E Way Bill & E-Invoicing

Home » E Way Bill & E Invoicing

E Way Bill & E-Invoicing Under GST

Amongst the very important tools, used in promoting transparency and tracking movement of goods for tax compliance in India under the Goods and Services Tax regime, two tools have emerged – E-Way Bills and E-Invoicing. An E-Way Bill is one generated for the transport of goods, either due to excess distance or excess value being carried over a specific distance, and E-Invoicing involves the validation of a B2B invoice digitally at the GST portal to achieve accuracy and have real-time records.

Both these systems aim to minimize tax evasion and facilitate a very paperless process with smooth information flow within the GST network. This article explains the basics of E-Way Bill and E-Invoicing in terms of how to create them, benefits, and common issues that businesses usually face.

What is an E-Way Bill and When is it Required?

What is an E-Way Bill?An E-Way Bill is one of the key documents in the process of movement of goods in the GST system. The bill is an electronic document created at the E-Way Bill portal that is considered a compliance mechanism to ensure the transport of goods is within the guidelines regarding GST. It is one of the crucial bills as it would monitor good transit, which could be made applicable by the authorities for accurate GST collection without any scope of tax evasion.

When Is an E-Way Bill Required?

An E-Way Bill is required in the following situations:

- Value-Based Requirement: Where the value of goods shipped is more than INR 50,000 which equates to approximately USD 600.

- Distance-Based Requirement: The transportation of goods for over 50 km irrespective of any value. The E-way bill requirement depends upon state rules.

- Inter-State Movement: E-Way Bill shall be mandatorily required for all inter-state movement of goods if the value exceeds INR 50,000.

- Specific Goods: There are some specific types of goods for which an E-Way Bill is not required and certain other categories of goods are compulsorily required irrespective of the value. For example, hazardous material transport and a couple of other high-value commodities will have to mandatorily obtain an E-Way Bill even though the value is low.

Exceptions to E-Way Bill Requirement

Exceptions for not mandatorily requiring an E-Way Bill are as follows:

- Transportation for private party usage or exempted categories

- Transportation for notified zones or specific low-value commodities

Transit within a single state under a specific distance (usually 10–20 km)

Step-by-Step Guide to Generation of E-Way Bill

E-Way Bill can be generated through the E-Way Bill portal and can be generated using a step-by-step process:

- Login to the E-Way Bill Portal

Access the portal (ewaybillgst.gov.in) and log in with your registered GST credentials.

- Select the E-Way Bill Generation Option

Once logged in, go to the “Generate New” option to initiate a new E-Way Bill.

- Enter Consignment Details

Fill up details on the shipment, which include whether it is an outward or inward transaction and then what type of transaction it is, which can be supply, export, import, etc. Then one should fill in the number of the document and also the date.

- Fill up Supplier and Recipient Details.

Fill in all the GSTIN or even the address of the supplier and the recipient. You must also fill in more details like the name and all other details at the receiver’s end to avoid any discrepancies.

- Fill up Goods and Transport Details

Include the details of the goods by mentioning the HSN code, Description, Quantity, and Taxable value. Then, add transport details such as vehicle number, mode of transport, and distance.

- Review and Generate

- Recheck all the details provided for correctness and then click on the “Submit” button to generate the E-Way Bill. In return, you will get an EWB number that will be used in transport.

- Printing or Sharing E-Way Bill

The E-Way Bill shall be printed and shared electronically with the transporter as well as the recipient. The E-Way Bill will be accompanied by the transporter during transportation to satisfy GST requirements.

