Step-by-Step Guide to File GSTR 1

To report details of outward supplies of goods and/or services, taxpayers have to file GSTR 1. Every registered taxpayer excluding composition, ISD, TDS/TCS Deductors, and Collectors is required to file the GSTR 1. Normal taxpayers have to file this return on or before the 11th of each while QRMP taxpayers have to file this on or before the 13th of each quarter. This article highlights on the GSTR 1 Filing Procedure on GST Portal.

To file the GSTR 1 all by yourself, you must secure all the documents required to complete the process. Once you have secured the necessary documents (mentioned in another article on TaxDunia), follow the steps below to fill out the form online.

Step 1

Go to the official GST Portal and log in, then select “services” and click on “Returns dashboard”

Step 2

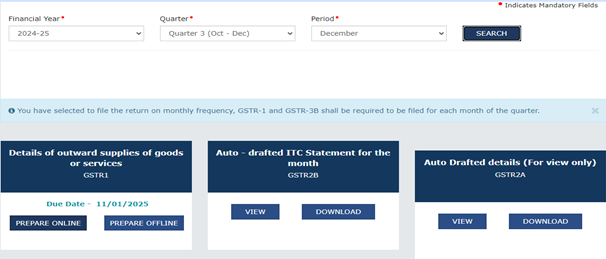

Select the financial year for which you are filing the returns and choose whether it is a quarterly or monthly return. And prepare the GSTR 1 online, prepare it offline if the sales invoices are more than 500.

Step 3

The e-invoicing details are auto-populated and they will be filled automatically by the GST Portal within two days. The further process includes several steps therefore begin with the B2B invoices.

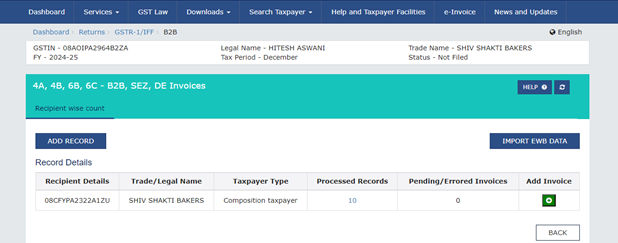

- 4A, 4B, 6B, 6C- B2B, SEZ, DE Invoice

- Click on “Add Record” to get legal name, trade name and GSTIN of the business

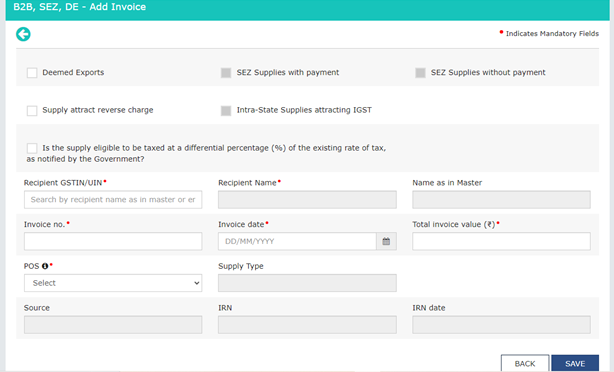

- Then choose a check box from Deemed Exports, SEZ Supplies with Payment, SEZ Supplies without Payment, Supply Attract Reverse Charge, and intra-State Supplies attracting IGST

- Once you enter GSTIN/UIN, other details such as name, POS, and supply Type will be auto-populated

- Provide other details for total invoice value and IRN and click on “save” to continue with the filing

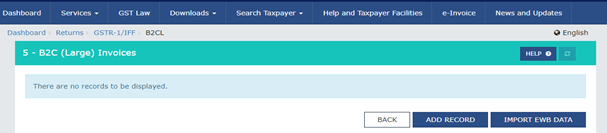

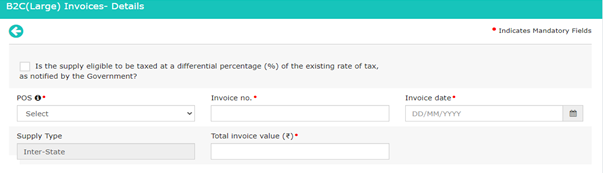

- 5 B2C Large Invoice

- Outward supplies and invoices valued more than RS 2.5 Lakh have to be entered in this section

- You will see a B2C Large Invoices Summary to add new, click on the “add record” section

- In the POS section, select the state where goods are delivered and the supply type will be auto-populated in the box

- Insert the taxable value of supplies, based on the type of transactions, CGST, SGST, and IGST will appear on the amount field and it will be auto-populated. Click on “save” and proceed further

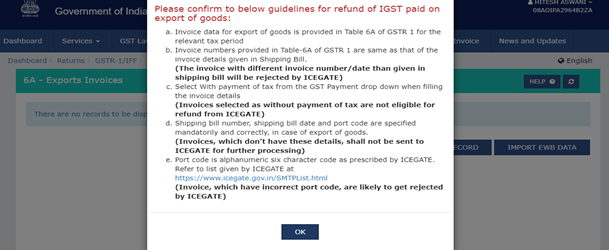

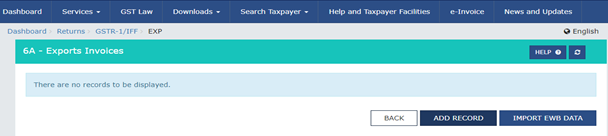

- 6A- Exports Invoices

- This section reports invoices of supplies exported

- To claim the refund of IGST, read the instructions and click on the “ok” button to proceed further

