Home » ESI Registration

ESI (Employee State Insurance) is a social security Act that was started by the Government of India to provide medical and monetary assistance to employees and their family members. The Ministry of Labour and Employment manages the Employee State Insurance Scheme. Both employee and employer contribute a specific amount to the scheme. As per the current norms, the employer contributes about 3.25% of the monthly payable wage to the employee, while employees themselves contribute about .75% of the wages. Employers having an average of Rs 21000 monthly wages and Rs 25000 monthly wages in case of disability have to contribute under the ESI Scheme. This guide will help you to understand how you can complete ESI registration successfully.

Organizations or establishments that have employed a minimum of 10 persons need to have ESI Registration within the first 15 days from the date of applicability of circumstances. If an organization employs more than 10 persons, then in the following sectors, they need to get ESI Registration:-

If an employer has employed more than 15 persons in the following sectors, they need to get ESI Registration.

● Mandatory Compliance: For certain employment sizes, ESI registration is compulsory to ensure compliance with the standard laws of employment.

● Employee Welfare: ESI offers means that support employees in terms of health and finance as well as boost the morale of the workforce.

● Tax Benefits: Amounts paid to ESI can be written off against business expenses and therefore reduce the company tax.

● Enhanced Credibility: Therefore, registering for ESI improves the reputation of your business and its positive image among employees.

● Access to Government Schemes: When registering for ESI, one gets to avail of many governmental schemes and subsidy-based programs that may be required for the well-being of the employees

Companies incorporated in India should obtain registration under the ESI Act, which will depend upon the number of employees a company has. ESI registration helps to make medical and financial benefits available to the employee as well as their family members during sickness, maternity, or injuries, thus satisfying the social security laws and guarding the interest of the employee.

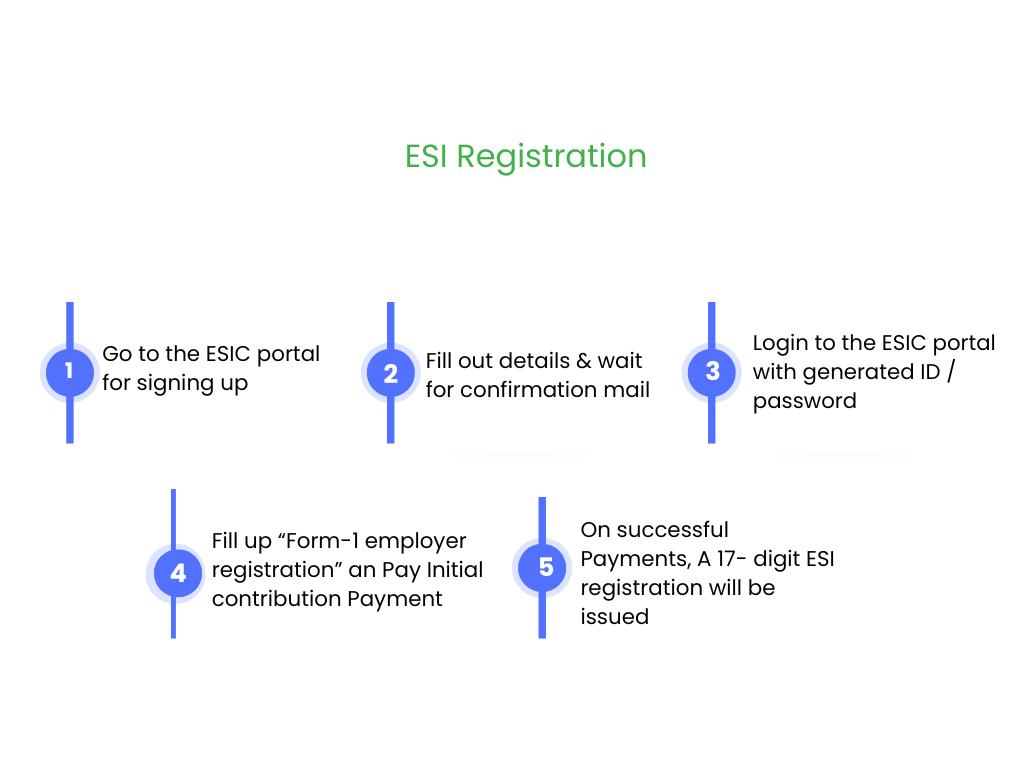

1. Log in to the ESIC Portal.

● Visit the ESIC portal and log in using the ‘Employer Login’ option on the home screen.

● Click ‘Sign Up’ to sign up for the process.

2. Sign Up and Fill Out Details

● After clicking on ‘Sign Up,’ create an account by filling up the details required and fill in your email ID and mobile number.

3. Confirmation mail

● Once you have filled out the registration form, check your registered email for a confirmation message. The confirmation message will carry login details like username and password.

4. Login to the ESIC Portal.

● Now log in to the ESIC portal using the details provided in the email. Click again on the option ‘Employer Login’ and provide the details with the help of a username and password.

5. Form-1 Employer Registration Form

● Once logged in, click on the option of ‘New Employer Registration’.

● Select ‘Type of Unit’ from the dropdown and then click on ‘Submit’.

● A form called Employer Registration Form-1 will appear wherein you are supposed to input information about the employer, factory/establishment, and employees.

● On filling out all the information in the form, click ‘Submit’.

6. Initial Contribution Payment

● After you submit Form-1, it asks you to pay the initial contribution.

● Click ‘Pay Initial Contribution, and the initial contribution amount will appear. Select the mode of payment as online and click Submit.

● Note the Challan Number given, and then proceed to the Payment Gateway by clicking on ‘Continue.’

● Select the mode of payment and continue with the transaction by providing the amount to be paid.

7. Registration Letter C-11

● On successful payment, a registration letter shall be mailed to the e-mail ID of registration, wherein a 17-digit ESI registration number issued shall be used as evidence of registration.

TaxDunia eases the process of registering for ESI because that is a very complex process. Now, let us do your documentation, compliance check, and follow-up work so you can be worried about growing your business and know that all employees under you are well taken care of and your business is well-compliant.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.