Income from Capital Gains

Home » Income from Capital Gains

Income from Capital Gains

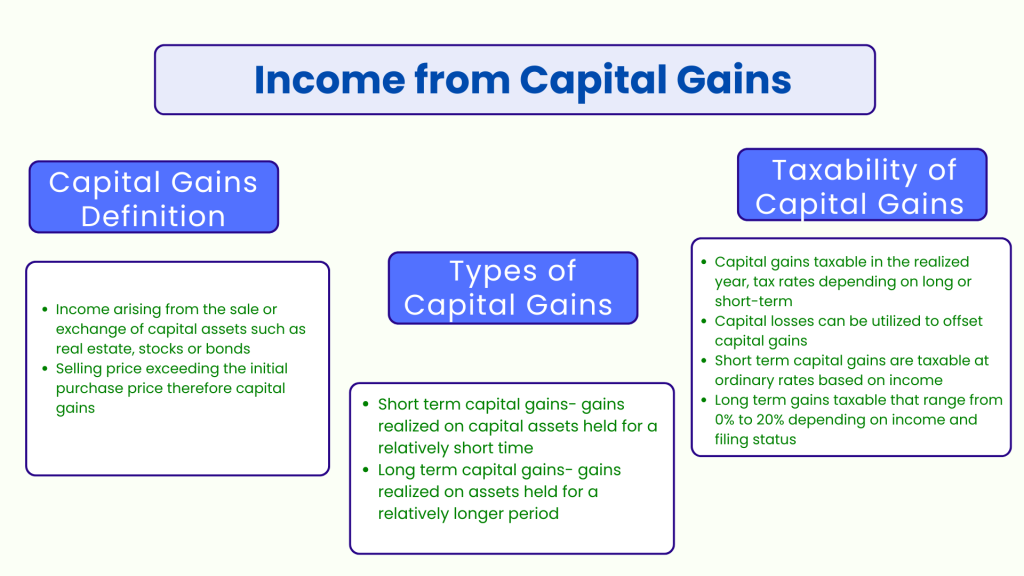

Capital gains are the income that arises from the sale or exchange of capital assets such as real estate, stocks, or bonds. The selling price exceeds the initial purchase price, thus considered a capital gain. Thus, capital gains are a component of taxable income subject to varying rates and treatments under different tax laws. Here are some types of capital gains,

Types of Capital Gains

- Short-Term Capital Gains (STCG): Gains realized on assets held for a relatively short period, say under a year, though it depends on the jurisdiction and the type of asset.

- Long-Term Capital Gains (LTCG): Gains realized on assets held for a relatively longer period, say over a year, though again it is subject to the discretion of tax regulations.

Capital gains may affect the overall taxable income, and thus effective management of these assets plays an important role in efficient tax planning.

What is a Capital Asset?

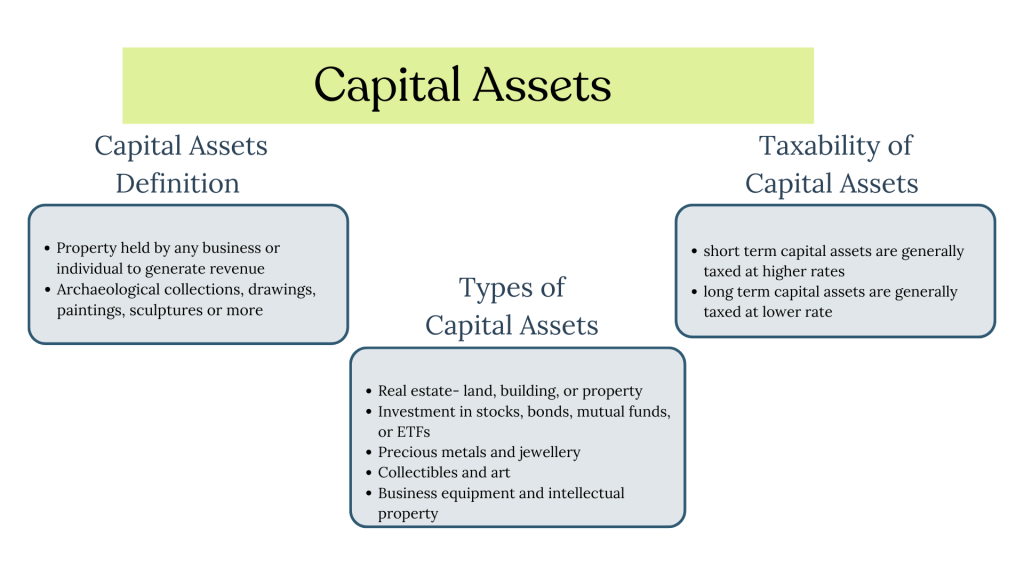

“capital asset” means—

(a) property of any kind held by an assessee, whether or not connected with his business or profession;

