GST Composition Scheme

Home » GST Composition Scheme

GST Composition Scheme: A Detailed Explanation

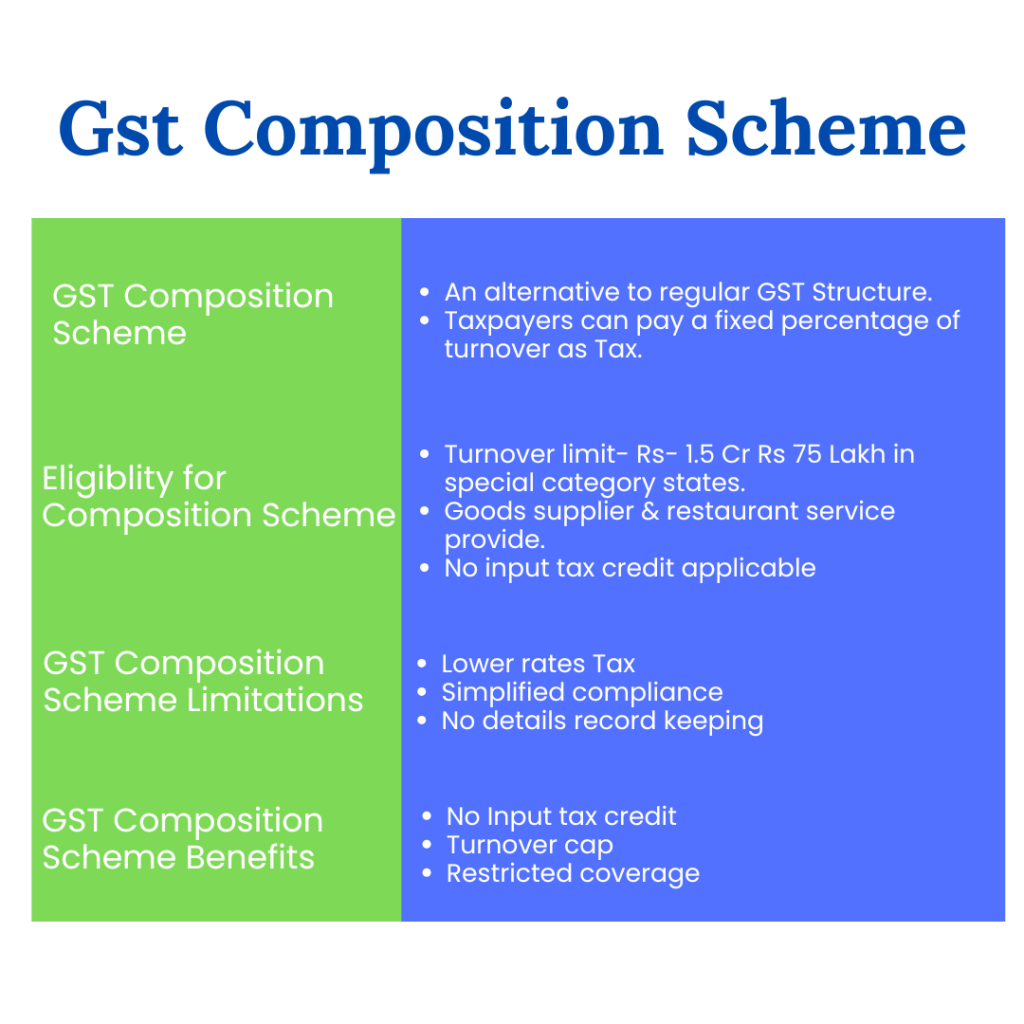

The GST Composition Scheme is the method devised to simplify the compliance of tax for small business units and service providers operating in India. This scheme will offer an alternative to the regular structure of GST where the eligible taxpayers pay a fixed percentage of their turnover as tax, thereby reducing the compliance burden. This guide covers who can opt for the Composition Scheme, its benefits and limitations, the filing process, and how to transition from this scheme to the regular GST framework.

Who Can Opt for the Composition Scheme?

The Composition Scheme is primarily for small taxpayers. The main eligibility criteria are as follows:

- Turnover Limit

The entities whose aggregate turnover in the previous financial year is not more than Rs. 1.5 crores can take up the Composition Scheme. For special category states like Arunachal Pradesh, Nagaland, and so on, it is Rs. 75 lakhs.

- Nature of Supply

Only businesses concerned with supplying goods may claim the scheme. Normally service providers are not entitled unless it is restaurant service and the turnover does not cross the threshold.

- Type of Business

Businesses will not be involved in the following-

- Supply through e-Commerce.

- Supply across states or inter-state trading.

- Exempted supplies.

- Services of value exceeding INR 5 lakhs.

- No ITC

Under the Composition Scheme, a taxpayer will not be eligible to obtain input tax credit on purchased goods and services.

- Disallowance of Certain Suppliers of Goods or Services

Supplying businesses registered under normal GST or supply of goods through an e-commerce operator shall not be allowed to become eligible under this scheme.

