Income from Salaries

Home » Income from Salaries

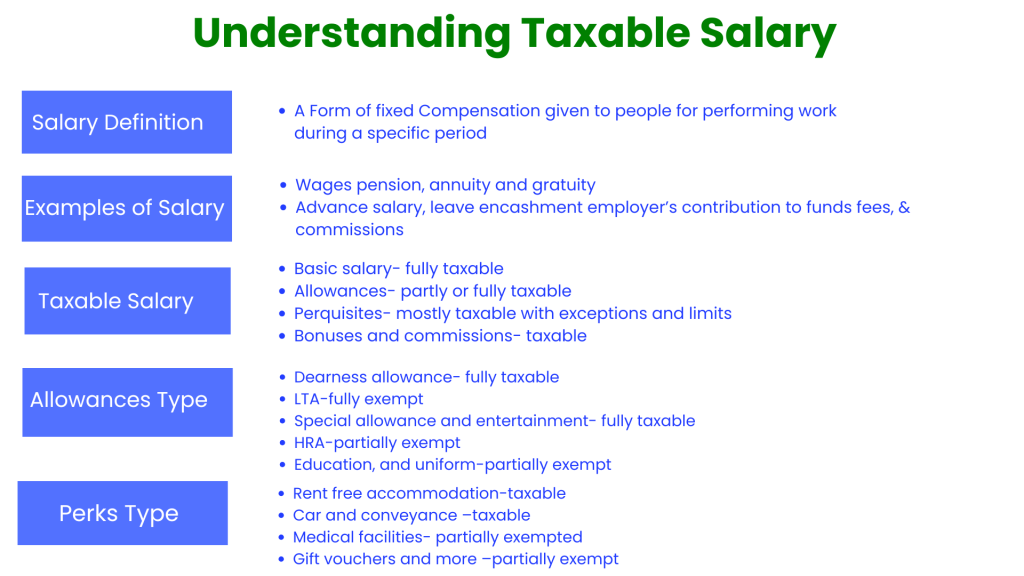

Understanding Taxable Salary

The salary component is one of the major constituents of an individual’s taxable income in respect of income tax. The guide explains the definition of salary for tax purposes, various types of allowances and perquisites, and their taxability. This understanding of the concepts helps employees manage their tax liability and benefits them by helping them make better financial decisions.

1. What is Salary?

A salary is a form of fixed compensation given to a person for performing work during a specified period. However, in income tax, the definition of salary also includes various other forms of payments offered by the employer to the employee.

According to tax legislation, salary includes the following among others:

- Wages

- Pension

- Annuity

- Gratuity

- Fees, commissions, or profits in addition to or instead of salary or wages

- Advance salary

- Leave encashment

- Employer’s contribution to a recognized provident fund exceeding the specified limit.

Elements of Salary:

- Basic Salary: The core element of salary, typically forming a large part of the total salary. The basic salary is fully taxable.

- Allowances: These are also payments made by the employer on behalf of the employee towards certain expenses or needs of the employee. They are partly or fully taxable, depending on their nature.

- Perquisites: Any non-cash benefit or facility extended to an employee, such as rent-free housing, cars, medical facilities, etc.

- Retirement Benefits: Gratuity, provident fund contributions, and pension payments, which employers provide to the employees as post-retirement benefits.

2. Taxable Salary: What Parts of Salary Are Taxable?

All but some aspects of salary are tax-free; the rest have a certain percentage of tax deducted in some cases. In simple words, the whole salary of the employee except that based on the employee, as per the existing law. A basic salary is purely taxed, and some sorts of allowances might attract just partial tax. So Taxable Salary would be worked out as under.

Taxable Salary = Basic Salary + Allowances – Exemptions/Deductions

The employer is breaking down the salary structure, so an employee can determine what’s taxable and not exempted. This list of items makes taxable the salary:

- Basic Salary: Fully taxable

- Allowances: Allowances are only exempt up to a particular percentage while wholly taxable

- Perquisites: Perks are mostly taxable, however with exceptions and limits to both.

- Bonuses and Commissions: These too are taxable in the very year they are received

3. Definitions and Taxability of Allowances

Allowance is an additional payment offered by the employer for expense purposes. Allowance is also taxable, partially taxable, or exempt subject to the event it is incurred and tax exemptions available under tax law provisions.

Types of Allowances and Their Taxability

- House Rent Allowance (HRA):

- HRA is provided to the employee to pay accommodation rent.

- Tax Exemption: HRA is partially exempt under specific conditions. The exemption is determined as the lowest of the following:

- Actual HRA received

- 50% of salary for employees working in metro cities (40% for non-metro).

- HRA amounts to more than 10% of salary.

- Taxable Part: Amount of HRA, after exempting this amount, it is taxable.

- Dearness Allowance (DA):

- DA is given to compensate an employee with the effect of inflation in the income.

- It is computed mainly as a percentage of basic salary.

- Taxability: DA is fully taxable and forms part of salary income.

- LTA or Leave Travel Allowance

- LTA is for expenses while traveling with family within India and it is fully taxable.

