GST Audit and Annual Return

Home » GST Audit & Annual Returns

Understanding GST Audit and Annual Return

As per the Goods and Services Tax in India, a yearly return needs to be filed along with an audit for every business. This is followed by transparency and compliance. The annual return details all the GST activities of the taxpayer through the year, filed through GSTR-9. Larger businesses need GSTR-9C and require a further audit that checks if the returns match the financial statements and are in compliance with GST laws.

Businesses will be able to ensure proper completion of the GST compliance process only if they get a complete view of GSTR-9 and GSTR-9C, including common errors and best practices. From preparation and filing processes for such forms to some practical tips on avoiding common mistakes, this article includes it all.

How to Prepare and File GSTR-9 (Annual Return)

What is GSTR-9?

GSTR-9 is an annual return form under GST, which is essentially a compilation of all monthly and quarterly returns filed by the taxpayer for the financial year. The details of outward supplies, input tax credit, tax paid, and adjustments done during the year get consolidated here. GSTR-9 filing is mandatory for all regular taxpayers with a valid GST registration, while it is not required for the composition taxpayer or casual taxable persons.

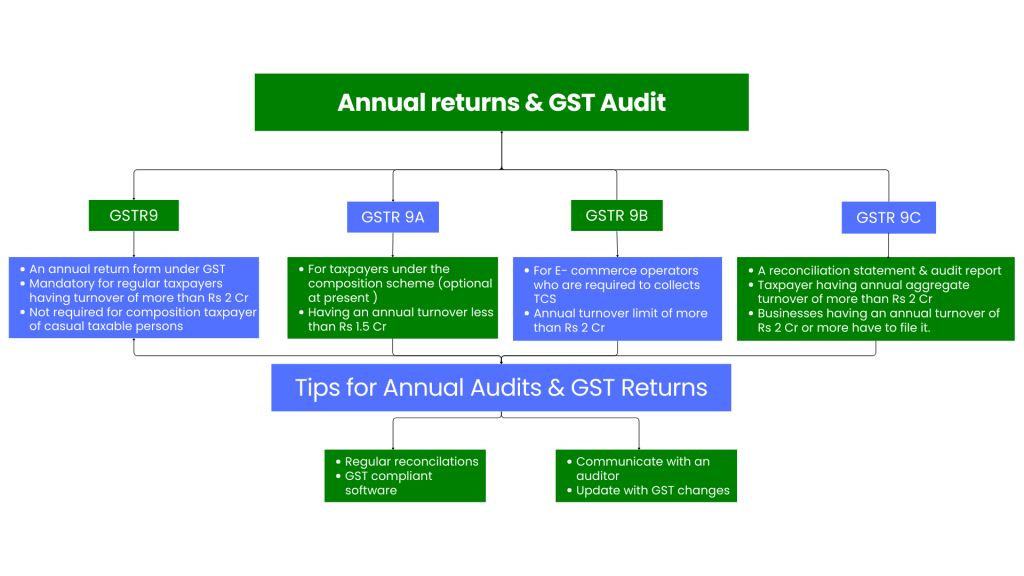

Types of GSTR-9 Forms

- GSTR-9

For regular taxpayers registered under the GST mandatory with an annual turnover of more than INR 2 crore and other taxpayers may file it voluntarily.

- GSTR-9A

For taxpayers under the Composition Scheme (optional at present)

- GSTR-9B

For e-commerce operators who are required to collect TCS

- GSTR-9C

The GST audit form is required for businesses with an annual turnover of more than INR 5 crore

Step-by-Step Guide to Preparing and Filing GSTR-9

- Gather the Required Documents and Data

Obtain all the monthly or quarterly GSTR-1, GSTR-3B, and GSTR-2A filings, books of accounts, invoices, and tax payment records before filing GSTR-9.

- Verify Auto-Populated Details

Log on to the GST portal at gst.gov.in and access GSTR-9. A good number of fields in the form are auto-populated by the previous filings – that is, tax paid and input tax credits – but check for accuracy in such details.

- Outward and Inward Supply Details

Add outward supplies (taxable sales) and inward supplies such as purchases on which tax is paid section-wise. Ensure the amount corresponds to the monthly return filed during the year.

- Declare ITC.

In the ITC section detail, ITC claims are reversed or adjusted throughout the year. Reconcile ITC records with GSTR-2A without mismatch.

- Amendments and Changes-

All the post-filing amendments in case of those transactions have to be placed within that particular section. Also, the post-filing taxes paid or ITC reversals.

- Interest and Late Fee, if any-

If there are delayed payments of tax or returns filing, then interest and late fees on those heads must be included

- Check and File

Once all the details are filled in, review the return to submit it and pay for any balance, if any, through the GST portal. You can get it e-signed using the Digital Signature Certificate or, instead of that, through an OTP verification process.

- Download and Retain Acknowledgment

Once the return is duly submitted, download the acknowledgment and keep a copy safe with you for further reference.

GST Audit Turnover Based Limit

The registered businesses file GSTR 9C for auditing purposes under the GST. Only the businesses that are registered and have an annual turnover above a specific limit require a GST audit in the form GSTR 9C. The annual turnover for GST Audit must exceed Rs 5 Cr in a financial year running from 1st of April to 31st of March next year.

