Company's Income Tax Return

Home » Company Income Tax Return

Company's Income Tax Return

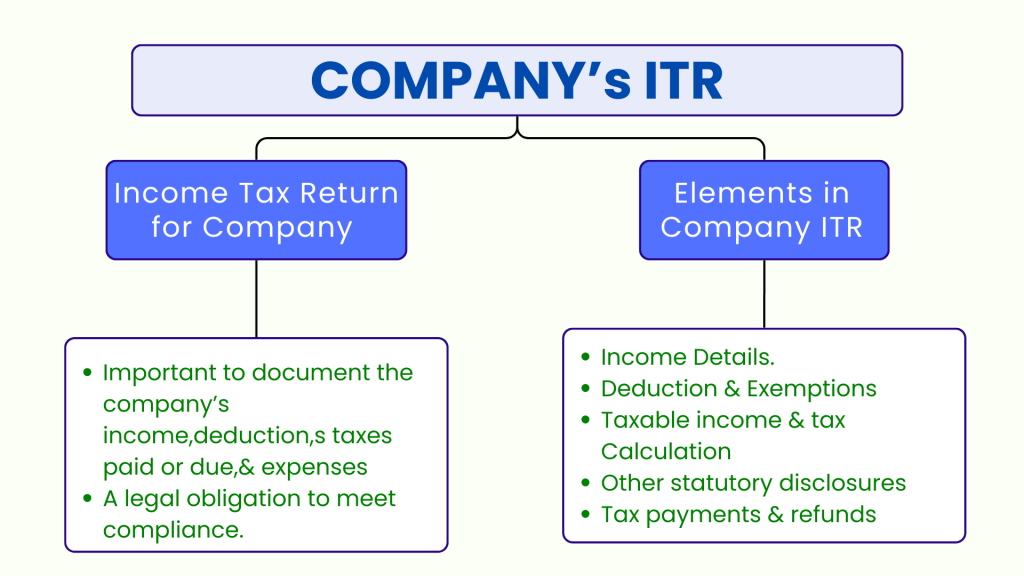

Income Tax Return is considered one of the key and mandatory documents for any business or income-generating organization. Simply put, an income tax return is a formal statement made to the tax authorities, explaining income, deductions, and taxes paid or due for a specific financial year. For companies, filing an ITR is a legal obligation that ensures compliance with tax laws and reflects the company’s financial health and corporate governance.

This article explores the significance of ITR for companies, its components, the filing process, and the implications of non-compliance.

Importance of Filing ITR for Companies

Filing ITR is crucial to corporate tax management and serves multiple purposes. For one, it ensures that the company is following the laws of the land and is not liable for any penalties or legal complications. The tax authority demands this accurate ITR to be submitted as part of the filing of the annual tax returns. Further, the submission is an open book for the government to track and audit a company’s financial position, income, and tax liability. An ITR serves as proof of the company’s financial dealings and can be asked for in instances such as loan applications, regulatory checks, or mergers and acquisitions.

Furthermore, timely and accurate filing of ITR also improves a company’s credibility with investors, stakeholders, and financial institutions. Submission of ITRs within the required timelines helps companies maintain a cordial relationship with the regulatory authorities and builds trust with the financial community. Finally, ensuring accurate tax calculation and proper deductions reflected in the ITR can help companies claim tax benefits or refunds.

Elements in a Company's Income Tax Return

A company’s ITR usually contains a few important elements that disclose definite information about the company’s financial activities for the current year. These elements are as follows:

Income Details

The company is expected to report its total income for the financial year in the first section of the ITR. This includes revenue from sales, interest, dividends, capital gains, and any other source of income the company may have earned during the year. The income figures are based on the audited financial statements prepared by the company, including its balance sheet and profit-and-loss account, according to accounting standards.

Deductions and Exemptions

Tax deductions and exemptions are often available to companies under the Income Tax Act, thereby reducing taxable income. The expenses could relate to employee salaries, overheads of the business, or depreciation on assets. Exemptions might pertain to some investment or activity that may be exempt under the law from taxation.

