How to File GSTR 3B Online: Step-by-Step Guide

To report the summary of sales and purchases, all taxpayers except those exempted have to file a monthly GSTR 3B. Once taxpayers have filed GSTR-1 and GSTR-2, they are required to file GSTR-3 B. Some of the details in this return are auto-populated from the GSTR 1 and 2, while the remaining details have to be filled out manually by the taxpayer. Here in the article, you will find a step-by-step guide to filling up the return online. Once the return is filed successfully, the taxpayer receives an alphanumeric Acknowledgment Reference Number sent to the registered mail ID or Mobile Number.

Step 1

Log in to the official GST Portal and click on “services” then go to “returns” and click on “Returns Dashboard”.

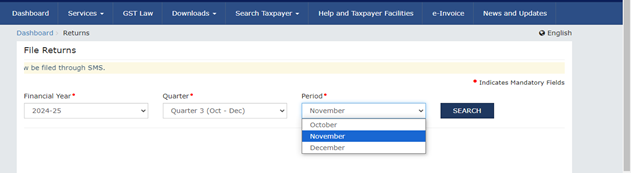

Step 2

Now select the financial year for which you want to file the returns select the quarter and then a month. For nil returns, you can also file GSTR 1, GSTR 3B, and CMP-08 through SMS services.

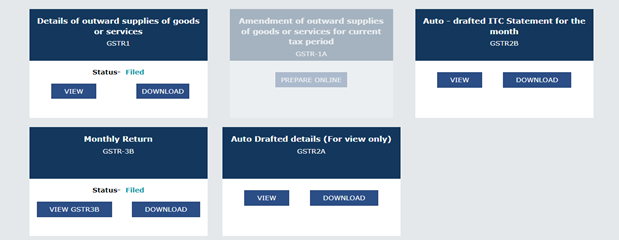

Step 3

On the computer screen are several tiles on which you can see the status of GSTR 1, GSTR 2A, GSTR 2B, and GSTR 3B, and more, and prepare them online as well. Click on the “prepare online” option in the Monthly Return GSTR 3B options (in the image below, the GSTR 3B is already filed, you cannot view the prepare online or prepare offline options).

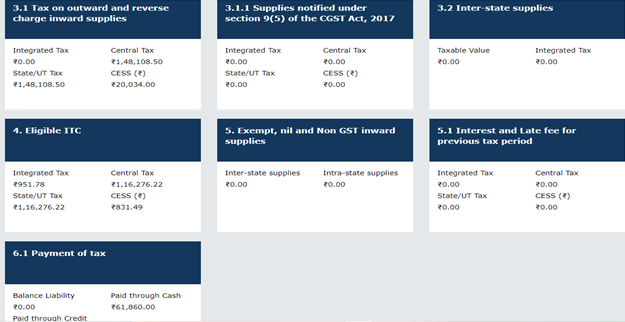

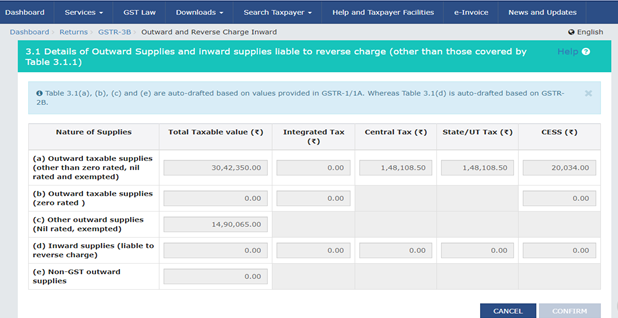

Step 4

Some of the details in the GSTR 3B will be auto-populated from the GSTR 1 and GSTR 2B. You can choose to edit the details or keep them as they are. The details on Tax on Outward supplies and inward supplies liable to Reverse Charge Mechanism will be auto-populated.

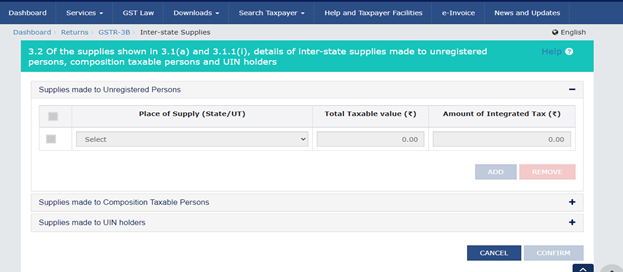

Step 5

Details for interstate supplies to unregistered persons, composition taxable individuals, and UIN holders are to be entered in the next tab in the return form these details are also auto-populated from GSTR 1, you can edit them later (no data auto-populated in the below image as of now, GSTR 1 of the taxpayer is not filed).

