GST Compliance

Home » GST Compliance

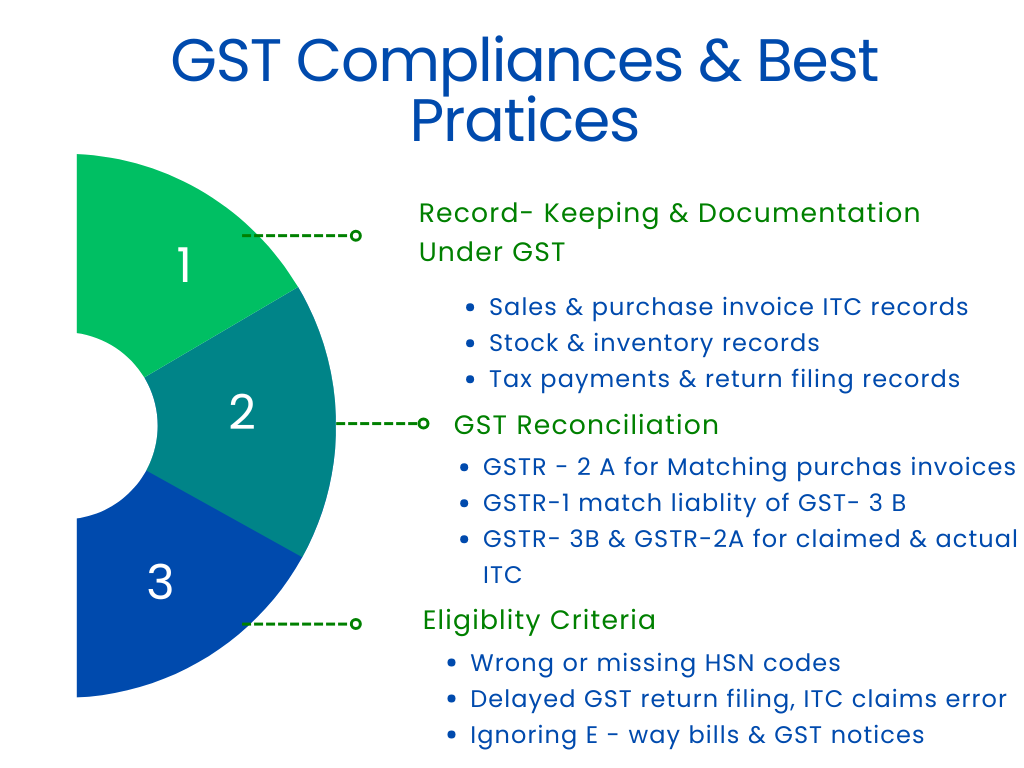

GST Compliance and Best Practices

Goods and Services Tax (GST) is one of the important structures of tax in India by integrating all indirect taxes into a single system. Businesses have to comply with this tax structure in the form of rules prescribed, recording, and return filing accurately and on time. Penalties, audits, or even legal issues can occur if there is no GST compliance. It is very important for small businesses also to know the basics of GST and how best practices can be followed.

It addresses major GST compliances along the lines of the need for record-keeping and reconciliation, the most common mistakes to avoid, and a compliance checklist specifically designed for small businesses.

1. Record-keeping and Documentation Under GST

Why Record-Keeping Important?

GST record-keeping is the first step towards compliance since it forms the foundation for accurate tax filings, reconciliation, and audit. Detailed records help businesses claim input tax credits properly, calculate taxes correctly, and respond confidently to GST audits or notices from tax authorities. For GST purposes, businesses are required to maintain specific records and documentation for at least six years.

Key Records to Maintain Under GST

- Sales and Purchase Invoices

These are necessary to calculate output tax (sales) and input tax (purchases). Maintain physical or electronic copies of all the invoices, and ensure they meet GST norms by carrying HSN codes, GSTINs, and the break-up of taxes.

- Input Tax Credit (ITC) Records

Maintain a record of all ITC availed on purchases of goods and services. This would include invoices, debit/credit notes, and records of ITC reversals where the vendors have failed to comply or for any other reason.