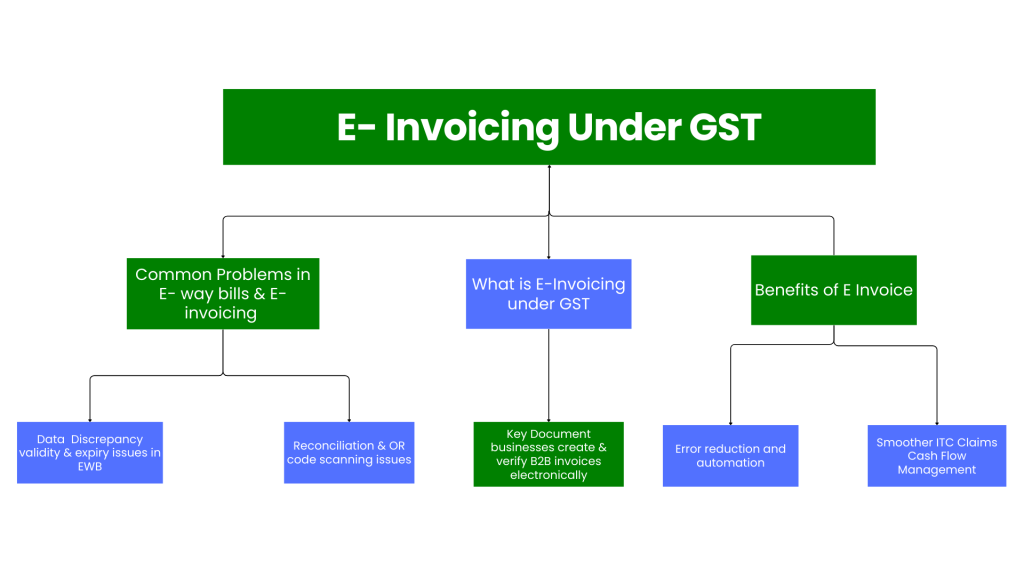

E-Invoicing under GST: Benefits and Implementing it

What is E-Invoicing?

E-invoicing under GST is a process under which a business creates and verifies B2B invoices electronically using a government portal. The unique Invoice Reference Number on every invoice ensures its genuineness and generates an automatic record in the GST system. E-invoicing thus simplifies record keeping, reduces fraud, and simplifies compliance by making sure that every invoice is standardized and digitally verified.

E-Invoicing Benefits

- Improved Compliance

E-invoicing enhances compliance since it standards and automatically validates invoice data with records of GST, thus helping to avoid risks of undervaluation and non-compliance.

- Error Reduction and Automation

As validations happen in automatic ways due to E-invoicing, the risk of mistakes while entering data is reduced, and the reconciliation process, which used to be manual, will be reduced.

- Smoother ITC Claiming

This helps in Input Tax Credit claims, which are faster and more accurate as compared to the discrepancies between the supplier and the recipient.

- Cash Flow Management brings transparency in the transaction, hence cash flow management becomes easier, and receivable tracking will be better for the business.

- Invoice Tracking in Real Time

E-Invoicing thereby connects the businesses, their suppliers, and GST authorities in real-time so that there will be easy tracking of the invoices and also, it will be efficient in record-keeping.

Who needs to implement E-Invoicing?

- E-invoicing is compulsory for those businesses that have more than a particular amount of turnover, which the GST Council changes periodically. To begin with, E-Invoicing was made mandatory for businesses that had a turnover of over INR 500 crores, which has now been brought down to make more businesses fall under it.

Confirm whether your organization requires the adoption of E-Invoicing under mandate concerning your turnover; the software, as well as the infrastructure, have to be ready for that

- Select your E-Invoicing Software or ERP: This means E-Invoicing will need to be incorporated within your accounting software or an ERP. There are so many vendors with GST compliance with E-Invoicing-ready software to which E-way Bills integration from GST Portal could also be available.

- Register on the E-Invoice Portal

Visit the official E-Invoice portal (einvoice1.gst.gov.in) and register using your GSTIN and other business details.

- Create and Validate E-Invoices

Raise an invoice from your E-Invoicing software or ERP and make sure it is in GST standard format. The E-invoicing software would auto-post the invoices generated to the E-Invoice portal, and each such invoice gets an IRN and a QR code on the E-Invoice portal.

- Share IRN-Validated Invoices with Buyers

Once validated, each invoice is issued with an IRN and a QR code, which must be communicated to the buyers. The QR code will contain the GSTIN, invoice number, and HSN code.

- Auto-Reporting to GST Portal-

Once validated, the invoice details are automatically communicated to the GST portal, and therefore no separate GSTR-1 reporting is required for those invoices.

Common Problem and Solution in E-Way Bill and E-Invoicing

- Invoice Data Discrepancy

Problem: Incorrect GSTIN, HSN, and value details may be sent which leads to rejection and errors in generation.

Solution: Double-check before posting the data and train about the accurate entry procedure.

