Computation of Advance Tax

Home » Computation of Advance Tax

Advance tax is a procedure available under the Indian Income Tax Act, 1961, by which tax liability has to be paid during the financial year in installments instead of paying the entire at one time along with the income tax return. This system ensures the government’s timely collection of taxes and helps avoid any delays or large payments towards the end of the year. Advance tax is leviable on individuals, Hindu Undivided Families (HUFs), firms, and companies whose estimated tax liability exceeds a specified limit.

Advance tax may appear complicated, but the basic principles and the pattern of payment are relatively simple to understand. The procedure involves estimating the total income of the financial year and determining the payable amount of tax, considering the income categories, deductions, and exemptions available to the taxpayer. The tax is then paid in installments based on the due dates as prescribed by the Income Tax Department.

1. Eligibility to pay advance tax

Under Section 208 of the Income Tax Act, any taxpayer whose estimated tax liability for the financial year exceeds ₹10,000 is required to pay advance tax. This applies to individuals, corporations, and other entities. However, taxpayers whose income is derived from salary, pension, or other sources where tax is already deducted at source (TDS), may not be required to pay advance tax if their total tax liability is less than ₹10,000.

Pay advance tax will not be required for individuals having income only from the salary or pension since tax is already being deducted by the employer at respective slab rates. Advance tax might be required if the individual has other sources of income like rental income, business income, or capital gains where the total liability exceeds the above-mentioned threshold amount.

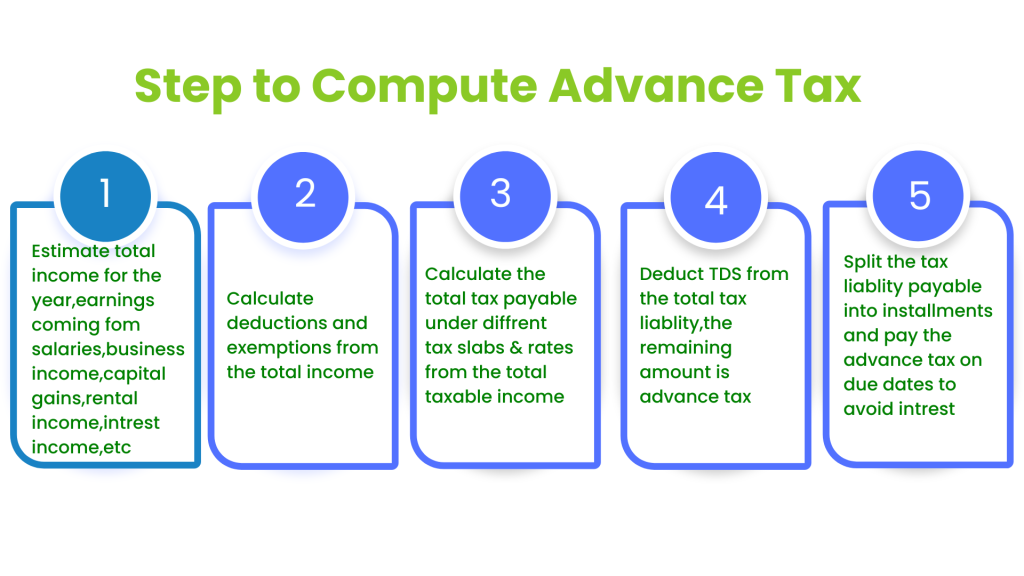

2. Steps to Compute Advance Tax

To calculate advance tax, the taxpayer has to adhere to the following steps:

Step 1: Estimate Total Income for the Year

To start with computing advance tax, the taxpayer has to estimate his or her total income for the financial year. This comes from multiple sources, including income from salaries, business income, capital gains, rental income, interest income, and so on. The projection of the total amount is called for by the taxpayer, considering all forms of earnings.

Step 2: Deductions and Exemptions

The total income is then reduced by the deductions available under Section 80C to 80U of the Income Tax Act, such as provident fund investment, life insurance premiums, home loan interest, etc. This leaves the taxable income-the sum of money from which the tax will be computed.

Step 3: Calculation of Tax Payable

Once the taxable income is arrived at, calculate the tax payable. Tax slabs and rates as defined under the provision of the Income Tax Act are applied for computing total tax. Individual tax rates vary with age brackets and income range while corporations and other entities may be subject to a different set of rates.

Step 4: Deduct TDS and Other Advance Tax Deducted already

Whatever amount of tax the taxpayer has already paid or deducted at source (TDS) is subtracted from the total tax liability. The leftover amount will be the advance tax liability, and that is what the taxpayer needs to pay ahead of time.

Step 5: Split the Tax Liability payable into installments

The advanced tax computed is required to be paid in specified installments during the financial year. The tax needs to be paid in quarterly installments, and the number of each installment shall be a percentage of the total tax liability as prescribed by the Income Tax Department.

3. Due Dates for Payment of Advance Tax

As per the Income Tax Act, the Income Tax department fixes advance tax payable dates for the taxpayers. Different advance tax payable dates have been kept according to categories of taxpayers and the nature of their incomes.

