How to Download & View GSTR 2B

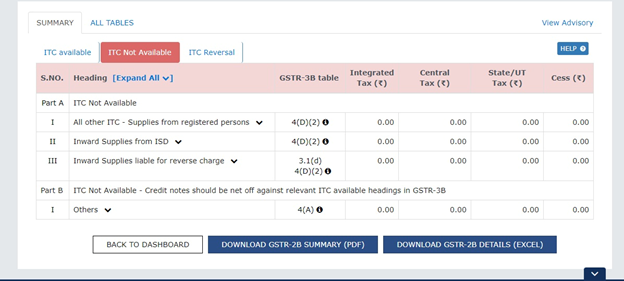

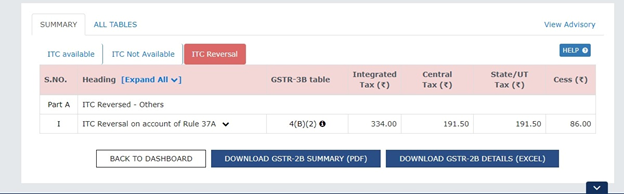

GSTR 2B is an auto-drafted ITC statement that contains details of invoices or debit notes furnished by the supplier through his GSTR 1, GSTR 5, and GSTR 6. It also contains details on imports of goods from the ICEGATE system. The recipient of services can download or view the GSTR 2B from the GST portal. It contains details on ITC available, ITC not available, and ITC reversal.

GSTR 2B has inputs on invoices, credit, and debit notes filed by suppliers through GSTR 1/IFF, GSTR 5 filed by NRTP, and GSTR 6 filed by ISD taxpayers and ITC of IGST filed in ICEGATE.

Invoice details of less than 1000 documents can be viewed on the portal itself but if the documents are more than 1000, then taxpayers have to download the GSTR 2B auto-generated in JSON or Excel file format. Refer to the following to know how to view or download the GSTR 2B. continue through the page to learn how to download or view the GSTR 2B on the GST portal.

Step-by-Step Guide to Download & View GSTR 2B

Step 1

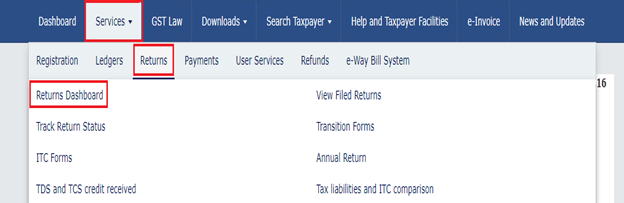

Go to the GST portal and log in with the updated credentials. Then select “services” and go to “returns” then select ‘returns dashboard”.

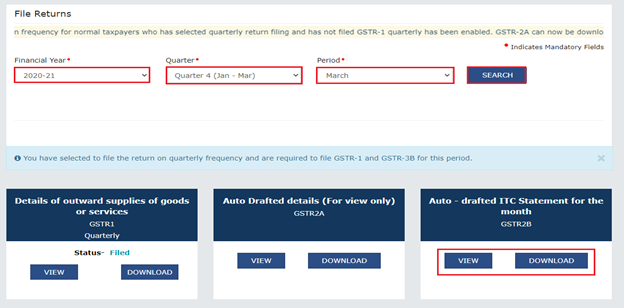

Then select the financial year for which you want to view or download the GSTR 2B, enter the quarter or month, and search.

There appear Several GSTR files in separate tiles, from there by clicking on “Auto-Drafted Statement for month GSTR 2B”.

Step 2

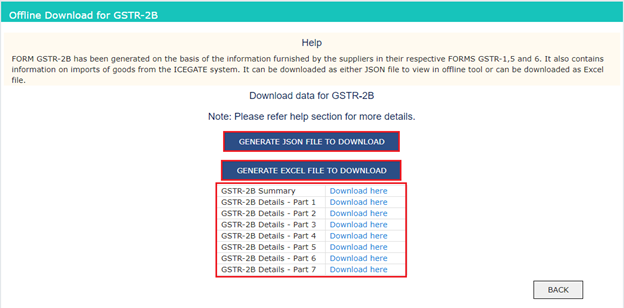

If the GSTR 2B form contains documents numbered more than 1000, then the taxpayers can download the file in Excel or JSON format.

You can click on the view button if the documents contained by GSTR 2B are less than 1000.

Step 3

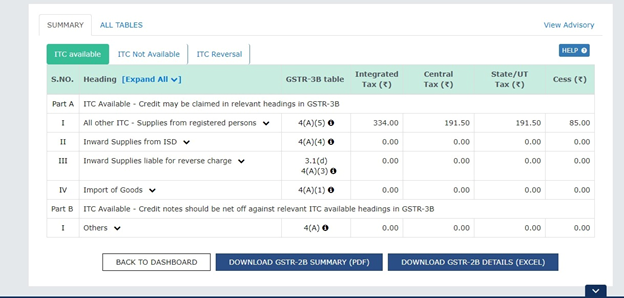

There are two options to view GSTR 2B one as a summary report and the other in table format. The ITC available, ITC not available and the ITC reversal have the following features

You can also view the summary of GSTR 2B on the GST portal. GSTR 2B also has an advisory on the portal for taxpayers. The advisory guides about the actions that can be taken in case of irregularities in data and documents.

Get Started with TaxDunia

For further help in filing the GST Returns and other taxation and finance-related services, let TaxDunia assist you with optimized solutions with a tech-driven approach. Everything is simplified by the unified efforts of TaxDunia’s dedicated team.