(b) any securities held by a Foreign Institutional Investor who has invested in such securities by the regulations made under the Securities and Exchange Board of India Act, 1992 (15 of 1992);

(c) any unit linked insurance policy to which exemption under clause (10D) of section 10 does not apply on account of the applicability of the fourth and fifth provisos thereof,] but does not include—

(i) any stock-in-trade [other than the securities referred to in sub-clause (b), consumable stores or raw materials held for his business or profession;

(ii) personal effects, that is to say, movable property (including wearing apparel and furniture) held for personal use by the assessee or any member of his family dependent on him, but excludes—

(a)jewellery;

(b)archaeological collections;

(c) drawings;

(d) paintings;

(e) sculptures;

(f) any work of art.

Explanation 1. For this sub-clause, “jewelry” includes

(a)ornaments made of gold, silver, platinum, or any other precious metal or any alloy containing one or more of such precious metals, whether or not containing any precious or semi-precious stone, and whether or not worked or sewn into any wearing apparel;

(b)precious or semi-precious stones, whether or not set in any furniture, utensil, or other article or worked or sewn into any wearing apparel.

Common Types of Capital Assets:

- Real Estate: land, building, or property.

- Investment in Stocks, Bonds, Mutual Funds, or ETFs:

- Precious Metals and Jewellery: Gold, silver, or other precious jewelry.

- Collectibles and Art: Paintings, rare coins, or stamps.

- Business Equipment and Intellectual Property: Machinery, patents, or trademarks.

- Personal use items like a first home or a car may also be capital assets but are treated differently for tax purposes. For these, exemption and exclusion apply.

Non-Capital Assets:

Assets that are not capital assets might include:

- Inventory or stock in trade.

- Depreciable property used in business

- Government bonds and treasury securities, depending upon jurisdiction.

Holding Period

The holding period refers to the time an asset is held by the owner before it is sold. It may be essential in computing short or long-term capital gains tax as well as their rates and treatments.

Importance of Holding Period:

It determines the tax rate since short-term and long-term capital gains are taxed differently.

Reduces Tax Liability: Holding assets for long periods often results in better tax rates- especially true with investments

Holding Periods by Asset

- Stocks and Bonds: Generally, less than one year for short-term income and more than a year for long-term income.

- Real Estate: Now, for real estate, in some jurisdictions, the holding period may be up to two years or even more to qualify for long-term gains.

- Collectibles: There could also be collectibles that have other holding periods or treatments.

- A long-term capital asset is an asset held by an individual or any legal entity for a given period that usually exceeds a year. This qualifies such an asset for the long-term capital gains tax treatment. Long-term capital assets enjoy lower tax rates which therefore promote long-term investments and stable asset appreciation.

Examples of Long-Term Capital Assets:

- Real estate over two years; this depends on the rules prevailing in the local taxes.

- Stocks over one year.

- Bonds, ETFs, or mutual fund investments for long-term

Tax Advantages of Long-Term Capital Stock:

- Lower Tax Rates: Long-term capital gains generally incur much lower rates of taxation than ordinary income or short-term gains.

- Economic Incentives: Governments often encourage the economy by providing incentives for long-term investments. Consequently, it reduces the tax imposition on such gains.

- Tax Deferral: Long-term gains bring a postponement of taxes for investments so that the values may increase first and then get taxed at a favorable rate.

Short-Term Capital Asset

A short-term capital asset is an asset that is held for a short period, usually less than a year, before such assets are sold or exchanged. The gains from these assets are referred to as short-term capital gains, which are taxed as ordinary income rates or higher rates compared to long-term gains.

Examples of Short-Term Capital Assets:

- Stocks, bonds, or mutual funds are sold within a year of purchase.