- Special Allowance:

- Special allowances are allowed by employers specifically for a few purposes of the employees. It covers children’s education, study, research, or conveyance.

- Taxable Entirely unless covered under the Income Tax Act

- Allowance for children’s Education:

- Provided for children’s educational expenses

- Deduction: Deduction is allowed up to a specified amount per month per employee for up to two children.

- Taxable Portion: Whatever is more than the allowable amount is taxable.

- Uniform Allowance:

- Given as compensation for costs in the acquisition and maintenance of uniforms required to be worn at the workplace.

- Deduction: Deductible only in case of used for official expenses.

- Taxable Amount: The whole amount that does not go into procuring the uniforms or maintaining them is taxed.

- Entertainment Allowance:

- The amount provided to the employees for conducting entertainment and hospitality expenses.

- Tax exempted: Partial exemption if a government employee.

- Taxable Portion: The entire entertainment allowance is taxable for non-government employees.

- Conveyance Allowance:

It is provided to meet the cost of conveyance between home and office.

Taxability: Fully taxable as part of salary.

Summary of Allowance Taxability

Allowance Type | Taxability |

House Rent Allowance | Partially Exempt |

Dearness Allowance | Fully Taxable |

Leave Travel Allowance | Fully Taxable |

Special Allowance | Fully Taxable |

Children’s Education | Partially Exempt |

Uniform Allowance | Partially Exempt |

Entertainment Allowance | Fully Taxable (except government) |

Conveyance Allowance | Fully Taxable |

4. Definitions and Taxability of Perquisites

Perquisites, also known as fringe benefits, are non-cash benefits granted by employers to their employees. Most of these benefits are taxed and get added to the income of the employee to be taxed. Some perquisites have exemptions or tax-free limits.

Types of Perquisites and Their Taxability

- Rent-Free Accommodation:

- Many employers offer accommodation as part of the package to the employee.

- Taxability: The perquisite value of free accommodation is a tax on location, salary of the employee, and many more such factors.

- Car and Conveyance Facilities:

- Companies offer personal and official use cars.

- Taxability: The taxable value depends upon whether the car is to be used solely for an official purpose for private purposes or both

- Medical Facilities:

- Employees may receive provision for payment of medical bills by their employers or other forms of health coverage.

- Taxable: this is tax exempted but that is exceeded charged.

- No interest loan or concessionary loans:

- Loans that an employer grants to his or her employees may not accrue interest nor attract interest either.

- Taxability: Savings in interest incurred by an employee are fully taxable in the hands of the recipient as a perk, reckoned on a differential between the market rate compared with the concessional rate that was applicable.

- Gift Vouchers or Tokens

- For gift vouchers, especially on special occasions, the employer may provide gift coupons.

- These are exempt when they fall within a set value limit; above that specified value the amount is subjected to taxation.

- Vendors might sell products or goods at the cheapest rates.

- Taxability difference between what is the market price of and that the worker pays

- LTC or Leave Travel Concession

- LTA is for expenses while traveling with family within India.

- Exemption: LTA is exempt twice in a block of four years for travel within India, subject to some conditions.

- Taxable Portion: If the allowance exceeds the exempted amount or if for overseas traveling, it is taxable.

Summary of Perquisite Taxability

Prerequisite Type | Taxability |

Rent-Free Accommodation | Taxable (Based on salary/location) |

Car/Conveyance Facility | Taxable (Varies with usage) |

Medical Facilities | Partially Exempt |

Interest-Free Loans | Taxable (Difference in interest) |

Gift Vouchers | Partially Exempt |

Free/Discounted Goods or Services | Taxable (Market vs. paid price) |

LTC | Partially Exempt |

5. Exemptions and Deductions on Salary Components

Certain salary components also carry exemptions and deductions in the form of exemptions in taxable salary. Knowing this will help in the proper planning of taxes:

- Certain allowances such as HRA, conveyance allowance, LTA, etc. are exempt from tax under Section 10 of the Income Tax Act.

- Standard Deduction: Salary individuals are entitled to the standard deduction, which is the flat deduction of their salary.

- Chapter VI-A Deductions: In addition to that, they are also eligible for deductions for investments made in particular tax-saving instruments like ELSS, PPF, health insurance, etc. Section 80C to Section 80D deduct total tax income.

Conclusion

Knowing about the taxability of allowances and perquisites allows an employee to control his tax liability better and, thus, optimize take-home salary. Further, if different exemptions and deductions are known, it makes good tax planning easier, thereby letting the employees make the best of their income and lowering taxable income within the safe and legal constraints. Proper financial management and proper knowledge of salary break-up can be beneficial to improve the financial health of the individual and also to comply with all the tax provisions.

Get Started with TaxDunia Today

TaxDunia is a financial services platform offering expert solutions in tax planning, filing, and compliance. It helps individuals and businesses navigate tax regulations, ensuring accurate returns and maximizing tax savings. With user-friendly tools and professional guidance, TaxDunia simplifies complex tax processes for clients across various sectors.