GST Rates under Composition Scheme

The rates under GST are comparatively lower for the registered businesses and it is one of the benefits that you can also accrue if you opt to get registered under this scheme and meet the liabilities. The applicable rates are the following

Business Category | CGST | SGST | Total |

Manufacturer and trader of goods | 0.5% | 0.5% | 1.0% |

Restaurants not serving alcohol | 2.5% | 2.5% | 5.0% |

Other service providers | 3.0% | 3.0% | 6.0% |

What are the Conditions to Avail of the Composition Scheme?

If you want to enjoy the benefits offered under the composition scheme, you need to meet the following conditions. These conditions are as follows

- The composition scheme dealer does not claim Input Tax Credit

- The dealer is prohibited from supplying goods that are not taxable under GST. For example, alcohol

- If the dealer has different businesses under the same PAN, they must register all the businesses under this scheme collectively

- Paying taxes at normal rates for transactions under the Reverse Charge Mechanism

Benefits and Limitations of the Composition Scheme

Benefits

- Lower tax rates

Composition scheme tax rates are generally more favorable compared to those charged on regular taxpayers. The rates depend on the type of goods supplied:

- Manufacturers: 1%

- Restaurant services: 5%

- Traders: 0.5%

- Simplified Compliance

It has significantly reduced the burden of compliance. Here, the taxpayer has to file only one return every quarter, GSTR-4. In the normal scheme, taxpayers have to file many returns.

- No Detailed Record Keeping

There is no need for the record keeping of every sale and purchase in this scheme as the business will have ease while running the operations.

- Predictable Cash Flow

The fixed percentage of tax based on turnover ensures that businesses can predict better their tax liabilities, helping in cash flow management.

Limitations

- No Input Tax Credit

This is one of the critical drawbacks as input tax credit cannot be claimed, resulting in higher costs of procurement for businesses.

- Turnover Cap

The limit of INR 1.5 crores in turnover does not help the business grow. The businesses have to shift to the regular GST scheme if the turnover exceeds the said limit, which in turn may increase the compliance cost.

- Restricted Coverage of Supplies

The scheme does not cover inter-state supplies or the supply of services (with certain exceptions), thereby restricting the market for many businesses.

- Restrictions on Certain Businesses

These have been kept outside the ambit, and for particular business categories- those trading online, for instance, whose business the supply has to be made through this facility, participation is only to that extent.

File Returns under the GST Composition Scheme

Return filings under the Composition Scheme are simple and uncomplicated, so the burden of compliance is relieved as much as possible.

- GSTR-4

The composition taxpayer has to file a return in GSTR-4, which is a quarterly return.

Due Date: GSTR-4 has to be filed within the 18th day of the month following such a quarter.

Return should be furnished with basic details, which are:

- Outward supplies summarised.

- Amount of tax payable on the prescribed percentage of turnover.

- Inward supplies particulars and tax paid.

- Tax Payment

The Taxes are to be paid together with the filing of GSTR-4. For this, payment can be made online through the GST portal.

- Record Keeping

Although it is not necessary to keep up-to-date records, keeping the sales and purchase books at all times is always suggested in case of proper reporting.

How to Transition from Composition Scheme to Regular GST?

A trader or manufacturer may wish to opt out of the composition scheme and opt for a regular GST scheme for several reasons like crossing the threshold limit for the composition scheme or desiring for input tax credit.

- Eligibility to exit from Composition Scheme

A taxpayer can opt out of the Composition Scheme if his total turnover exceeds INR 1.5 crores or if he wishes to add new business lines which are not permitted under the Composition Scheme.

- Transition Process

- Intimation: He is required to give a formal intimation to the GST authorities about his desire to transition to the regular scheme.

- Filing GSTR-1 and GSTR-3B: The taxpayer needs to file the monthly returns, that is, GSTR-1 and GSTR-3B, as may be applicable post-transition.

- Availing Input Tax Credit: After the transition, the business can take an input tax credit on all purchases, which would result in cash flow benefits.

- Record Keeping

The businesses that have transitioned are mandated to maintain records with minute details as is expected from the regular GST regime. This includes recording every sale, purchase, and payment of tax.

- Compliance Readiness

The more complex and frequent returns combined with detailed record keeping place even greater compliance requirements on the business concerning the regular GST scheme.

Conclusion

The GST Composition Scheme is an advantageous framework for small businesses with simplified compliance and relief in tax burdens. However, it has limitations on input tax credits and turnover caps. Thus, the entire process of understanding both advantages and disadvantages and procedures in return filing and shifting to the regular GST regime becomes important for businesses while making decisions that support their growth strategy.

Hence, in navigating all these areas efficiently, businesses would find optimal fulfillment in tax compliance with adherence to the dynamically changing nature of regulation. Taxdunia is the perfect solution for all your tax and financial services, customized to meet the needs of both individuals and businesses. For services like GST filing, income tax returns, bookkeeping, and compliance management, Taxdunia simplifies complex financial tasks.