- Tax Payment and Return Filing Records

List each tax payment made under GST- challans and bank statements. Also maintain file copies of returns filed with the department (GSTR-1, GSTR-3B, GSTR-9, etc.) along with the relevant receipts.

- Stock and Inventory Records

There should always be a record of an accurate inventory by the manufacturers as well as the traders. They help in computing ITC on inputs and detecting losses or theft in stock which may affect the tax.

- Debit and Credit Notes

Invoices are amended due to return, discount, or for some other reason. Keep corresponding debit/credit notes as these will aid in reconciling GSTR-1 and GSTR-3B accurately.

- E-Way Bills and Transport Documents

For those business persons whose goods transport value crosses a particular threshold, they have to generate E-Way Bills. It is the proof of compliance of those goods in transit; keep the copies of those bills.

- Organizing and Storing Records

Digitally maintaining the record and making it GST-compliant accounting software would make record management pretty easy. They should also maintain records based on fiscal years, keep a backup, and have easy access to such papers during the time of auditing or raising queries by GST officials.

2. GST Reconciliation

GST reconciliation is matching records that are held in your business’s internal ledgers such as sales and purchases with the GST return of a taxpayer, specifically through GSTR-1, GSTR-3B, and GSTR-2A filed on the GST portal. Reconciliations are indispensable towards proper tax filings and making appropriate ITC claims hence ensuring fewer discrepancies which will warrant a penalty.

GST Reconciliation Steps

- Match Purchase Invoices GSTR-2A

Match the purchase invoices in your accounting system with GSTR-2A. This is to crosscheck for any differences or missing invoices from the vendors. The ITC claim will thus be compared with the actual report of the suppliers.

- Verification of Output Tax Liability in GSTR-1 and GSTR-3B

Ensure that the sales declared in GSTR-1 match the liability of GSTR-3B. If under-declared or over-declared, you may face interest or even a penalty.

- Unclaimed ITC or Excess ITC

Verify the ITC declared in GSTR-3B against the actual ITC available in GSTR-2A. Check if any ITC remains unclaimed. Reach out to the vendor, if possible, or get it rectified in further returns.

- Amendments and Corrections

Rectify all amendments or changes from invoices and ITC claimed, and ensure that these corrections are recorded in subsequent submissions.

Benefits of Reconciliation on Time

Fewer Mistakes and Penalties: Reconciliation at the right time allows you to identify mistakes before filing returns and avoids penalization.

Accrues full and on-time claims for ITC: Reconciliation can claim full amounts of eligible ITC, building cash flows.

Readies for Audit: Proper records and reconciliation of returns make it easier during the audit process, hence minimizing possible disputes with tax authorities.

3. GST Registration Compliance

GST registration holds so much significance for businesses that they must get registered to claim benefits like lower tax rates, more recognition for the business, enhanced confidence of shareholders, and more funding opportunities. Other compliances follow only after the registration. The turnover limit to get the registration done is Rs 40 lakhs for goods and Rs 20 lakhs for the services category businesses (they vary in special category states and UTs). Businesses crossing the aforesaid annual turnover must be registered, and e-commerce businesses have to get the GST Registration at the start, with no threshold bar for them.

Benefits of GST Compliance for Businesses

Easy and Faster Refunds: Businesses with a good compliance rating can claim easy refunds and faster recovery, resulting in improved cash flow and better operational work

Smooth ITC Availability: for buyers dealing with registered businesses, it becomes easier to claim ITC because of the proper maintenance of records, and only registered parties can claim ITC for the business expenses

Reduced Scrutiny: When you ensure that your business is fully compliant with the GST rules and regulations, you ascertain that your business is less likely to be under scrutiny from officials

Enhanced Reputation: Your compliance with legal rules demonstrates that the business is a genuine entity, and it results in building solid trust for potential clients and retaining stakeholders

Avoiding Common GST Mistakes to Comply Better

Non-compliance brings penalties, more attention to the returns, and obstruction to cash flow. Business houses should develop good GST practices by learning common mistakes.