Due Date for GST Audit GSTR 9C

The due date to file GSTR 9C, a reconciliation statement, is the 31st of December of the financial year. For example, the due date to file GSTR 9C for FY 2024-25 is the 31st of December 2025.

Procedure for GST Audit(GSTR-9C)

What is GSTR-9C?

A reconciliation statement and audit report are required by taxpayers in whose case the annual aggregate turnover during the financial year is Rs. 2 crore or more. GSTR 9C is a reconciliatory statement that reconsolidates the return filed under GSTR-9 with the audited annual financial statement of a taxpayer to assure congruence of GST records and financial records. GSTR 9C is to be certified either by a Chartered Accountant or Cost Accountant.

Under GST, every business with a turnover beyond INR 2 crores has to file GSTR-9C. This form is mandatory even for registered individuals and companies, failing which attracts a penalty.

How to Prepare and File GSTR-9C Step-by-Step Guide

- Gather Financial Statements and GST Returns

Collect any audited financial statements; and GSTR-9 together with all documents, especially the sales and purchase records.

This information is for the reconciliation of tax returns as shown below:

- Reconcile

Reconcile turnover, tax liability, and input tax credit reflected in the GST returns against a book of accounts. Thus, this is a balancing process that makes sure and identifies discrepancies.

- Identify Discrepancies and Adjustments

Mention all the differences, such as any unclaimed credits or pending liabilities, in GSTR-9C. The details of the reasons for such a discrepancy must be elaborated below.

- Fill all Part A and Part B in GSTR-9C; it contains the reconciliation statement. It includes turnover and tax paid, ITC availed, and mismatch, if any.

Part B will be certified by a CA or Cost Accountant who will audit the data of Part A.

- Review and Certify

Once the form is prepared, it has to be verified and signed by a CA or Cost Accountant. The auditor certifying would state that the GST data is true and fair.

- Submit GSTR-9C

The final step is the uploading of the digitally signed GSTR-9C on the GST portal. Download the acknowledgment receipt for record purposes.

Common Mistakes in Annual GST Return Filing

- ITC Mismatch

Problem: ITC in GSTR-9 does not match with GSTR-2A or the actual books of accounts.

Remedy: Detailed reconciliation of GSTR-2A and ITC records must be done before filing to avoid mismatches.

- Errors in Reporting Outward Supplies

Problem: You might get penalized or draw unwanted attention for the wrong reason due to incorrect reporting of taxable sales or exempted sales in GSTR-9.

Solution: You must ensure that the outward supplies reported in GSTR-1 match your books of accounts and GSTR-3B returns.

- Omission of Amendments or Adjustments

Problem: In case post-filing adjustments or amendments are not included, there will be inaccuracies in GSTR-9.

Cure Keep a record of any changes done through the calendar year and should be allowed in the annual return.

- HSN Code Reporting Discrepancy

Issue When HSN codes of good/service in the return mismatch, resulting in noncompliance; data is not perfectly matched; and the same thing happens regarding the monthly returns with the subsequent annual return also.

A proper HSN code while preparing the GST return needs to be used according to guidelines and in the monthly returns, where the same must be made sure to coincide with the codes used.

- Fail to Report late fees/interest

Problem in the GSTR-9, unless late fee or interest of any case that may have accrued through the course of a financial year is included then further additions might be made.

Solution Add calculations of what interest and what late fee would have been accrued during a financial year for saving upon further additions.

Tips for Annual Audits and GST Returns

- Last-minute preparation for an audit may lead to errors. Start collecting documents and reconciling returns in advance to allow time for review.

- Regular Reconciliations- Reconcile monthly returns with financial records and GSTR-2A data on a regular basis to catch and rectify discrepancies much before the annual return date.

- GST-Compliant Software- Use GST-compliant accounting software or ERP. The following can be used: to ensure correct filing and maintaining records and provide the reconciliation benefit with minimum or no manual efforts.

- Recording of all Reversals and Amendments of ITC and other reasons with relevant notes to be sure to have adequate documentation for representation before the auditor.

- Seek Professional Help if Required- In cases of complex reconciliations or ITC claims issues, it may be recommended to seek expert advice from a GST professional or a Chartered Accountant.

- Train Staff about Compliance Practices- Compliance practice awareness should be given by the staff who will be transacting in GST filings; any change in GST regulations will reach them.

- Communicate with the Auditor- Communicate with your auditor at all times provide all requested documents promptly and clear up any misunderstanding they may have about your returns.

- Verify Form Information Before Submittal Double-check for typographical errors, misreported numbers, and missing sections when submitting your forms and attachments.

- Print and Store All Confirmations- Maintain all the acknowledgment receipts, filing receipts, and submitted forms for the record to be produced in case queries arise in the future.

- Update with Change in GST- In fact, the GST Law is amended very frequently so one must be updated to any change that may bring an effect on the day of filing or audit.

Conclusion

The annual GST return filing and audit process will help sustain high compliance levels as well as high transparency levels. The structured steps followed in preparing and filing GSTR-9 help prepare and file it accordingly. Understand the requirements for filing GSTR-9.

TaxDunia is a reliable platform for handling all your tax and financial needs, making the task easy and hassle-free. Proficient in services like GST filing, income tax returns, bookkeeping, and financial consulting, TaxDunia brings expertise to individuals and businesses.