Home » Firm Registration

Firm Registration is a crucial process for anyone planning to incorporate and set up a legal entity in India. Firm registration ensures that businesses are compliant with legal obligations. Through registration, the traders can obtain government support and different schemes, receive bank loans, and commence operations that contribute to business stability and future progress.

Firm Registration is important for several legal reasons. It creates a legal environment within which a business may undertake its activities, more specifically, entering into contracts, accessing finance, and marketing new products. It also creates confidence for stakeholders, including customers, banks, and investors. In India, few incentives, government schemes, or tax exemptions for businesses are possible only if the business entity is registered. In either a small firm or a large partnership as your business, registration will be an added advantage since it is enshrined in law in the event of an expansion.

1. Legal Recognition: Lawfully register your business undertaking under the laws of India.

2. Limited Liability: Prevents personal properties from being used to meet business risks.

3. Investor Confidence: It is easier to attract investors and banks to source funds since the structure aligns with the organization’s capital structure.

4. Access to Government Schemes: The document allows for access to several government privileges.

5. Business Expansion: It helps the organization to easily expand to other markets by providing them with a smooth process.

The documentation for firm registration varies depending on the type of firm, whether it's a sole proprietorship, partnership, or LLP (Limited Liability Partnership). Below is a general list of required documents:

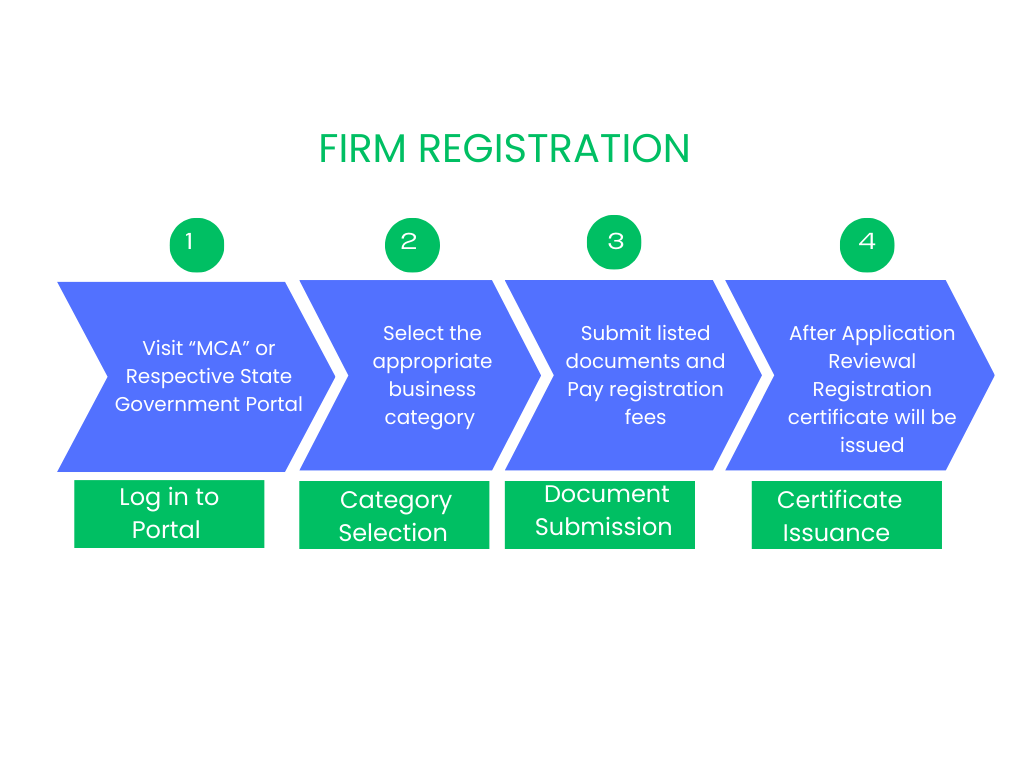

1. Visit the Official Firm Registration Portal: visit the portal and ollect Partner’s details and Business details

2. Complete the Application Form: Fill out the application form provided on the portal, including details like the firm’s name, business address, and partner information.

3. Prepare and Upload Required Documents: Attach the necessary documents based on the chosen structure (proprietorship, partnership, or LLP).

4. Pay the Registration Fee: Pay the applicable registration fee, which may vary based on the firm type and location.

5. Submit the Application: Submit the completed application and documents for review. Authorities may request additional information if required.

6. Receive the Registration Certificate: Upon successful verification, a registration certificate will be issued and sent to the firm’s registered address. This certificate serves as legal proof of the firm’s existence and allows the business to operate officially.

It is not complicated to register a firm, and TaxDunia facilitates your registration process. Our team of professionals guarantees your firm is compliant with all the laws. Regardless of whether you are a departmental trader or intend to be a partnership firm, we are available to assist you. To start your firm registration with us or to address your questions, call us today.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.