- Property acquired for less than the minimum holding period. This is typically less than two years.

- Collectibles or art sold in the year they are acquired.

Tax Effect on Short-Term Capital Assets: Higher Tax Levels

In most cases, these will be taxed like ordinary income and hence likely considerably higher than long-term capital gains levels.

Frequent Trading Impact

Short-term capital gains taxes can hammer a trader who buys and sells frequently, such as a day trader because they can add up quickly.

Taxability of Capital Gains

Capital gains are, normally, taxable in the year realized. Generally, this is at the time of selling or exchanging an asset rather than at the time of appreciation. Tax rates will depend on the nature of the gain, whether short-term or long-term, and local tax rules.

Treatment of Losses:

Capital Losses: In the sale of capital assets, losses in which the asset is sold for less than it was bought for can be utilized to offset capital gains.

Net Capital Loss Deduction: A net capital loss is normally deductible against other income to the extent of the allowable limitation amount; an excess is always carried over to future years.

Capital Gains Tax Compliance:

Filing Requirements: In general, the capital gains must be reported on tax returns subject to reporting requirements, including date of purchase/sale, cost basis, and proceeds of sale.

Record-Keeping: The correct recording of the purchase price, holding period, and sale proceeds will become important for accurate reporting of capital gains.

Capital Gains Tax Rates

Short-Term vs. Long-Term Rates:

- Short-Term Capital Gains Tax Rate: Tends to be taxed at ordinary income tax rates, which of course vary widely based on income.

- These generally have lower tax rates than short-term, although that can range from 0%, 15%, or 20% depending on the income and filing status of the tax filer.

Example Tax Rates

- Low-income: 0% in long-term gains to attract investment in low-income households

- Middle class: 15% for long-term gains to attract middle-income earners.

- High-income brackets: 20% and up for long-term gains and potentially subject to additional levies, such as the net investment income tax.

Special tax rates apply to certain types of assets.

- Collectibles: Taxed because these are mostly distinct items, and value appreciates significantly.

- Qualified Dividends and Certain Sales of Real Estate: May be eligible for favorable treatment or outright exclusions.

- Capital Gain Exclusion of Primary Residence: Most taxation systems allow taxpayers to exclude up to some level of capital realized on the sale of their primary residence, provided that the taxpayer has owned and used the residence for a certain period. There are limits, say, $250,000 for the individual and $500,000 for married filing joint).

- Retirement Accounts, e.g., IRAs: any profit realized inside retirement accounts is tax-deferred or tax-exempt if distributed in line with the rules of the respective accounts.

- Exclusion from Small Business Stock: Within certain states, a small business stock gain may be exempt if the holding period is long enough.

- Re-investment Exemptions: Within certain states, the deferral or exemption of gain shall apply if the funds are re-invested within some time frame, including sales of certain agricultural land or re-investing into another property.

Investment-Specific Exemptions

- 1031 Exchanges (available in the U.S. only): This is a capital gains tax deferral on real estate when proceeds are redeployed in “like-kind” property.

Rollover of Capital Gains into Qualified Opportunity

- Funds: Some capital gains are forward-timed, and even rolled back, if invested in “qualified opportunity zones.”

Timing and Strategy for Deferrals

- Strategic planning of asset sales, reinvestments, and timing should maximize the utilization of exemptions available and minimize the amount of tax liability on capital gains. Consider selling assets in lesser income years, among other examples.

Conclusion

Capital gains, classification of assets, holding periods, and tax rates all play a very significant role in financial planning and taxation compliance. Declaring such capital gains either short-term or long-term allows taxpayers to make choices between their investments and holdings. Maximizing exemptions and the sales of assets at tax rates can result in significantly higher after-tax returns on investments, thus leaving more of the hard-earned money in the pockets of people and businesses. Understanding the ever-branching tax laws would thereby mean taking into account possible allowable deductions, deferrals, and reinvestment options in making an investment decision that would foster financial growth and stability.

Get Started with TaxDunia Today

TaxDunia is a platform that provides tax and financial advisory services, helping individuals and businesses navigate tax regulations, compliance, and planning. It offers resources, guides, and tools for tax filing, GST, accounting, and financial management. With expert guidance, TaxDunia aims to simplify financial complexities for optimal tax benefits.