Set Off Capital Losses Before 31st March

It is difficult for investors to figure out capital gains and losses at the end of the financial year. The Indian stock market has had its ups and downs, which means that buyers in stocks may lose money. In this case, though, the losses can be used to lower taxes using a smart approach known as “tax-loss harvesting.” This method lowers tax bills by balancing stock losses against gains. This article discusses ways to set off & carry forward capital losses before the fiscal year ends on March 31.

A Look at Capital Gains and Losses

There are two kinds of capital gains in India

- short-term capital gains

- long-term capital gains

When you sell something that you’ve had for less than a year, you may have short-term capital gains. For securities sold after July 23, 2024, STCG is taxed at 15%. For certain deals, Section 111A taxes STCG at 20%.

Long-term capital gains are taxed on old assets. These assets have been held for more than one year. This gain is taxed at a rate of 10% on profits over Rs 1 lakh. The condition is that securities are sold before July 23, 2024. If you sell the securities after July 23, 2024, the rate is 12.5% without indexation for profits over Rs 1.25 lakh.

A Strategic Plan for Tax-Loss Harvesting

Securities are sold at a loss to balance out the gains from other investments. By keeping taxed capital gains very low, tax-loss harvesting can cut tax bills by a large amount. You can save taxes.

How to Use Tax-Loss Harvesting to Find Losses Go through your investments and find the ones that are losing money right now.

Sell Loss-Making Securities: You should sell the securities to lose money.

Offset Gains: Turn the loss you’ve already seen into gains from other purchases. This can be done during the same fiscal year or by putting the costs off until later.

Reinvest: With the money from the sale, buy other assets that look good to keep your portfolio’s asset mix.

Capital loss set-off rules

For tax-loss gathering to work, you need to know the set-off rules:

- Capital Losses in the Short Term (STCL): In the same year, these can be changed to match both STCG and LTCG.

- Long-Term Capital Losses (LTCL): These can only be changed by LTCG.

Carry Over of Capital Losses

If the loss of capital is more than the gain in income for a year, the extra loss can be carried over for eight years. To get this benefit, you have to file your Income Tax Return (ITR) by the due date.

A Case of Tax-Loss Harvesting

Here’s an example that shows how tax-loss harvesting works to help you understand:

Case study:

- The individual has a short-term capital gain (STCG) of Rs 100,000.

- The company has incurred a short-term capital loss of Rs 60,000.

- 15% tax rate for STCG

- The tax on STCG is Rs 100,000 times 15%

- It is Rs 15,000.

- With Tax-Loss Harvesting, the net STCG after deducting the loss is Rs 40,000

- It is calculated as Rs 100,000 minus Rs 60,000.

- Net STCG tax = Rs 40,000 * 15% = Rs 6,000

- Tax-loss harvesting helps the owner save Rs 9,000 in taxes.

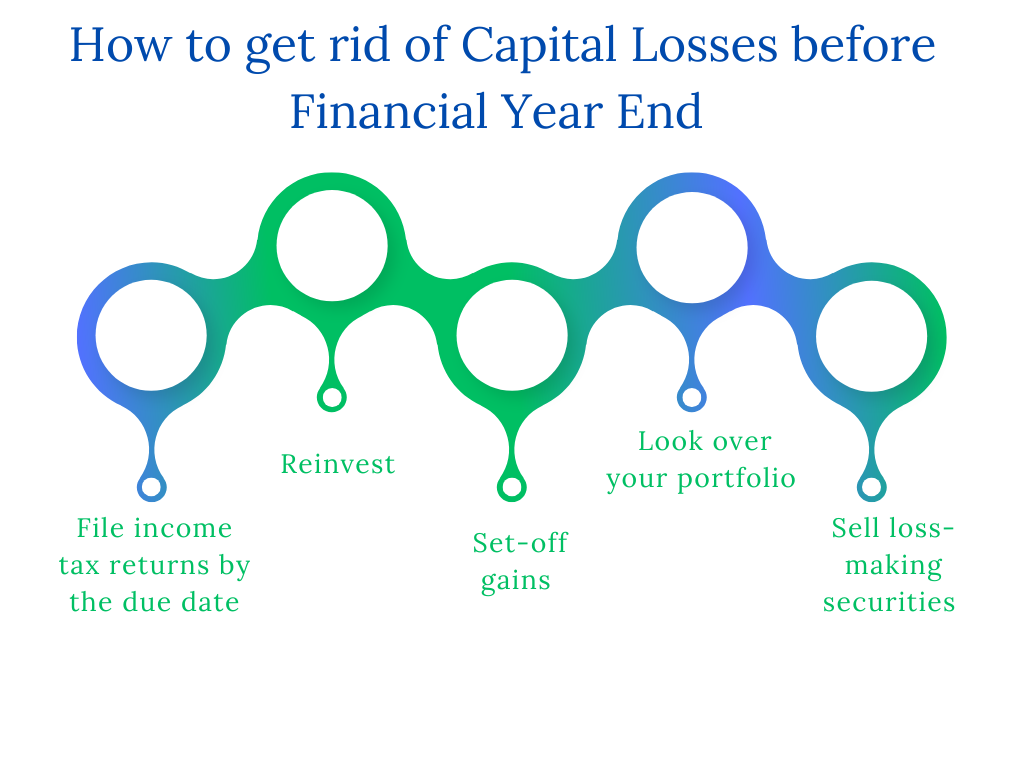

How to Get Rid of Capital Losses Before Financial Year Ending

- Look over your portfolio: Find the stocks that are losing money right now.

- Sell Securities That Are Loss-Making: Get your losses back by selling these securities before March 31st.

- Set-off gains: Use realized losses to balance out gains from other investments.

- If you don’t file your Income Tax Return on time, you may not be able to carry over any losses.

- Reinvest: Put the money you got back into other assets to keep your account balanced.

How to Get the Most Out of Your Tax Losses

Here are some tips you can follow:

- Keep Accurate Records

As you fill out your ITR, make sure you keep good records of all the deals you make.

- Seek Advice from a Financial Adviser

If you’re not sure what to do, talk to a financial adviser.

- Track Market Trends

Stay up to date on the latest market conditions so you can make smart choices about when to sell and when to spend.

By being strategic and using these strategies, you can effectively handle your capital losses and get the most out of your taxes before the end of the fiscal year.

Get Started with TaxDunia

In a volatile market, tax-loss harvesting is a powerful way to control your tax obligations. Investors can lower their tax bill by a large amount if they understand and use the rules for set-off for capital losses. It’s important to go through your investments at the end of the financial year, look out for possible losses, and set them off against wins. This not only saves money on taxes but also keeps your investments in balance. To get the most out of tax-loss harvesting, make sure that all of your tax-saving tasks are completed by March 31st. If you are still carrying forward capital losses and unable to set them off, reach out to TaxDunia to do the same for you. Our team of professionals ensures smooth results with a centric approach.