Taxable Income and Tax Calculation

Once all items of income and allowable deductions have been considered, taxable income is arrived at. Application of the tax rate to the taxable income yields the payable tax amount. Depending on the size and level of revenue for such a company, tax rates are expected to vary with provisions available for extra levies like MAT or other sector-specific types of tax.

Other Statutory Disclosures

In addition to income and tax details, the ITR form requires companies to provide other statutory information, such as the company’s Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), and registration details. This ensures that the filing is associated with the correct corporate entity and allows tax authorities to track the submission more effectively.

Tax Payment and Refunds

This section details the tax payments made within the year in the form of advance tax, self-assessment tax, or as TDS. If the amount of tax paid surpasses the tax liability, companies can claim a refund for it. If there are errors or underpayments, the company has to pay off the liabilities outstanding.

Steps in Filing Income Tax Return

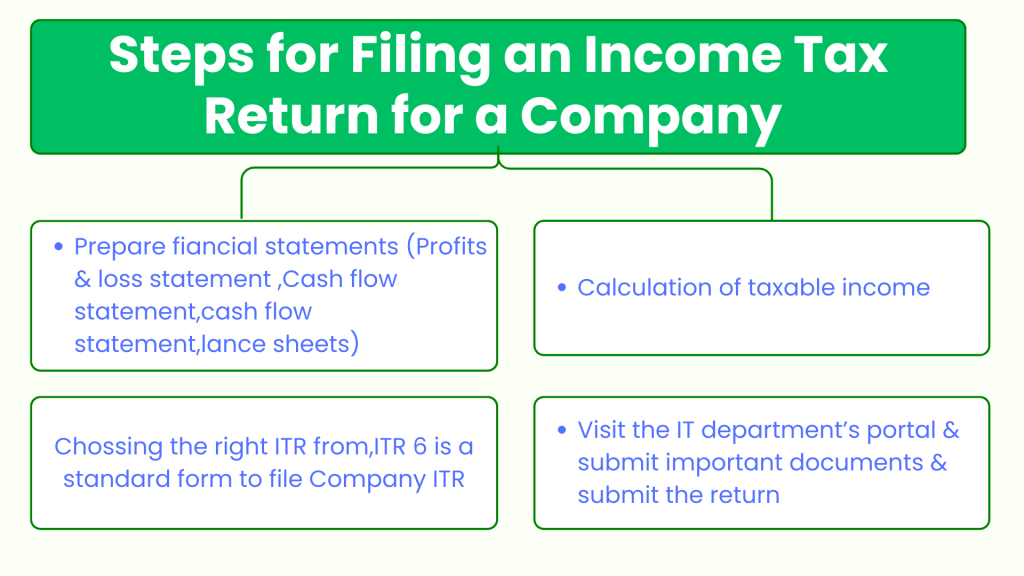

The process of filling an ITR on behalf of a company is quite formal and involves many steps. Companies are supposed to file their returns electronically with the income tax department. It generally follows these stages:

Step 1: Preparation of Financial Statements

A business must file the ITR after ensuring that its financial accounts are accurate and relevant. This means preparing audited statements of accounts and include including lance sheets, profit-and-loss statements, and cash flow statements. These form the base of the revenues, expenses, and taxes to be paid by the company.

Step 2: Choosing the Right ITR Form

However, there are several forms of ITR and different forms are meant for different types of taxpayers, such as that for the companies. For most companies, ITR-6 will be the standard form that must be filled. But, the applicable form depends upon the structure of the income as well as the nature of the company. In this case, choose the correct form to avoid complications.

Step 3: Calculation of Taxable Income

Once the financial statements are ready, companies need to calculate their taxable income, considering all allowable deductions, exemptions, and other tax benefits. This involves applying the tax rates appropriate for the type of company and ensuring that the figures reflect accurate accounting principles.