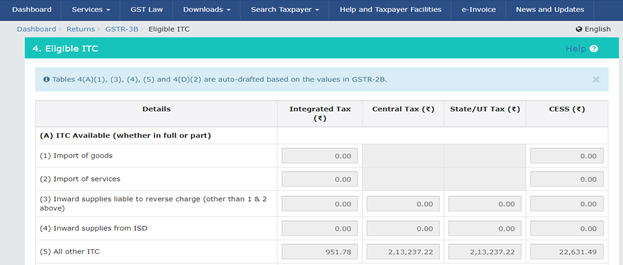

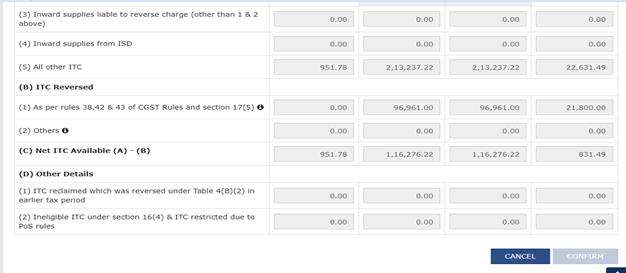

Step 6

Details on eligible input tax credits, ineligible ITC, and input tax credit reversed are to be entered later on (details to be auto-populated based on GSTR 1 and GSTR 2B), continue confirming the page to ore further.

Step 7

Details on exempt, nil-rated, and non-GST inward supplies made in interstate or intrastate.

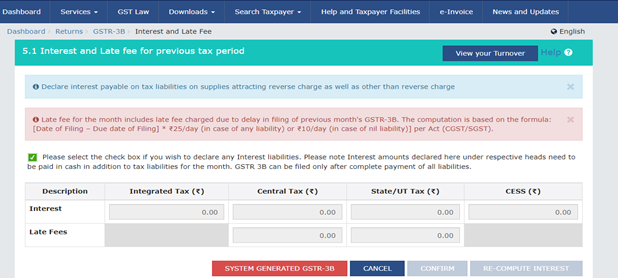

Step 8

The interest and late fee are auto-computed by the system and will be added to the liabilities. In case of nil liabilities, Rs 10 per day delayed is charged while it is Rs 25 for liabilities.

Before clicking on “save GSTR 3B” you can preview the return to edit the data or view it before final submission. Once you save the page, a message for successful submission appears on the computer screen.

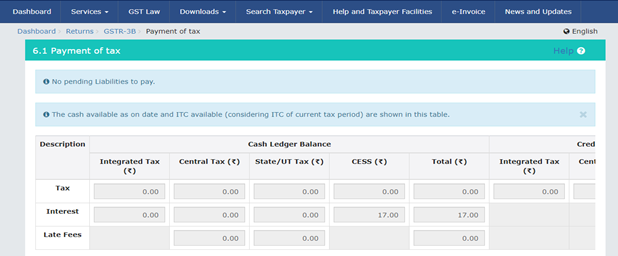

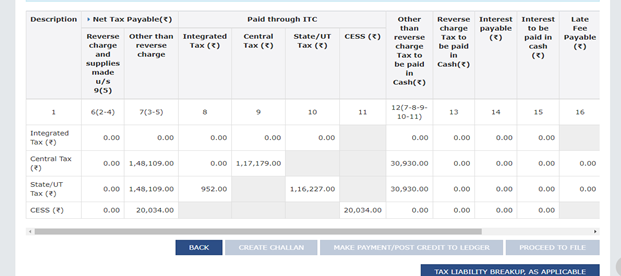

Step 9

Now pay the liabilities from the cash ledger. Tax liabilities get updated from the ledgers and you can make the payment from the electronic cash ledgers by clicking on “make payment/post a credit to ledger”.

If the available balance in the electronic cash ledger is less than the total liabilities, create a challan and if the balance is more than the liabilities, click on the make payment option.

File the GSTR 3B with DSC or with EVC. Once completed, you receive the ARN sent by mail and registered mobile number.

Get Started with TaxDunia

The filing process of GSTR 3B may be cumbersome for the taxpayers as it requires a lot of information and data, and understanding the same is altogether a different thing. Therefore, to avoid all this chaos, reach out to TaxDunia. We are delighted to help you and contribute in your success by providing valuable advice.