- Click on “add record” to add an export invoice or these details can also be retrieved through “Import EWB Data” e-way bills

- Enter the invoice number, shipping bill number, bill date, port code, and GST payment if paid

- Add the total taxable value, the system will auto-populate the IGST, click on “save” and proceed further

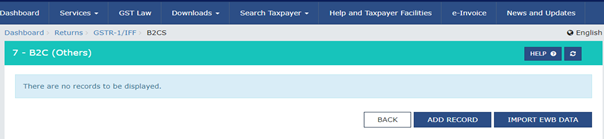

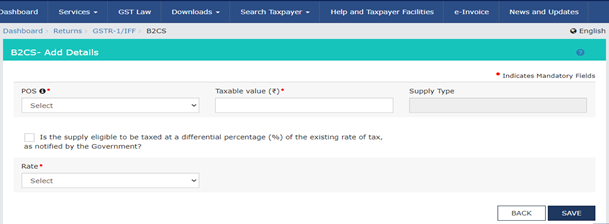

- 7 -B2C Others

- All invoices less than Rs 2.5 Lakh dealing in B2C supplies have to be entered in this section

- You can either click on “add record” to provide the details or choose to import the details through e-way bills by choosing “Import EWB Data”

- Now enter the place of supply where the goods are transported and the supply type will be auto-populated. Enter the taxable value and GST Rate if any other different rate is applicable. Save the page to reach further

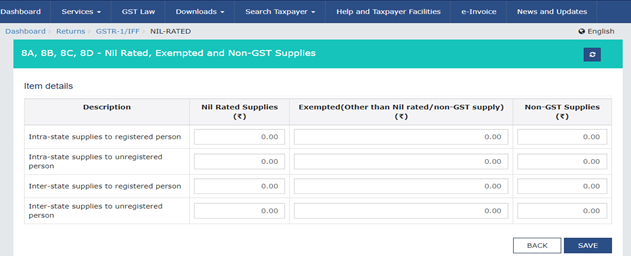

- 8A, 8B, 8C, 8D- Nil Rated, Exempted and Non-GST Supplies

- All nil-rated, exempted, and non-GST supplies made are to be reported under this section

- Now submit the inter and intra-state supplies for both registered and non-registered persons and save the page

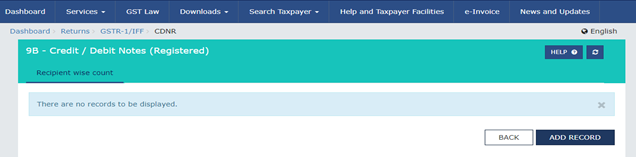

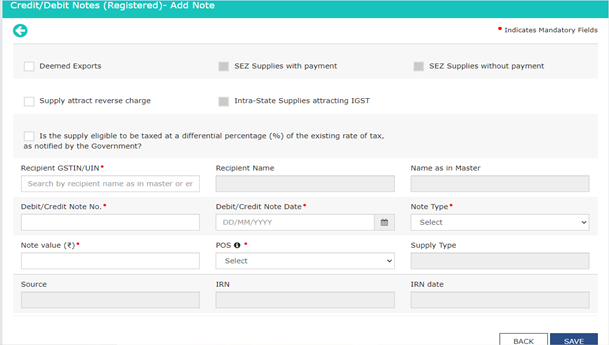

- 9B- Credit/Debit Notes Registered

- Click on “add record” to fill up the required details for the credit and debit notes for registered persons

- Select the type of entity and debit/credit note date and number, original invoice no, and taxable value of goods and place of supply, the supply type will be auto populated

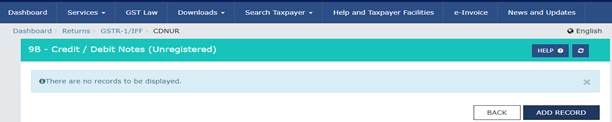

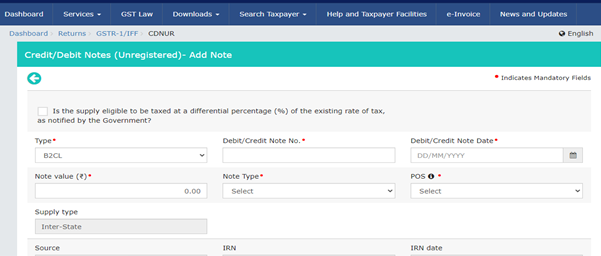

- 9B- Credit/Debit Notes Unregistered

- Click on the summary page to provide the details in 9B for credit and debit notes unregistered

- Select to add records to fill up the required information in the 9B tile in GSTR 1 form

