GST TDS

Home » GST TDS

GST TDS: A Critical Analysis

The Goods and Services Tax (GST) that India introduced on July 1, 2017, marks a milestone in the history of taxes as it drastically changed the norm for levying and collecting the same across the country. The GST brought some important concepts, one of which was TDS, or Tax Deducted at Source. It helps ensure compliance and clear tax collection. Mainly, GST TDS is designed to provide a platform for the government to collect taxes directly at source, creating efficient tax collection systems that improve tax revenue management. This article delves deeper into the concept of GST TDS, explaining its purpose, how it works, who is responsible for its deduction, and what businesses must do to comply with this provision.

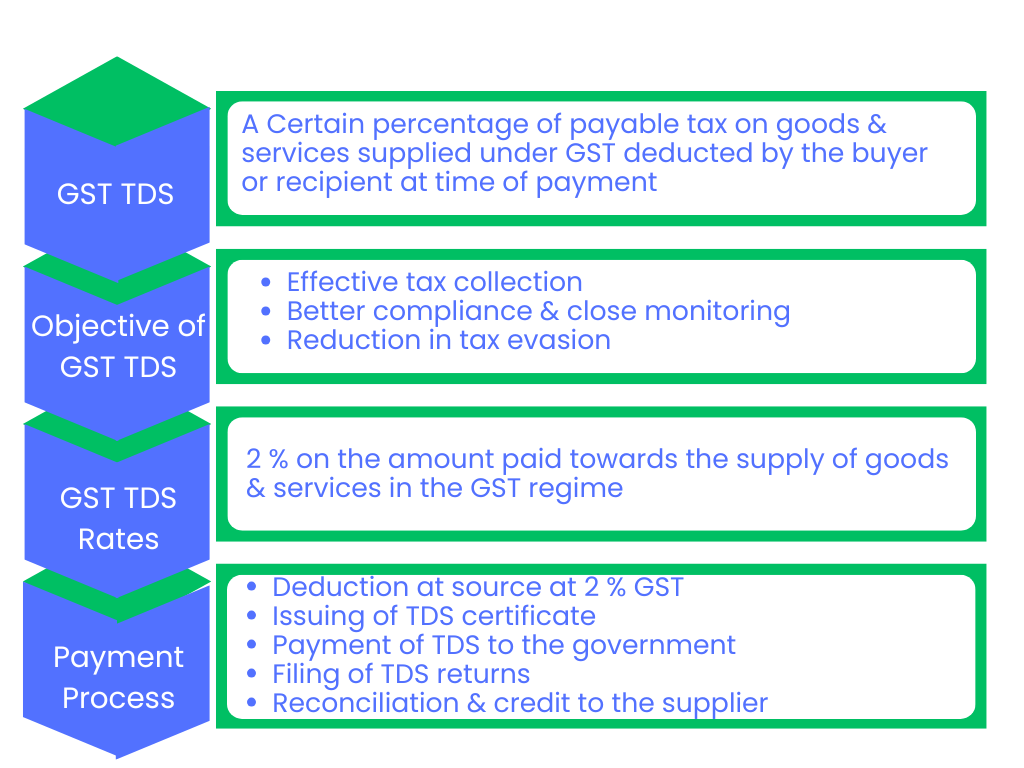

What Is GST TDS?

The GST TDS refers to a system wherein a certain percentage of the tax payable on the goods and services supplied under the GST regime is deducted by the buyer or the recipient at the time of payment. Though the concept of TDS under GST is like the TDS under the Income Tax Act, its implementation is to ensure efficient and timely collection of GST on certain transactions. It can only be applied to some categories of taxpayers: government departments, local authorities, and some notified entities, which have to deduct tax at prescribed rates from the payments made to suppliers.

TDS under GST helps mitigate the risks of tax evasion and defaults, particularly when dealing with large transactions or government-related procurements. By collecting the tax at source, the authorities ensure a more accurate and consistent flow of tax revenue, which can be credited against the suppliers’ tax liabilities. This process aids in reducing the chances of fraudulent claims and ensures that taxes are paid on time.

Purpose and Objectives of GST TDS

The principal aim of introducing TDS under the GST regime is to enhance tax compliance, especially in sectors where evasion may be higher or more likely or where sums of money are bigger. The objectives behind the introduction of GST TDS are as follows:

1. Effective tax collection: The TDS enables taxes to be collected at source and reduces the chances of tax leakage. This is very important in government contracts, where large payments are made, and proper tax compliance is highly essential.

2. Efficient Tax Collection: Since the Government is on the receiving end, TDS will also ease the process of collection of tax from the government’s point of view. It eliminates waiting for taxpayer returns and payment at the end of the period as the Cess flow will be assured and more or less foreseen.

3. Increased Compliance and Closeness of Monitoring: Tax deduction at the source on certain organizations-such as government bodies and public sector undertakings enhances compliance and closeness of monitoring as it increases the likelihood that suppliers might have transferred tax to the government, thus lowering the risk of non-compliance or evasion.

