Home » Get Your Business Registered

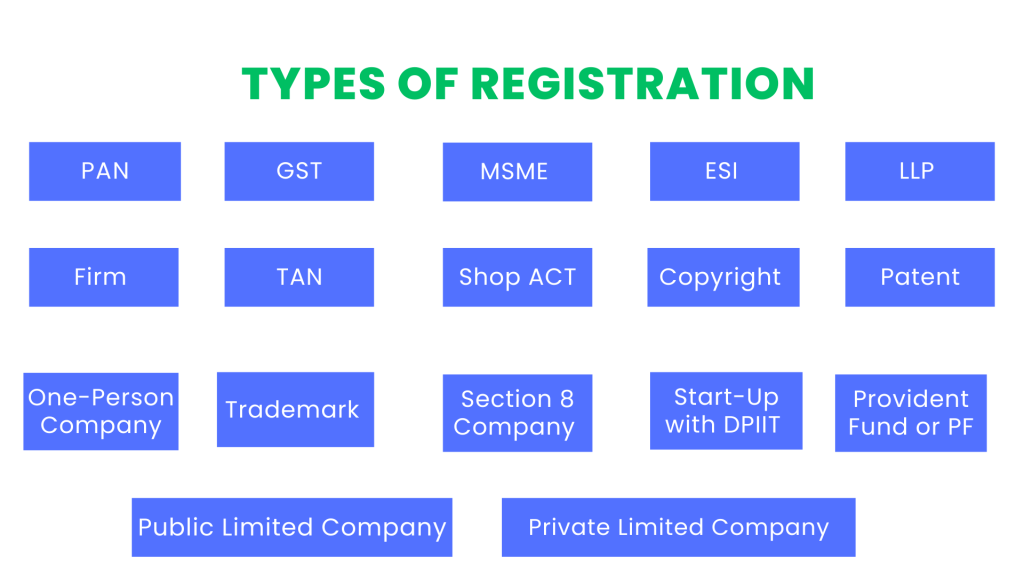

Registration is mandatory to start any business to ensure compliance with the rules and regulations in India. A business can be registered under several categories depending on various other factors. Each registration provides distinct benefits including government subsidies, lower tax rates, credibility, ease of fundraising, perpetual succession, limited liability, and more. TaxDunia facilitates businesses to get registered under the government and, therefore use the services from the comfort of your homes.

It is a 10-digit alphanumeric number issued by the Income Tax Department. PAN Card is used for easy retrieval of information from the cardholder. Authorities use the card to match investments, borrowings, and other business activities. A PAN Card is mandatory under the following circumstances.

The Goods Services Tax or GST eliminated previous indirect taxes and the cascading effect on the taxpayers. Businesses with total annual earnings exceeding Rs 20 lakh or Rs 10 lakh (North Eastern States) have to be registered under the GST. There are several tax slabs under GST and goods and services are taxed accordingly. GST Registration is important to claim Input Tax Credit and continue the business. The registered businesses become eligible for several government schemes and comparatively lower tax rates.

The PF is a contributory savings scheme under the Government of India that provides financial security and retirement benefits to employees. Businesses with employee strength of 20 or more need to be registered under the PF. It protects employees and offers them social security with pension and adequate insurance coverage. Employees enjoy retirement savings, pension, insurance and tax benefits, and emergency withdrawals under the provident fund.

To establish a business as a legal entity, businesses can opt for Public Limited Company Registration. Companies have to have at least 3 directors and a maximum of 15 directors to set up a company as a public limited one. Through registration, it becomes easier to enter into contracts, acquire finances, and diversify the business. It facilitates companies to enter the share market and start an IPO.

Businesses registered as LLPs have features of both partnerships and corporates. Partners or shareholders of such businesses have limited liability. LLP registration provides businesses a separate legal entity status reducing the risk for individual partners. It benefits by offering legal recognition, flexible management, limited liability, tax benefits, and ease of fundraising. It is not mandated under the laws to be registered as LLPs but it offers aforesaid benefits.

