

- Ownership: This head can be levied only on the owner or deemed owner of the property.

- Use of Property: The property cannot be used for business or professional purposes; in that case, the income is treated as business income.

- Kinds of Properties

- Self-Occupied Property: A property used by the owner, parents, or spouse and children for personal residence.

- Let-Out Property: A property that is given on rent for deriving rent income.

- Deemed to be Let-Out Property: Where any person has two or more self-occupied properties then the third and further ones are deemed let out and hence, its owner’s income is assessed on income from house property, even though such properties are not let out

Income from House Property

This house property income is standardized; it is calculated on the annual value of the property – actual or deemed, after deducting all allowable deductions.

House Property Income Calculation Steps

- Gross Annual Value (GAV):

- For Let-Out Properties, GAV would be the actual rent received or the expected rent, whichever is higher.

- For Self-Occupied Properties, GAV is zero as there is no rental income in self-occupation.

- Deduction of Municipal Taxes:

- Property taxes paid to the local government or municipal authority can be deducted from the GAV.

- Only such taxes paid by an owner in the financial year are allowed for deduction.

- Calculation of Net Annual Value (NAV):

- NAV = Gross Annual Value – Municipal Taxes Paid

- Standard Deduction:

- Deduction of 30% of the NAV for the payment of maintenance

- This is without actually determining the expenses and will apply only to let-out as well as deemed let-out properties.

- Interest on Home Loan (If Applicable):

- Interest is paid to take a loan for the acquisition, construction, repair, or rebuilding of the property.

- It is allowed as a deduction. In the case of self-occupied properties, its limitation is up to ₹2 lakh in a year.

- In the case of let-out properties, the full amount of interest paid is allowed. Income from House Property

Income from House Property

Income from House Property = (Gross Annual Value – Municipal Taxes Paid) – Standard Deduction (30% of NAV) – Interest on Home Loan

Example Calculation

You have a let-out property with the following details:

- Annual Rent (GAV): INR 5,00,000

- Municipal Taxes Paid: INR 20,000

- Interest on Home Loan: INR 1,50,000

The computation would be as follows

- Gross Annual Value (GAV): INR 5,00,000

- Less: Municipal Taxes: INR 20,000

- Net Annual Value (NAV): INR 4,80,000

- Less: Standard Deduction (30% of NAV): INR 1,44,000

- Less: Interest on Home Loan: INR 1,50,000

Income from House Property = 4,80,000 – 1,44,000 – 1,50,000 = INR 1,86,000

2. Tax Implications for Different Types of Properties

Self-Occupied Property (SOP):

A self-occupied property is a property used by the owner for which no letting or sub-letting is done during the entire year.

- The Gross Annual Value of an SOP is considered to be nil. Hence, there would not be any kind of rental income.

- Deductions Allowed: only interest on a home loan of up to INR 2 lakh per year

- Deemed Let Out Rules: In case there are multiple self-occupied properties with a taxpayer, then two can be declared as self-occupied whereas the rest will be considered let out.

Let-Out Property (LOP):

- A let-out property generates rental income and it is brought to GAV

- Gross Annual Value is computed about the actual rent received, or any sum likely on this behalf, whichever of them is higher.

- Permitted Deductions

- Municipal taxes paid

- 30 percent of NAV as a Standard Deduction

- Interest for a whole home loan – completely permissible as a deduction in whole.

Deemed to be Let-Out Property (DLOP):

- All other self-occupied property, over and above the two allowed as SOPs are considered to be let out for tax calculation.

- The GAV of a deemed let-out property is calculated on an estimate of rent for a similar property in the location.

- Deductions Allowed: Like that of a let out, municipal taxes, standard deduction of 30%, interest on a home loan, no capital.

3. Deductions Admissible Under Head 'House Property Income’

Under this, the Income Tax Act provides various deductions to be set off from the taxable income. The deductions are admissible under both let-out and self-occupied properties but differ in their limits and applicability.

Types of Deductions

Standard Deduction (30% of NAV):

- The tax act provides a fixed standard deduction of 30 percent of the Net Annual Value (NAV) admissible for repairs, maintenance, and other expenses.

- This is only applicable on let-out and deemed let-out properties and not self-occupied properties.

Deduction on Interest on Home Loan:

- Home loan interest is allowed under Section 24(b) of the Income Tax Act.