Step 4: Filing the Return

After arriving at the taxable income and tax liability, the company files ITR online on the Income Tax Department’s e-filing portal. Information such as PAN, TAN, etc., is to be provided correctly. The portal also provides an option wherein the company can upload supporting documents, such as audited financials and tax audit reports, as well.

Step 5: Return Verification

After the submission, the ITR needs to be verified to finally file. Digital signatures are required in most corporate filings for verification of returns. If digital signatures have not been utilized, a signed copy of ITR-V (acknowledgment) must be sent to the tax department via the pos of the company. After the return is verified, it is filed successfully.

Due Dates for Filing Company's ITR

The Income Tax Act prescribes specific deadlines for companies to file their ITRs. Generally, companies must file their returns by September 30 of the assessment year, which is the year following the financial year under review. However, this deadline may vary in some cases, particularly for companies that are required to undergo a tax audit. In such cases, the deadline may be extended to November 30.

Filing ITRs by companies within the due date is important to avert penalties or interest on delayed payments. Late filing attracts a penalty under Section 234F of the Income Tax Act, which can vary from INR 5,000 to INR 50,000, according to the lateness of the filing of the return.

Consequences of Non-Compliance

Failure to file the ITR in time exposes a company to various legal and financial consequences. In addition to penalties and interest on overdue taxes, failure to comply can attract the attention of tax authorities, which may lead to audits or other legal actions. The company’s reputation also gets impacted as it fails to meet deadlines for its tax filing obligation, which adds to the scrutiny against investors, stakeholders, and regulators.

Extreme cases can even lead to cancellation of a company’s registration, or even criminal prosecution if there is evidence of tax evasion. Therefore, time on-time curated filing of the ITR is not only a statutory compulsion but also an important aspect of responsible corporate governance.

Tax Audit and Its Role in Filing ITR

A tax audit is the final backbone of ITR for many companies. This is very crucial for those whose annual turnover exceeds a certain limit, according to the provisions of the Income Tax Act. A chartered accountant carries out the tax audit, where he verifies the genuineness of the financial records and ensures that the tax return filed by the company complies with the laws applicable thereto.

An audit report is provided by the auditor; it is a critical part of filing an ITR for the company. It indicates that the accounts have been audited properly, in line with the set standards, and that the financial statements are true to their record. Discrepancies or errors detected in the audit should be taken care of before the ITR filing.

Revision and Rectification in ITR Filing

Commonly, the companies make errors/misinformation while filing the ITR initially. The Income Tax Act has a provision for revising ITRs in case of necessity. A revised return can be filed within one year from the end of the relevant assessment year or before completion of the assessment, whichever is earlier. Companies need to revise their returns if they find mistakes, such as omission to deduct, under-reported income, or miscomputation.

Failure to rectify a return in case of mistakes may attract penalties, interest, or even an audit. Companies ought, therefore, to be meticulous in ensuring that returns made are without errors and that correction is made at needed points if there are mistakes in the return.

Conclusion

Income Tax Return (ITR) filing by companies is an important subject of corporate tax law about facts filed, transparency, accountability, and legitimacy. It requires careful keeping of financial records, tax legislation, and a timeline for filing the return. In return, the companies can not only avoid penalties but enjoy tax savings. They also ensure good relationships with the tax authorities. Moreover, the ITR filing marks a commitment to the cause of good corporate governance.

A company cannot enjoy long-term success and maintain a good reputation in the business circuit unless it practices good corporate governance. Companies must know when tax laws change and the filing requirements to ensure that they adhere within the set time. As taxation for corporate entities is complex, most companies are usually advised to engage tax professionals or auditors for them to lodge accurate and efficient returns.

Get Started with TaxDunia Today

Meet all your legal compliances with the professional assistance of TaxDunia. You can reach out to us in case you are looking for tax advisors, GST/ITR Return filings, or looking for ways to get your business registered. We provide both online and offline services to our clients. It is easy to communicate with our professionals. You can make a call to get in touch with us. Choose the eXcellent, and excellence will pursue you.