Businesses or taxpayers who deduct tax at source or TDS and collect tax at source or TCS on payments of salaries, interest, dividends, etc. are required to have a TAN. It is mandatory under TDS compliance therefore to avoid being penalized, and manage tax effectively, get a TAN.

This registration aims to boost new and innovative businesses that have been set up in the past 10 years and have an annual turnover of less than Rs 100 Cr. Start-up registration with DPIIT enables businesses to avail of certain government schemes and benefits, and tax exemptions. To provide much-needed support to new businesses that also contribute to the growth of the economy. DPIIT offers opportunities for networking and collaboration. Start-ups become eligible to seek fast-tracking of intellectual property rights protection.

To shield the rights of laborers in shops, commercial establishments, go-downs, storerooms, warehouses, or similar places, the government introduced the Shop Act Registration. It controls the workings of the unorganized sector. After commencing the business, shops or other establishments have to be registered as the Shop Act Registration. It highlights the provisions of working hours, wages remunerated and others applicable to the shops and commercial establishments.

Whenever a single person is looking forward to establishing a registered company in India, they can opt for the One-Person Company Registration. It has aspects of both sole proprietorship and limited liability. OPC lays down a framework to operate a company legally in the country. OPC registration results in easier borrowing of capital, enhanced credibility, simplified operations, and government support.

Companies Act 2013 mandated the Section-8 Company Registration for entities. To promote charitable, religious, scientific, literary, or educational objectives, this act was formed. Section 8 registered companies do not work for profit and do not distribute the profits among their members or directors. Such companies use all the profits to achieve social objectives not accrue personal gains. It does not require shareholders as active members to run the company.

Enterprises classified as micro, small, and medium can be registered under the Government of India as MSMEs. The annual turnover of MSMEs ranges from Rs 1 Cr to Rs 500 Cr as per budget 2025. To save lots of taxes and other government benefits and subsidies, MSME registration can be obtained.

The Ministry of Labor and Employment operates the Employee State Insurance Scheme which provides security to employees working in organizations or establishments. If such organizations or establishments have more than 10 employees have to get the ESI Registration. As per the current norms under the ESI, an employer contributes about 3.25% of the monthly wages while the employees contribute about .75%.

To enjoy a separate legal identity status, businesses can be registered as private limited companies. Such companies consist of a minimum of 2 partners while the maximum number could be 200 as per Indian laws. There is restricted entry of partners and minimum capital has to be managed. To reap benefits like fundraising, limited liability, and reduced risk of individual shareholders, register the business as a private limited company.

To incorporate and set up as a legal entity in India, Firm Registration is very important. Lower tax rates, government incentives, and exemptions are available for registered firms. It boosts investors’ confidence, access to government schemes, and firm registration is one of the options available right here.

To protect brand identity, exclusive rights, and consumer trust, trademark registration is important. A trademark is any sign, symbol, word, phrase, logo, or combination that distinguishes goods or services from those of others. The Controller General of Patents, Designs, and Trademarks regulates the process of trademark registration.

To protect the original works of authors and creators such as literary, artistic, musical, and dramatic, copyright registration is required. It is available for both published and unpublished works and it offers exclusive rights to use, reproduce, distribute, and adapt the registered works.

A patent is an intellectual property right granted to an investor to exclusively use, make, or sell a new and useful invention for a certain number of years. Patents can be issued to machines, chemical compositions, processes, or new forms of materials and plants.

To get the business registered under the Government of India and use benefits, reach out to the dedicated and experienced team of TaxDunia. Our personalized solutions lay a roadmap for your business so that you can give the business the due recognition. We assist our clients from the beginning to the completion of service and ensure successful results.

TaxDunia is one such destination where you can have a seamless experience in the domains of Taxation & Finance. Ensure that a well-versed team of CAs handles your Taxes.

By continuing past this page, you agree to our Terms of Service, Cookie Policy, Privacy Policy, and Refund Policy of Paperless Rack Digital Solutions Private Limited. All rights reserved.