- The deduction on interest varies for self-occupied and let-out property:

- Interest on borrowings for construction or purchase can be deducted up to INR 2 lakh per annum.

- Conditions: To be fully eligible for the deduction of Rs. 2 lakh, the property must be constructed or purchased within five years from the end of the year in which the loan is taken.

- Deemed Let-Out or Let-Out Property:

- Deeming Limit: No restrictible amount on let-out interest for deduction is seen. Instead, any and all actual interest paid gets deducted. Thus landlords get substantial relief from the tax under this section.

Pre-Construction Interest:

- This is otherwise referred to as the interest paid while loans are obtained to acquire or construct any property to acquire the rights over a particular property in advance of the completion of such construction.

- This is allowed as a deduction spread equally over five years from the year of completion.

- The pre-construction interest is allowed to be set off within the limit of INR 2 lakh if the property is self-occupied.

Deduction for Municipal Taxes Paid:

- All municipal taxes, including property taxes, are deductible from GAV.

- This relief can be claimed only when the taxpayer has paid the taxes and the taxes need to be paid in the same year for which income needs to be computed.

Tax Sops to First-Time Home Buyers (Section 80EE and Section 80EEA)

- Section 80EE

- To first-time buyers, they get extra interest relief on their home loan, up to INR 50,000 in one year.

- Conditions: The amount for the loan will not be more than INR 35 lakh, and the property’s value will not be over INR 50 lakh.

- Section 80EEA

- In this section, interest on a home loan is given an extra deduction to the amount of INR 1.5 lakh.

- This scheme can be implemented for home loans provided in between specific dates to individuals who are the first ones to avail of this facility in case they wish to acquire affordable houses.

4. Special Cases and Taxation

Co-ownership of Property

If a particular property is jointly owned, then the co-owner or co-owners can have the benefit as per share. The benefit along with the deductions will also be done separately, only if both the owners or each individual owner has been granted a loan and satisfies all other requirements for the benefit to be sanctioned.

Vacant Properties

If a let-out property remains vacant for any part or whole of the year, Gross Annual Value can be determined on account of actual rent received if any during the period under occupation. Vacancy loss can be adjusted and is allowed to reduce taxable income.

5. Tax Planning Tips regarding Income from House Property

Here are some tips for efficient tax planning related to house property income:

- In the presence of let-out properties, the interest on the loans for let-out properties need not be capped to come about with substantial reductions in taxable income.

- Multiple Self-Occupied Benefits- wherein, self-occupation is allowed on more than one property, that is, if there’s a let-out of one of these, then the tax savings in case of a let out on that particular property reduces the tax liability in return.

- Spread Home Loan Ownership Across Family Members: If a person owns a property with their spouse or family member, both can claim deductions proportionate to their share, which maximizes the tax benefit, especially if both are paying the loan and are co-borrowers.

- Strategic Prepay of Home Loan: The home loan should be prepaid in such a manner that interest payments are maximized during the early years. Since this would imply payment of home loan interest, which is taxable and deductible, one is likely to have fewer tax payments in the years that result in higher interest outgo.

- In addition to this, in case it is a first home and falls into the affordable housing category, it would have an additional deduction as provided under Sections 80EE and 80EEA. Therefore, a tremendous amount of tax for first-time buyers can be saved by this means only in the affordable segment.

- Strategic Utilization of Deemed Let-Out Exemptions: Provided you have more than one property you can look to choose properties that might have lower expected rental value so that tax liability on those properties is minimized.

- Strategic Utilization of the Income from Properties for Building Wealth: Rental income should be used strategically to make investments, create emergency funds, or prepay other debts. Proper financial planning with rental income as one of its components will only lead to better wealth creation.

Conclusion

It may very well be a significant source of income, but one should be aware of many tax implications and rules as well. The correct knowledge of taxable income from the house property, such as standard deductions, interest on home loans, and municipal taxes, will help a taxpayer be more accurate in tax reporting and tax planning. Be it a property owned and used by you or rented out, knowing the deductions together with their applicable limits helps you cut down tax liabilities and make financial decisions better.

Get Started with TaxDunia Today

With appropriate planning and judicious leverage of available deductions, a taxpayer may be able to effectively control the property income, tax outgo, and strategize investments in real estate. Also, a visit to a tax professional will guide one on how to advise concerning property income tax rule variations and exemptions that can benefit an individual. Visit TaxDunia for further help and assistance.