- Now relevant type from the given options, enter debit, credit note no., date, reason for issuing note, and taxable value. The supply type will be auto-populated and the amount of tax will be calculated once you enter the taxable value. Save the page to move on

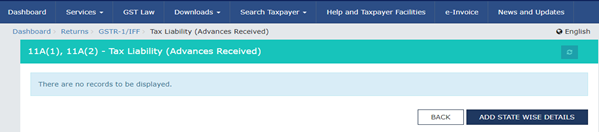

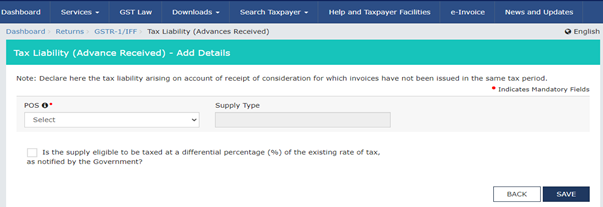

- 11 A (1), 11 A (2)- Tax Liability (Advances Received)

- Supplies for which advance is received but the invoice is not issued will be reported under this section

- Click on add state-wise details to available on the summary page

- Select place of supply and supply type is auto-populated. Enter gross advance, IGST, or CGST and SGST is auto-calculated. Save the page

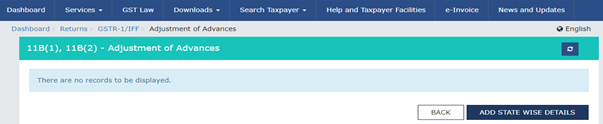

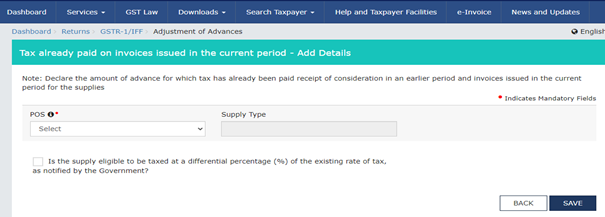

- 11 B (1), 11 B (2)- Adjustment of Advances

- All invoice details raised in the month which is return is being file but the advance is received in the previous month and the tax is already being paid, 11 B (1), 11 B (2) Adjustment of Advances tile is used

- Click on summary page to add details

- Fill the details described in the image below, the IGST or CGST/SGST will be calculated and save the page

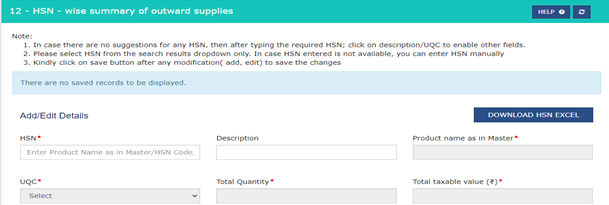

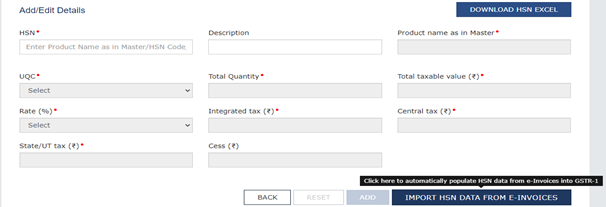

- 12 HSN Wise Summary of outward Supplies

- Go on the summary page and add the details

- All HSN details, descriptions, UQC, and IGST, CGST or SCGST details be mentioned or all these details can be imported from e-invoices

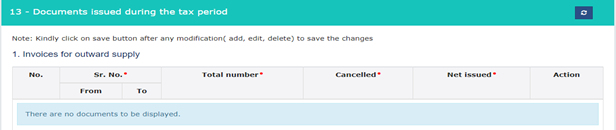

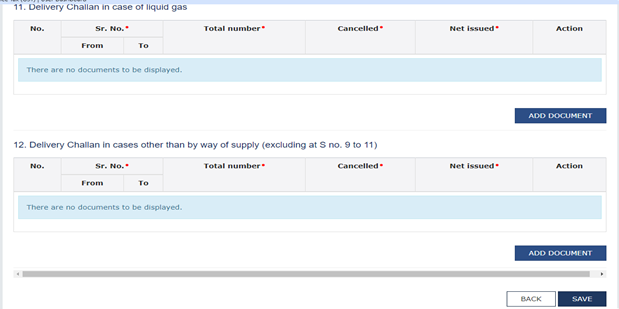

- Documents Issued

- All the documents issued in a month have to be reported in this section of the GSTR 1 form. This section contains 12 options and fills up the details one by one to proceed further

The tiles 14 and 15 are to be filled up by the e-commerce operators and the supplies on which an ECO is liable to collect tax have to be reported.

Save the GSTR 1 form on the system and submit the return either with DSC or EVC as per the requirements. A message for successful filing will be sent to your registered mobile number and mail ID.

Get Started with TaxDunia

The process described in the article might be a lengthy one and time-consuming as well. To meet the legal compliance and file the returns on time, you can choose TaxDunia to assist you. Our team of professionals will arrange all the documents and file them on your behalf so that you can save time and invest more on the business.