Private Limited Company Registeration

Home » Private Limited Company

Get Private Limited Company Registration Now

A Private Limited Company is a small business with limited promoters. For the exponential growth of your gradually budding business entity, getting a Private Limited Company Registration proves to be an additional feather on the cap. You may already know that a Private Limited Company consists of a minimum of 2 partners while it can have a maximum of 200 shareholders as per Indian Laws. Once you secure this registration, your company will enjoy benefits such as limited liability protection, ease of formation, and other tax exemptions and government benefits. Get the registration now with professional help from TaxDunia.

Why Opt for Private Limited Company Registration?

To enjoy a separate legal identity status, companies require a Private Limited Company Registration. After the successful registration, the activity of shareholders is restricted which somehow benefits the company. To align with the vision of the major shareholders, the restricted entry of partners reaps favorable results. Such companies have to maintain a Minimum Capital to start or run the operations as per the rules, then registration is required to keep a record of the capital. The Private Limited Company enjoys a distinct legal entity status which protects it from various legal troubles and contributes to its unhindered growth.

Benefits of Private Limited Company Registration

- Reduced Risk of Individual Shareholders : as shareholders have limited liability, their assets are not at risk. They do not need to pay out of their assets as they have limited liability

- Credibility: getting a Private Limited Company Registration brings credibility to the company and makes it a trustworthy brand

- Tax Benefits: it shields companies from excessive taxes as the government promotes new business and encourages them by giving certain remunerations

- Future Growth: after the registration, the company becomes a separate legal identity which means any disassociation does not affect it negatively

- Convenience in Fund Raising: there will appear more fundraising options once the registration is done as it brings recognition and creates a market value

- Limited Liability: the shareholders and investors have limited liability which draws a fine line between personal and professional liabilities and obligations

Documents Required for Private Limited Company Registration

- PAN Card

- Passport (only for foreign nationals)

- Address Proof

- Director Identification Number DIN

- Digital Signature Certificate

- Memorandum of Association

- Articles of Association

- No objection certificate

- Shareholding Pattern of Company

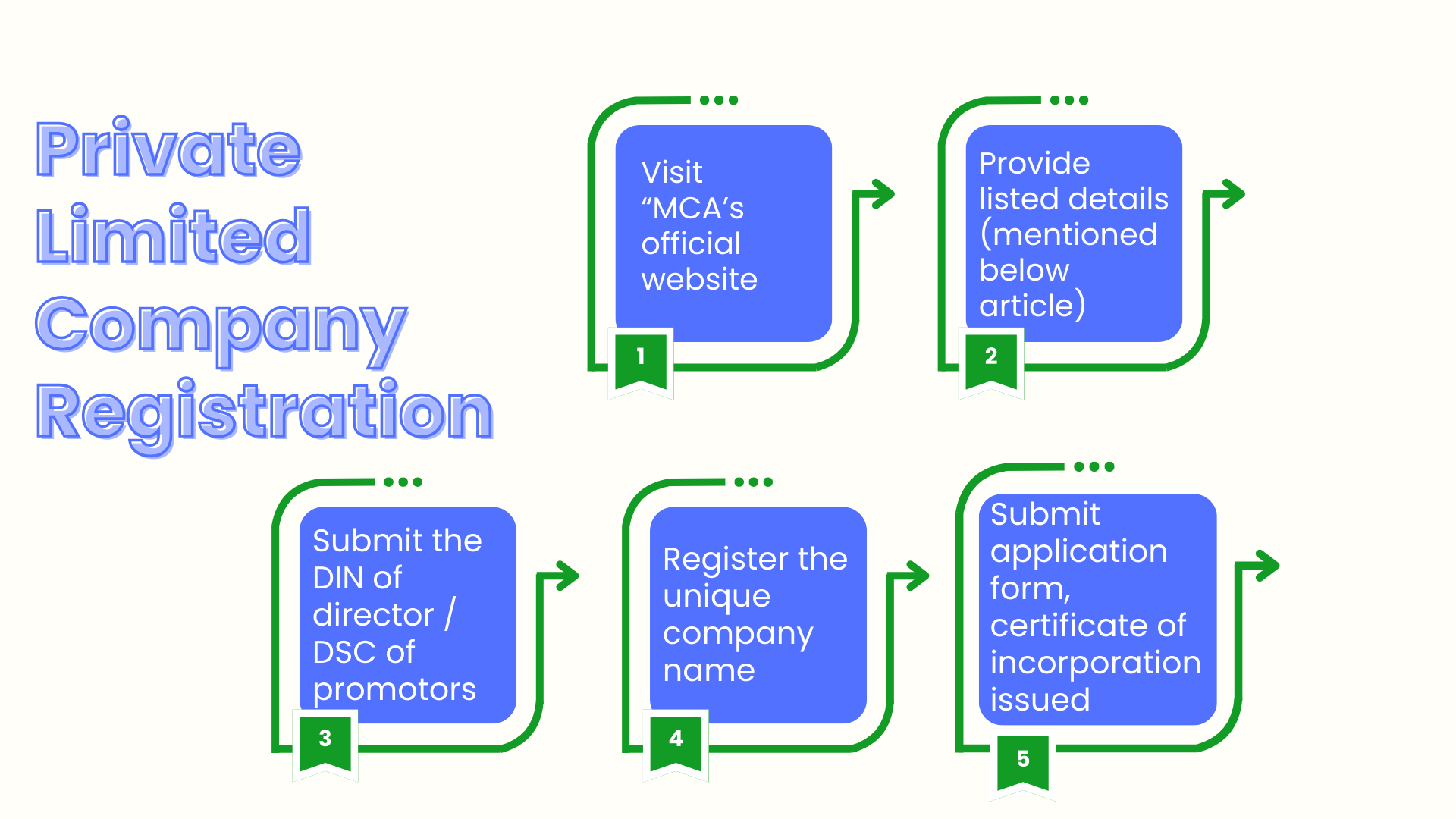

Key Steps for Private Limited Company Registration

- Ministry of Corporate Affairs: visit the official website of the MCA, to begin with the registration

- Digital Signature Certificate: provide PAN card, Aadhaar Card, phone number, and mail address to get a DSC

- DIN: directors have to hold DIN to get limited liability

- Name Reservation: fill up the required form to secure a name for your company and select a category, class, type, and division

- Final Submission: once the details are completely done and you have secured all the details, submit the form along with above listed documents

- Certificate of Incorporation: once the process is successfully done, the Ministry of Corporate Affairs will grant the certificate of incorporation

Subscribe To Our Newsletter

Want to get special offers before they run out? Subscribe to our email to get exclusive discounts and offers.

Get Started with TaxDunia Today

At TaxDunia, we offer: Expertise: A group of experienced accountants who know accounting policies, requirements, and procedures that may be useful for your company to thrive. Personalization: Specific consulting services in the field of accounting that are aimed at the specifics of your company and its problems, improving the financial activity of the enterprise. Reliability: As our customer, we pride ourselves on providing you with sound, professional accounting services that are timely, accurate, and confidential