Common GST Mistakes to Avoid

- Wrong or Missing HSN Codes

HSN code is necessary for some products and services. Without it or with incorrect codes, there will be errors and non-compliance.

- Delayed GST Return Filing.

There may be interest and late fees. GSTR-1 and GSTR-3B must be submitted on time to avoid extra liabilities.

- ITC Claims Errors

Incomplete or wrong claiming of ITC because of non-cooperation by vendors or because of missing invoices can bring in a mistake. Balance ITC claims with regular reconciliation using GSTR-2A to avoid it.

- Error in Tax Payments

It may occur due to the calculation of incorrect tax liability or less tax payment. Sales and purchase records must be checked accordingly to pay the correct tax amount to avoid penalties.

- Ignoring the E-Way Bills

All purposes of transport falling within the threshold limits established should be accompanied by ensuring the generation and maintaining of all copies of E-Way Bills.

- Ignorance of the notices from the GST Authorities

The notices issued by GST authorities arise from some such mismatches or even issues of non-compliance which also needs prompt replies to prevent its escalation

What best practices will help me to avoid making these errors?

Ensure accounting software maintains GST-compliant books so that proper invoices and correct tax computation are prepared.

The accounts reconciliation process is done every month, thereby ensuring consistency in data presentation on all returns.

Train the staff on the latest updates about GST, especially regarding ITC, payment of tax, and documentation.

GST Compliance Checklist for Small Businesses

This checklist can help small businesses maintain effective GST compliance despite the limited resources:

- Registration and Setup

- Register for GST and obtain GSTIN if turnover is above the threshold.

- Display GST registration certificates in all locations of business

- Use GST-compliant invoices with HSN, GSTIN, and tax break-up

- Invoicing and Documentation

- Generate invoices for all the taxable sales correctly with accurate HSN/SAC and tax rates; maintain digital or physical copies of all invoices for six years.

- Get E-Way Bills to transport goods over $500.

- Return Filing

- Fill GSTR-1, and GSTR-3B by the due dates for the same

- Annual returns to be filled for all the months: GSTR 9 Data cross verification before return filing

- ITC Management

- ITC Claimed GSTR-2A: check the variance each month

- Check on your ITC on inward invoices; and your suppliers’ GSTR so your ITC is available.

- Reversal of ITC in case of non-compliance or other ineligible claims as the case may be.

- Tax Payment and Reconciliation

- Compute and pay the tax accurately on time

- Maintain record of all challans in respect of tax paid.

- Reconcile each month’s return with your book of accounts to ascertain its correctness.

- Common Error Prevention

- Not to make mistakes in the computation of ITC computation of tax and selection of HSN codes.

- Keep track of changes in GST and adjust the business accordingly.

- Educate your employees on the common GST know-how to stay away from errors.

- GST Audit Preparedness

- Organize sales and purchase documents, ITC, and tax payment records.

- Scan all records to face an audit at a split-second notice.

- Verify any notice sent by the authorities of GST and respond thereon so that no notice of more breach of compliance arises.

- Receipt GST Notice

- Act on each notice sent by the officers of GST immediately.

- Tend to become complicated matters, seek professional assistance if the notice does.

- Maintain copies of all written communications with the authorities.

Conclusion

GST compliance is always a must for business firms since non-compliance attracts certain penalties and can cause issues in the smooth running of the business. With systematic record-keeping, periodical reconciliation, and clarity on common mistakes, error reduction and streamlined GST compliance can be achieved. Even small businesses can benefit through a comprehensive checklist of GST compliance, covering all elements, from registration and billing to return filing and claims of ITC.

Following best practices and using the appropriate tools will help businesses ensure that their GST compliance efforts are efficient and error-free, thus focusing their energies on growth and profitability. TaxDunia is your trusted platform for handling all your tax and financial needs, making compliance easy and hassle-free. Specializing in services like GST filing, income tax returns, bookkeeping, and financial consulting, TaxDunia brings expertise and convenience to individuals and businesses alike.