File Your ITR

Home » File Your ITR

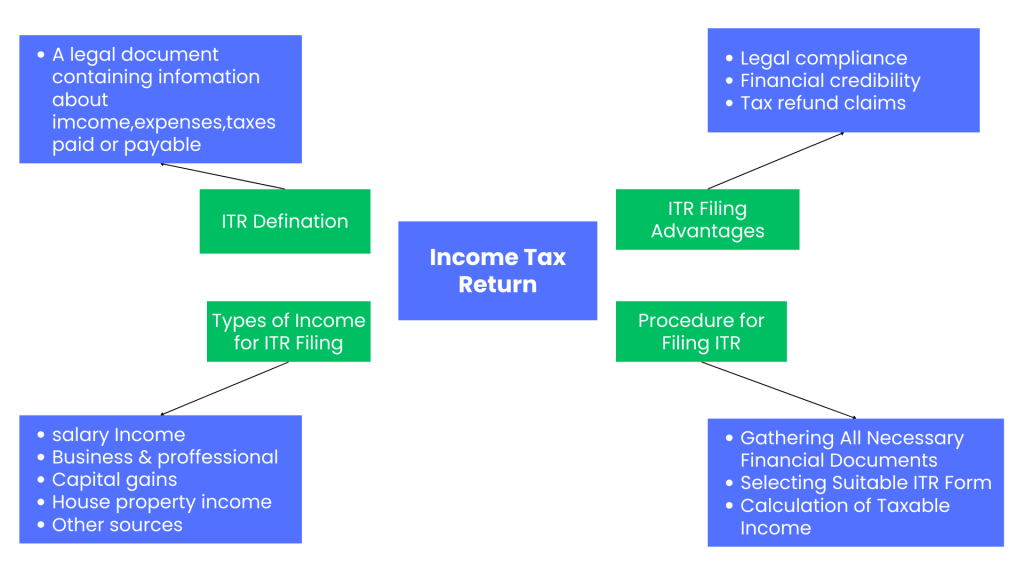

Understanding Income Tax Return (ITR)

Income tax is directly levied by the government on individuals and business ventures according to their respective earnings or income. This stands as one of the vital sources of revenue for the government, which collects funds from it to finance such essentials of public services, infrastructures, health care, education, and other basic needs of the nation. For the individual, it is computed based on his total income earned in a financial year, which includes wages, salaries, profits from business, and all other sources.

According to the tax laws, income tax is payable by those whose income is at a particular threshold. Income tax rates and slabs are different in each country and depend on the level of income of the taxpayer. Most tax systems have a progressive tax structure; this means that the higher the income, the higher the tax rate.

What is an Income Tax Return?

An ITR is a legal document submitted to the tax authority, which will contain information about the income, expenses incurred, and taxes paid or payable in any given financial year. It, in essence, declares the income of the person or entity and the tax paid or payable during any given financial year. Its submission is generally an annual affair, and if the individual or entity fails to file it within the due dates, it attracts some interest and penalty charges.

Filing an ITR not only is important for fulfilling compliance requirements but also ensures one maintains a record of all his income and taxes for further use in financial or legal procedures. Governments of all nations have set specific dates by which one needs to submit tax returns, and nowadays, in most nations, returns can be filed through the internet, hence quicker and easier.

Advantages of ITR Filing

There are many reasons for filing an ITR and then submitting an income tax return for all, whether it is individuals or businesses compliance to financial reasons:

Legally Compelled: Generally, the law requires individuals or business persons to file an ITR if they earn above a certain monetary threshold. This will allow them to avoid penalties imposed by the law and hence legal issues.

Building Financial Credibility: Proper record-keeping about ITR filing is a necessary requirement for establishing financial accountability. This builds credibility in the eyes of financial organizations, and it may turn out to be very crucial at times when loans credit cards, or even mortgage is required.

Tax Refund Claims: If excess tax has been deducted, for example through TDS or advance tax, then an ITR is needed to be filed in order to claim the refund. This can be the case when actual income falls within a lower tax bracket than initially anticipated.

The third advantage is carrying forward the losses: An ITR filed by both the individuals and businesses enables the carrying forward of their losses, which can include the capital losses or business losses, to set off in later years and thereby pay lesser tax in the later years.

Visa Process: Most countries demand one proof of ITR filing with application papers. A continuous, paid-up record shows up good about the taxpayer applying for the visa. Avoiding penalties can occur due to failing in ITR submission on the appointed dates. Timely submissions bring it within the statutory compliances and avoid un-inevitable penalty situations.

Qualification for Government Benefits: In most countries, filling an ITR is considered a compulsory condition to benefit from different government benefits, subsidies, or welfare.

What are the Types of Income for ITR Filing?

Income tax systems differentiate the income types, giving the government grounds to consider each type against the given rules. Among the numerous income types considered for taxes are the following:

Salary Income: Earnings, bonuses, and other forms of compensation earned by individuals from employment. Payment to individuals through employers also attracts source-based tax deducted at source (TDS). In return, a person files his or her ITR to cover extra taxes, if any, or recover any refunds.

Business and professional: income is reported by business owners, freelancers, consultants/entrepreneurs, and all others who work from the services of businesses and professionals. There are deductions on most business-related expenses available to reduce such income into taxable income.

Capital Gains: Earnings derived from the sale of capital assets, such as shares, real estate, and other investments, are treated as capital gain. Further classification is into long-term and short-term gains, with the tax rates applied to each based on how long the asset is held.

House Property Income: The income that is generated from renting or leasing property is taxable. Tax laws provide for the deduction of all expenses relating to the property, including mortgage interest and maintenance costs.

Other Sources of Income: This is residual income which may include interest on savings accounts, dividends, winnings from the lottery, and gifts. Some of the incomes in the category can be tax exempt while others are subject to withholding tax.

Procedure for Filing Income Tax Return

The process of ITR filing is a step-by-step procedure, and this varies according to the tax jurisdiction and the mode of filing, whether online or manual. The steps generally involved are:

Gathering All Necessary Financial Documents: These would include salary slips, bank statements, 16 for salaried individuals, interest certificates, capital gains statements, etc., and all documents showing deductions.

Selecting Suitable ITR Form: Depending upon the source of the income and the type of taxpayer, there are diverse ITR forms. These forms are to be accordingly selected to ensure effective submission.

Calculation of Taxable Income: This aggregates all sources of income and allowable tax deductions under the law with permission from various sections on exemptions to decrease losses realized that were carried over from previous years. Calculation of Tax Liability The taxable income, therefore, with the associated rate and slabs, shall give the amount of tax liabilities for every taxpayer.

Filing Return: After the computation of tax liability, the taxpayer submits the ITR either through e-filing or manually. While filing online, an acknowledgment is received.

Return Verification: The return is verified within a given timeframe after the submission. Online verification is done through EVC, while manual verification is done by sending a signed copy to the tax authority.

Conclusion

Knowledge of income tax and its benefits to income tax returns facilitates compliance and effective financial planning. Several reasons explain why filing an ITR comes with various advantages. Penalties will never be there, and an individual becomes financially credible when they file an ITR. By choosing the best pack to file with, coupled with the correct declaration of income types, a taxpayer would be rest assured that obligation has been met while taxes will be reduced. It simply improves financial stability as time goes on, thereby creating personal and national growth if taxes are updated and filed appropriately and before time runs out.

Get Started with TaxDunia Today

TaxDunia is your one-stop solution for tax and financial services, tailored to meet the needs of both individuals and businesses. With services like GST filing, income tax returns, bookkeeping, and compliance management, TaxDunia simplifies complex financial tasks.