4. Reduction in Tax Evasion: With the introduction of TDS under GST, the government aims to ensure that taxes are deducted at every step of the transaction chain, thereby reducing the chance of tax evasion or underreporting. This system encourages taxpayers to comply with the regulations and file accurate returns.

Applicability of GST TDS

GST TDS provisions apply to specified categories of transactions and the parties involved under the GST Act. The Government of India has identified certain categories of suppliers and recipients who should comply with these provisions. All the persons mentioned below are required to deduct GST at source:

- Government Departments and Local Authorities: All departments of a government, local authority, or public sector undertaking which pay suppliers for goods or services supplies are supposed to recover GST at source. This usually accrues in the form of contracts and payments under the process of government procurement.

- Notified persons/Entities: The government can notify specified categories of persons/entities, such as large corporate entities or bodies receiving government funding, responsible for deducting tax at source. Such notifications may vary with the nature of the transaction or sector involved.

- Threshold Limit: A threshold limit is prescribed. GST TDS would be required only if the aggregate value of the contract or payment exceeds a certain amount. This limit avoids subjecting smaller transactions to compliance burdens.

- It must be further noted that although government agencies are the largest taxpayers responsible for tax deductions, the private sector could also be affected in terms of contracts that fall under GST TDS. The big private companies contracting with any government department need to deduct GST from the payment received.

Rates of GST TDS

The government derives the GST TDS rate and modifies it according to fiscal policies and specific sectoral requirements. Currently, through the latest updates, the GST TDS rate stands at 2% on the amount paid towards the supply of goods and services in the GST regime. The said amount will attract GST in the succeeding period.

GST TDS rates may vary with the nature of the transaction as well as the specific type of supply. For example, if there is a supply of goods, services, or both, then the applicable rate will be levied on the taxable value of the supply.

It is essential for businesses and taxpayers to stay updated on any changes in the TDS rate as per the notifications and circulars issued by the government. Any deviations from the prescribed rate can result in penalties and interest charges for non-compliance.

Deduction and Payment Process

The process for deducting and paying GST TDS is presented in various stages. First, identify the types of transactions falling within the GST TDS ambit. After identifying a transaction, the deductor has to deduct the appropriate percentage of tax from the amount given to the supplier.

- Deduction at Source: A deductor is usually a buyer or recipient of the goods or services and has to deduct GST from the total value of the invoice. For instance, if a supplier issues an invoice for Rs 100,000, the deductor will calculate the 2% GST (Rs 2,000) to be deducted from the payment.

- Issue of TDS Certificate: The deductor, after deducting the tax at source, must issue a TDS certificate to the supplier, confirming the amount of tax deducted. This helps the supplier, when the GST returns are being filed, claim that tax credit through the TDS certificate issued.

- Payment of TDS to the Government: After deduction, the deductor is obligated to pay the amount of TDS to the government within the time frame provided. In the case of GST, this is usually done through the GST portal, where the deductor must furnish details of the deducted tax along with relevant documents.

- Filing of TDS Returns: The deductor is required to file periodic GST TDS returns, providing details of the transactions, the amount of tax deducted, and the payments made. These returns must be filed on time to avoid penalties or late fees.

- Reconciliation and Credit to Supplier: The tax credit could be claimed by the supplier towards the amount deducted at the source, and these would be reflected in their GST returns. The suppliers can use the tax credit received by them to offset their tax liabilities.

Compliance and Penalties

Therefore, it is imperative for businesses and entities responsible for deduction to adhere to GST TDS provisions. Failure to deduct or deposit tax at source within the prescribed time frame or not furnish returns would attract an appreciable quantum of penalties and interest charges on the respective entity.

Penalties for non-compliance also include fines, interest on late payments, and sometimes even disqualification from receiving tax credit. All this makes it mandatory that businesses maintain accurate records of all transactions that are subject to GST TDS and follow the timelines set up by the government.

Suppliers whose TDS certificates are not received or whose TDS is deposited incorrectly may also face hindrances in claiming tax credits. This may create cash flow problems for businesses that rely on timely input tax credits for offsetting their GST liabilities.

Conclusion

This would be a crucial step by the government of India to improve tax compliance and bring the tax collection mechanism under the system of GST, which is primarily designed for government departments and major organizations but is required for all business concerns to understand its implications and apply the regulations accordingly.

By ensuring that taxes are collected at the source, the government can reduce the risk of tax evasion and create a more transparent and accountable tax system. Businesses need to be aware of the procedures for deduction, payment, and filing and ensure that they issue correct TDS certificates to their suppliers to avoid complications. Ultimately, GST TDS forms a core component in building the tax infrastructures of India while ensuring that the tax system is robust, efficient, and sustainable.

As businesses continue to adapt to the GST regime, understanding and implementing GST TDS will be a critical component in maintaining compliance and contributing to the overall success of the country’s tax system.

Get Started with TaxDunia Today

TaxDunia is a comprehensive platform offering expert services in tax advisory, compliance, and planning. It provides businesses and individuals with solutions for GST, income tax, and other financial matters. With a focus on simplifying complex tax processes, TaxDunia helps clients navigate India's ever-evolving tax landscape efficiently. Get started today!