Key Landmark Judgements on GST in 2024

The Goods and Services Tax or GST was introduced in 2017 and since then the Supreme Court has been giving landmark judgements on it. These judgements define the path of indirect taxation for the taxpayers. Input Tax Credit is one of the GST’s elements and there have been several landmark judgements on ITC in 2024. This article will provide a detailed guide on recent Comments made on ITC in 2024.

GST Department’s Plea Against HC Order on ITC

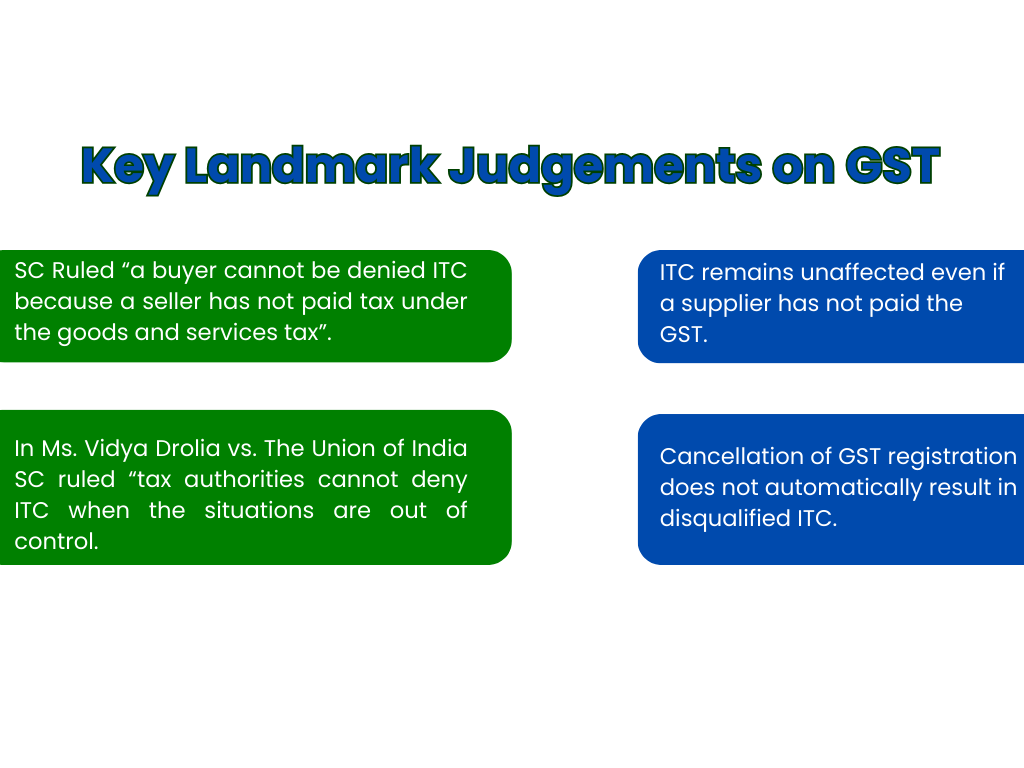

The Supreme Court squashed a petition filed by the GST authorities against ITC claims. The Calcutta High Court passed a judgement directing the authorities to clear the ITC claims but the authorities were against this decision and approached the Supreme Court. The Supreme Court said that a buyer cannot be denied ITC because a seller has not paid tax under the goods and services tax. The authorities argued that the GST paid by the supplier was not reflected in the relevant form and there was a mismatch in the supplier’s form and the company’s form claiming ITC.

The Calcutta High Court’s order stated that the company cannot be denied ITC by citing the ground that the supplier has not remitted the tax unless there are situations where the GST department cannot collect tax from the supplier. The Supreme Court took the landmark decision only in case the of this particular company and it does not set a broader precedent for other businesses facing the same issues.

Important Judgement by Supreme Court

Ms. Vidya Drolia vs. The Union of India

This one particular case is based on the “vested right” in ITC as the appellant Ms Vidya is eligible for an ITC but her registration has been cancelled lately. Though she was registered under GST earlier, her registration was cancelled and on that grounds, the GST authorities denied her ITC.

The Supreme Court addressed the concerns of the taxpayer and stated that the tax authorities cannot deny ITC when the situations are out of control. This judgement provides commercial entities with a shield against being punished in cases like registration cancellation or other similar factors.

Key Outcomes on Input Tax Credit

ITC remains unaffected even if a supplier has not paid the GST

Court decisions highlight that even if a supplier has not paid the taxes, the taxpayers cannot be denied ITC as these matters are out of the control of the ITC claimant. The Supreme Court and the Madras High Court both have given the same judgement stating that the businesses cannot be denied ITC because the supplier has not filed the taxes.

Cancellation of GST registration does not automatically result in disqualified ITC

In Ms. Vidya Drolia vs The Union of India, it is clarified that if a business has cancelled GST registration or the registration is cancelled by the authorities, such business is still eligible for the ITC under GST. The recipient cannot be debarred from receiving ITC. This judgement provides relief to businesses and limits the role of suppliers in ITC claims.

Get Started with TaxDunia

The GST is comparatively a new tax regime in the country and the authorities realize the loopholes with the passage of time and such landmark judgements will be given therefore, businesses can be up to date to know about the latest GST rule changes. If you are denied ITC even though you have relevant receipts, then reach out to TaxDunia. We offer personalized solutions to meet the unique needs of our clients. Our team of professionals will ensure smooth compliance, let us connect.