- Portal Connectivity and Technology Issues

Problem: Connectivity issues or technical downtime with the E-Way Bill and E-Invoice portals happen quite frequently, especially during peak filing times.

Solution: Schedule preparation of E-Way Bills and E-Invoices to be generated in advance. Also, many businesses avail themselves of integrated GST software, which helps in doing the data syncing and minimizing portal downtime.

- Lack of Software Integration

Problem: Several organizations are facing an issue with E-Invoicing since their accounting software or ERP systems are not GST E-Invoice portal compatible.

Remedy: Invest in GST-compliant software that supports E-Invoicing. Customizable software solutions from many vendors integrate quite easily with existing ERP systems.

- Transporter Details Issue on E-Way Bills

Issue: Errors from transporters or incorrect vehicle numbers/missed details will be chargeable for a penalty.

Solution: Ensure the complete and correct information regarding transporters, and also update along the way. If there are several consignments, then make use of any transport management system.

- Validity and expiry issues in EWB

Problem: E-Way Bills are only valid up to a certain distance, and if transportation takes more time than what is allowed, then the bill expires.

Solution: Extend the validity of the bill through the use of the E-Way Bill extension option available on the portal. Ensure proper estimate of transport time so that E-Way Bills do not expire.

- Reconciliation Issues

Issue: E-Way Bill, E-Invoice, and GSTR may result in mismatch issues, which can create problems when audited or checked for compliance.

Solution: Periodical reconciliation of data among invoices, E-Way Bills, and GSTR filings. Most businesses use GST-compliant accounting software or ERP systems that have automatic reconciliation features to minimize errors and discrepancies.

- Duplicate Invoice Reference Numbers (IRNs) in E-Invoicing

Issue: It might be because of an error in the software or submission by different staff members, where the same invoice is submitted more than once, resulting in duplicate IRNs.

Solution: Implement access control in the ERP, thereby restricting only a few users to generate IRNs; also implement an invoicing policy wherein if a return receipt is generated, then no one is allowed to present it at the GSTN portal.

- Mistake in HSN Code

Problem Statement: Due to some error, an incorrect HSN code is applied on goods or services while raising E-Invoices or while creating E-Way Bills, thereby making non-compliance, and in the worst case, they were even rejected entries.

Solution: Maintain an up-to-date list of HSN codes that are relevant to your business and train staff members on which codes to use with the correct type of product or service being sold.

- QR Code Scanning Issues in E-Invoicing

Problem: Sometimes the QR codes generated on E-Invoices fail to scan while printing due to the reasons of formatting mistakes or poor quality printer.

Solution: Print only good quality, readable text on physical invoices and test the QR code from time to time so that it is ensured that it scans correctly. E-invoice sharing is always encouraged through digital mediums in the hope that one never faces this problem.

- Canceled E-Way Bills

Problem: If it is returned, rejected, or otherwise canceled, there are numerous cases where the concerned EWB needs to be canceled. In such cases, for example, one needs to cancel the concerned EWB within 24 hours since otherwise, reconciliation problems may arise.

Solution: Establish a protocol to cancel the E-Way Bills in such situations rapidly and warn the transporter in time so that there is no confusion at the time of transit.

Conclusion

E-Way Bills and E-Invoicing are some of the compliance tools under GST that have been designed for smoother information flow and curtailing tax evasions to make the supply chain transparent. The companies are avoiding the costlier mistakes or penalties in transit while moving the goods; hence it makes transportation easy for the company. In the meantime, maintenance of records is also smooth in this process.

Both systems come with specific requirements and challenges but are worth all the compliance efforts. Traceability and compliance while transporting goods are made possible by E-Way Bills, while E-Invoicing eliminates manual errors, speeds up ITC claims, and ensures transparency. As the GST framework develops, it will be wise for businesses to keep themselves abreast of the changes, invest in good software, and follow best practices to easily comply with the ease of the digital system and reap the full benefits.

Get Started with TaxDunia Today

With regular training, quality ERP integration, and proactive monitoring, businesses can overcome most of the common challenges associated with both the E-Way Bill and E-Invoicing process, making the GST process less burdensome and more efficient. TaxDunia is a one-stop solution for tax and financial services, tailored to meet the needs of both individuals and businesses. With offerings like GST filing, income tax returns, bookkeeping, and compliance management, TaxDunia simplifies complex financial tasks.