For those taxpayers who fall under the direct head of non-corporate taxpayers like HUF, firms, advance tax should be paid in the following installments:

- 15th June: 15% of total estimated tax

- 15th September: 45% of total estimated tax (cumulative)

- 15th December: 75% of the total estimated tax (cumulative)

- 15th March: 100% of the total estimated tax (cumulative)

Due dates for corporate taxpayers vary marginally:

- 15th June: 15% of the total estimated tax

- 15th September: 45% of the total estimated tax (cumulative)

- 15th December: 75% of the total estimated tax (cumulative)

- 15th March: 100% of the total estimated tax (cumulative)

These dates are very crucial because the failure to pay advance tax on or before these due dates would attract interest under Sections 234B and 234C of the Income Tax Act. In addition to this, the assessee is also liable to a penalty for default or delayed payment of income tax.

4. Interest on Delayed Payment of Advance Tax

If a taxpayer fails to pay the required advance tax or makes a late payment, they are liable to pay interest under Sections 234B and 234C of the Income Tax Act.

Section 234B: If the taxpayer fails to deposit at least 90% of the advance tax liability by the end of the previous year, interest will be levied. Interest is charged on the shortfall at the rate of 1% for every month or part of a month.

Section 234C: Interest is levied on defaults in payment of advance tax for every quarter. If the advance tax paid by the taxpayer is less than the prescribed percentage for any of the quarters, interest is levied at 1% per month for the shortfall.

It is therefore imperative to calculate and pay advance tax before the due dates to avoid these interest levies.

5. Adjustment of Advance Tax Payments

In case the income or any other details change during the financial year, taxpayers can update these advance tax payments. If the amount of income is less than projected in the estimate, then taxpayers may have to update their estimates and pay a reduced amount of advance tax in subsequent installments.

On the converse, if the income is overestimated and tax is paid in excess, such excess advance tax has to be paid during the remaining installments otherwise one will have to face the interest component. The facility of adjusting the payments also precludes that the taxpayer should not be burdened with excess tax payment nor does he suffer the underpayment for genuine estimations.

6. Calculation of Advance Tax for Self-Employed and Professionals

The self-employed, freelancer, doctor, lawyer, consultant, etc., are expected to first arrive at the estimation of income to be earned by them from their practice or business and then they will estimate advance tax. These people usually do not have TDS across any of their source receipts.

Since the income varies from time to time with self-employed persons, a clear record of receipts and expenses is necessary throughout the year. These records will then give an accurate estimation of the tax payable. They are also entitled to deductions under various sections of the Income Tax Act, like Section 80C, and 80D, among others.

7. Advance Tax for Corporations and Businesses

Corporates and businesses must also calculate their advance tax based on the income projected for them for the year, like individuals. However, the computation with more complications and higher rates is for corporate taxpayers. A company needs to estimate income and calculate the liability towards advance tax every quarter.

Companies, unlike individuals, may also claim exemptions, deductions, and rebates specific to corporate tax structures. Companies may be eligible for tax credits on taxes paid overseas or be subject to the Minimum Alternate Tax (MAT) provisions, depending on their financial structure.

8. How to Calculate Advance Tax

To calculate the total estimated advance tax, you can go by the following steps.

- Calculate your total estimated income from all the sources, like capital gains, professional income, rental income, interest from FDs, savings accounts, etc., and any other sources

- Add the salary income estimated in step 1

- As per the applicable slab rates, calculate the tax on your gross taxable income

- Subtract TDS if it is already deducted at the source or expected to be deducted

- Now, if the total tax liability is above Rs 10,000, you have to pay advance tax in four instalments in a Financial year

9. Penalties and Provisions for Default in Advance Tax

While advance tax is an essential requirement for taxpayers, the Income Tax Act also has provisions for penalties in case of defaults or delayed payments. Failure to pay the entire tax or within the target dates results in the deduction of interest under Sections 234B and 234C.

Further, failure to pay advance tax on time may attract legal consequences and may also attract penalties under Section 271F. Section 271F is levied when a taxpayer fails to file his return of income on time, along with the payment of advance tax.

Taxpayers who anticipate difficulty in making timely advance tax payments may approach the tax authorities for relief under provisions of the Income Tax Act, such as an extension of the due date or an adjustment in the tax amount.

Conclusion

Advance tax is an important provision in the Indian taxation system designed to ensure the timely and efficient collection of taxes. By paying taxes in installments, taxpayers not only help avoid a lump sum payment at the end of the financial year but also contribute to the country’s economic stability. For individuals and businesses, understanding the nuances of advance tax computation, due dates, and penalties is crucial to maintaining tax compliance and avoiding unnecessary fines.

TaxDunia, being composed of very knowledgeable and user-friendly tools, guides taxpayers through various tax law complexities, so that they encounter smooth tax planning and compliance. TaxDunia in this regard helps taxpayers understand advance tax payments with related issues clearly and enables them to avoid possible financial pitfalls which can prove costly and may lead to hassle in tax experience.