New GST Amnesty Scheme

The Indian government’s New GST Amnesty Scheme, which was made possible by Section 128A of the Central Goods and Services Tax (CGST) Act, 2017, is a big relief move meant to make it easier for taxpayers who still owe GST from earlier financial years to follow the rules. Starting on November 1, 2024, this plan will temporarily waive interest and fines on tax claims made under Section 73 of the CGST Act for cases that were not fraudulent and happened between 2017-18 and 2019-20. This in-depth summary talks about the scheme’s history, who is eligible, benefits, how to apply, new updates, and what this means for Indian taxpayers. File your due GST returns now.

Evolution of GST Amnesty Scheme

Since India started using GST in July 2017, a lot of people have had trouble following the rules on time, which has led to disputes, fines, and interest on taxes that were late or not paid at all. The government set up the GST Amnesty Scheme under Section 128A of the Finance Act, 2024, to settle old GST disputes and urge people to follow the rules on their own. One goal of the plan is to help people by waiving interest and penalties on unpaid GST bills in cases where the money was not stolen.

- Taxpayers should be able to pay off their debts without worrying about having to pay more money.

- Cut down on lawsuits and make it easier for tax officials to do their jobs.

- Get the GST set up in a format that is more stable and according to the rules.

- The plan is only for tax claims made under Section 73 (non-fraud cases) from July 1, 2017, to March 31, 2020. It includes FY 2017–18, 2018–19, and 2019–2017.

Important Things About the GST Amnesty Scheme

1. Coverage and Scope

- This rule applies to GST claims made under Section 73 of the CGST Act that are not fraudulent.

- Includes the years 2017–18 through 2019–20.

- Does not charge interest or penalties under Section 50 for these requests.

- Doesn’t apply to Section 74 situations where there was fraud, false statement, or hiding of facts.

- Cases where refunds were claimed wrongly or where appeals or writ petitions are still open and not withdrawn are not included.

2. Not having to Pay Interest or Fines

- If the main GST amount is paid in full by the due date, the plan waives all interest and penalties on the overdue amount.

- If interest or fines have already been paid, there will be no refunds.

- The waiver is only good for one time, and under the scheme, you can’t review the final order again.

3. Due Dates for Payments and Applications

- Last but not least, the tax bill must be paid in full by March 31, 2025.

- By June 30, 2025, the deadline for applications to waive interest and fines has passed.

- Before applying, taxpayers must drop any appeals or legal cases that are still going on that are linked to the dues.

4. Bringing Back the Input Tax Credit (ITC)

People can claim ITC for invoices or debit notes until November 30, 2021, according to Section 16(5) of the CGST Act. This is true even though the normal limit under Section 16(4) has already passed.

This helps people get back ITC that was taken away because they filed late or for some other technical reason.

5. Forms for Applying

Two forms must be used to apply for the scheme:

- GST SPL-01: For requests for waivers of warnings or statements.

- GST SPL-02: For requests for waivers linked to demand orders.

The GST portal is where the application is made, and taxpayers must add supporting documents and digitally sign the form.

Criteria for Eligibility

People must meet the following requirements to be qualified for the GST Amnesty Scheme:

- Section 73 says that the GST claim has to be raised in cases that are not fraudulent.

- By March 31, 2025, the main tax amount must be paid in full.

- No appeals or writ petitions should be ongoing; if there are any, they need to be withdrawn before the application can be made.

- The plan doesn’t work if the demand comes from wrong return claims or ITC claims that aren’t valid.

- Folks who have already paid fines or interest on their taxes cannot get those amounts back.

