Cancellation of GSTIN for Migrated Taxpayers

The cancellation of GSTIN for Migrated Taxpayers can be either a voluntary action or a mandatory one. In the following cases, a taxpayer can apply for the GSTIN Cancellation. Here is a complete guide on how to cancel GSTIN for migrated taxpayers.

- In case the current GST rules do not apply to the existing registered persons or he business gets shut down, an individual can apply to request the cancellation.

- When legal heirs have used to cancel the registration in case of the death of the registered person or the GST Officer has issued a notice for the cancellation, then also the cancellation of the GSTIN for the Migrated Person is subject to review.

This article will guide you through everything so that you being a migrated taxpayer can proceed with the cancellation process of your GSTIN. Once the cancellation application is accepted, the registered person will not be liable to pay or collect GST, file GST Returns, and claim Input Tax Credit anymore. Under the Goods and Services rules, there is a provision that allows taxpayers to renew or get a fresh GSTIN again when such situations arise.

How to Cancel GSTIN for Migrated Taxpayers

Step 1

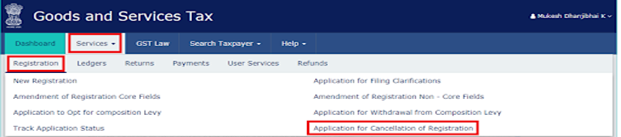

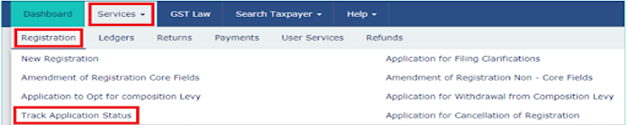

- Go to the official GST Portal and log in with username and email ID

- Now click on the “Services” menu and select “Application for Cancellation of Registration”

- There appear three sub-tabs in the “Application for Cancellation of Registration” option

Step 2

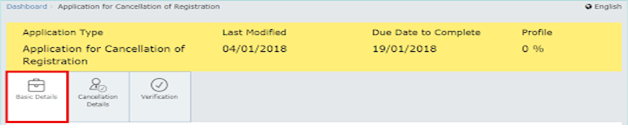

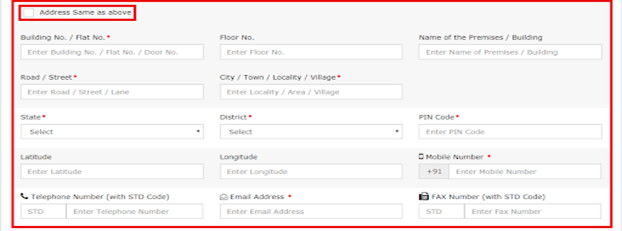

- From three visible options on the computer screen, choose “Basic Details” and there comes a pre-filled form containing the basic details of the taxpayer

- Only the “Address for Future Correspondence” or “Address Same as Above” option has to be chosen as per the case

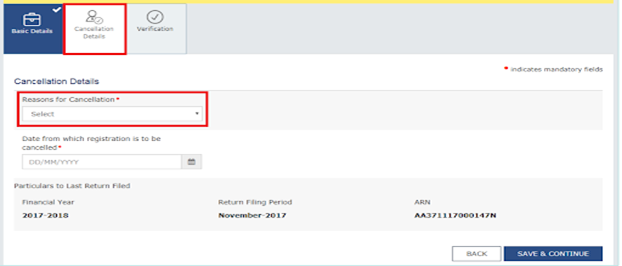

Step 3

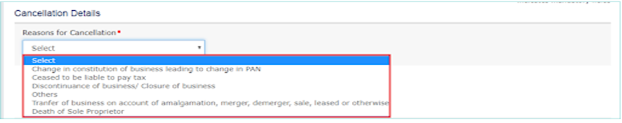

- Now comes “Reason for Cancellation” under which will appear several options to be selected from to proceed with the cancellation process. The following options appear for reasons for cancellation

- changes in the constitution of the business resulting in changes in PAN details

- select a date from which you wish to cancel GST Registration

- enter the transferee entity’s GSTIN and the system will auto-populate the trade name of the same

- ceased to be liable to pay tax

- enter the date on which registration is to be canceled

- details on the value of stock and tax liability

- details of tax liability to be offset by electronic cash ledger, credit ledger

- enter the amount to be deducted from the ledger and click on “save & continue”

- discontinuance of business/closure of business

- enter the date on which registration is to be canceled

- submit details on the value of stock and tax liability

- details of tax liability to be offset by electronic cash ledger, credit ledger, or both

- enter the amount to be deducted from the ledger and click on “save & continue”

- others

- mention the reason for cancellation first

- enter the date on which registration is to be canceled

- details on the value of stock and tax liability

- details of tax liability to be offset by electronic cash ledger, credit ledger

- enter the amount to be deducted from the ledger and click on “save & continue”

- transfer of business owing to leased, sale, merger, de-merger, or amalgamation

- reason for cancellation

- the date on which registration is to be canceled

- GSTIN of the transferee and “save & continue” to move on to the next and final step of the GSTIN cancellation for migrated persons

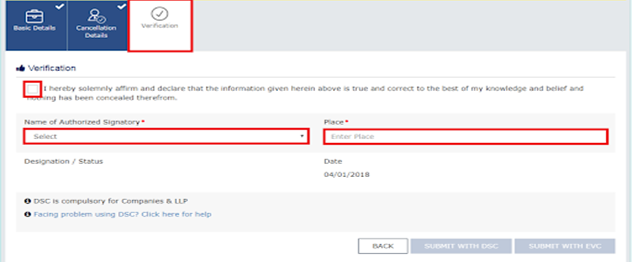

Step 4

- to verify the details, give your consent, enter the name of the authorized signatory and place information, and sign off using DSC for companies/LLPs or EVC for others

- the applicant will receive an OTP on the registered mail ID or mobile number to validate the application, enter the OTP, and the application for Cancellation of GSTIN for Migrated Taxpayer is done. Now track the status through the portal

If you are looking to get the cancellation done or want to have a fresh GSTIN, reach out to TaxDunia for a seamless experience and quick results. Our team of qualified professionals is ready to guide you at every step in the complex world of taxation.

FAQs

Can I again apply for GST Registration once I have got the registration canceled?

Yes, you can apply for the GST Registration even though you have got your previous GSTIN canceled. If such circumstances arise, you can apply through the GST portal.

What happens next when tax is payable on stock and the taxpayers have applied for the cancellation of the registration?

In the process of cancellation of registration, a taxpayer is liable to input the value of stock and ensuing liability. From the amount available in the ledgers or electronic credits, offset the tax payable.

In case of capital goods, a taxpayer is to pay the amount equal to the input tax credit availed on the capital goods.

How to initiate the GST Registration for the new GSTIN again?

The procedure for securing a new GSTIN again after cancellation is the same as the new registration. For it, you can reach out to TaxDunia.