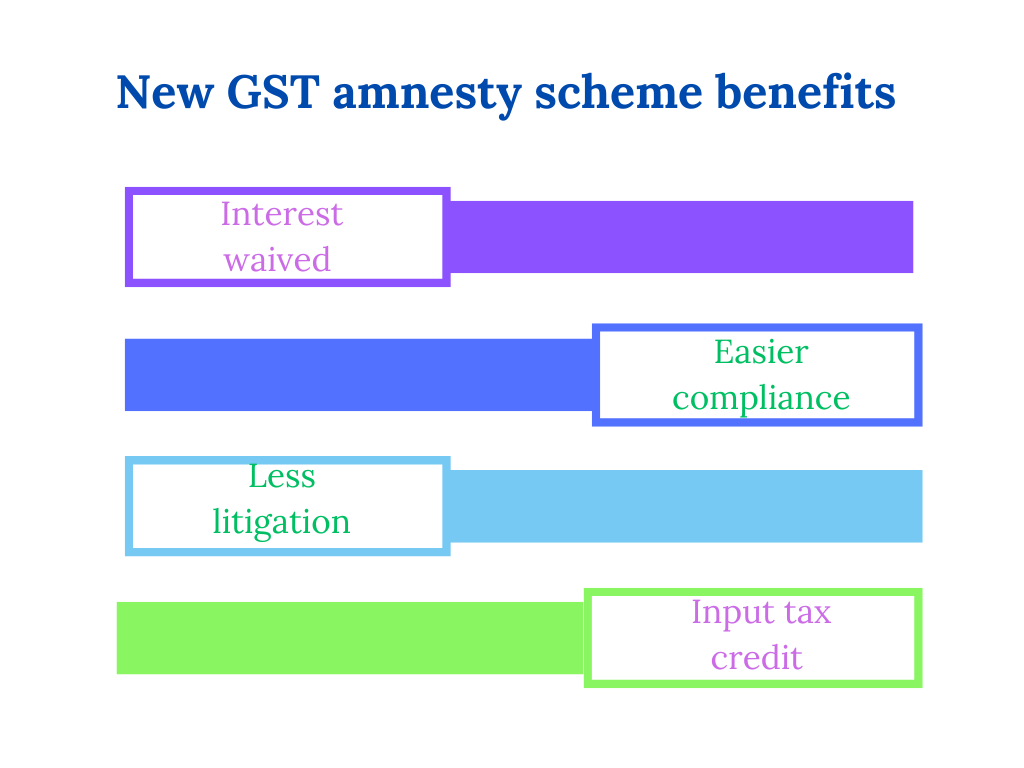

Pros of the GST Amnesty Scheme:

For a full list of the scheme’s benefits, see below:

1. It saves money

Waiving interest and fines makes it a lot easier for taxpayers to pay their taxes.

Allows businesses to pay off old GST debts without having to pay extra, which improves their cash flow and financial security.

2. Made compliance easier

It tells people that they can get back to complying with GST by paying off their debts.

Lowers the chance of future lawsuits and fines.

3. Less litigation

Taxpayers can avoid long court battles by dropping pending appeals and paying their bills.

The plan helps settle disagreements and makes things easier for tax officials.

4. Getting ITC Back

The ITC was brought back for eligible invoices until November 30, 2021. This helps taxpayers get back input credits that they were refused before, which improves their working capital.

5. Made more people eligible

The scheme can help people who have already paid their taxes through GSTR-3B before November 1, 2024. This makes the scheme more useful.

How to Use the GST Amnesty Scheme Step-by-Step

Step 1: Find eligible cases

Have a look at the GST requests made under Section 73 for the years 2017–18 to 2019–20.

Make sure the case isn’t a fraud and that there aren’t any claims that are still open.

Step 2: Pay any last-minute tax bills.

By March 31, 2025, you must pay the full amount of the capital tax.

According to CGST rules, payment can be made with a cash register, ITC (if applicable), or both.

Step 3: Drop any pending appeals

Take back any appeals or writ petitions that have to do with the claim.

Along with the release application, you must send proof that you are withdrawing.

Step 4: Fill out the online waiver application

- Go to the GST site and log in.

- Go to “Services,” “User Services,” and “My Applications.”

- To apply for the waiver scheme under Section 128A, click on it.

- Depending on the type of demand, pick the right form (SPL-01 or SPL-02).

- Upload up to five supporting papers, each of which can be up to 5 MB in size.

- Use a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC) to apply.

- An ARN (Application Reference Number) will be made when the form is successfully sent.

Step 5: Wait to be approved

- The entry will be checked by the right officer.

- Interest and fees will not be charged once the loan is approved.

- The order made under the plan can’t be changed or appealed in any way.

Recent Changes and Clarifications

On March 27, 2025, the Central Board of Indirect Taxes and Customs (CBIC) released Circular No. 248/05/2025-GST, which made some important points clear:

- People who paid GST through GSTR-3B before November 1, 2024, can join the plan, but they will have to be checked out first.

- Appeals can be partially withdrawn if they cover both qualified and ineligible periods.

- As long as a notice or order covers some of the amnesty period and periods after it, taxpayers can ask for amnesty after paying their taxes for the amnesty period.

- You can’t get back interest or fines that you paid before March 26, 2025.

- Changes to Rule 164 of the CGST Rules make it clearer how to apply for the plan and how to pay for it.

What This Means for Taxpayers in Real Life

- Taxpayers who have old GST disputes should quickly check to see if they are eligible and pay their bills before March 31, 2025.

- Expert help from GST experts or companies like Taxdunia can help make sure that the right paperwork is filed and that the rules are followed.

- To keep their applications from being turned down, businesses should keep good records and proof of payment and review withdrawals.

- The plan is a unique opportunity to eliminate old GST debts and focus on future compliance without worrying about penalties and interest.

Get Started with TaxDunia

The New GST Amnesty Scheme, part of Section 128A of the CGST Act, is a groundbreaking plan to settle old GST disputes by not charging interest or fines in cases that were not fraudulent from FY 2017-18 to 2019-20. The scheme encourages taxpayers to regularize their GST compliance by giving them a clear framework, deadlines, and easier processes. This lowers litigation and improves their financial health. Taxpayers must quickly pay any back taxes by March 31, 2025, and send in waiver requests by June 30, 2025, to get the most out of this help. Reach out to TaxDunia to get started today and avail optimized services.