TDS on NRIs under Section 195

Section 195 of the Income Tax Act 1961 deals with the legal provisions for individuals or companies making payments to foreign companies or NRIs. Under this section, eligible persons have to deduct tax at the source before making the payment to NRIs. Transaction details of such NRIs and their collective parties are submitted through Form 15CA and 15CB. This blog has included all details on section 195, applicability, taxability, and other aspects as well.

What is Section 195?

To prevent double taxation of foreign-residing Indian nationals, a separate provision was added. It has specified the rates of TDS deduction and the time when it is to be deducted.

The TDS can either be deducted at the time of crediting payment to the non-resident account or when the actual payment is made.

A person meeting the following criteria is considered a non-resident Indian for TDS purposes.

- If they have stayed in India for 182 or more days in any given financial year, they are not NRIs but resident Indians

- In case they have stayed in India for 60 or more days in a financial year and have stayed 365 days or more in the immediately preceding four financial years

Indian citizens or persons of Indian origin who have a total income, excluding foreign sources exceeds Rs 15 lakhs in a FY, then the

- The 60-day threshold is increased to 120 days

- And if Indian citizens left India for employment outside the country, the 60-day threshold is increased to 182 days

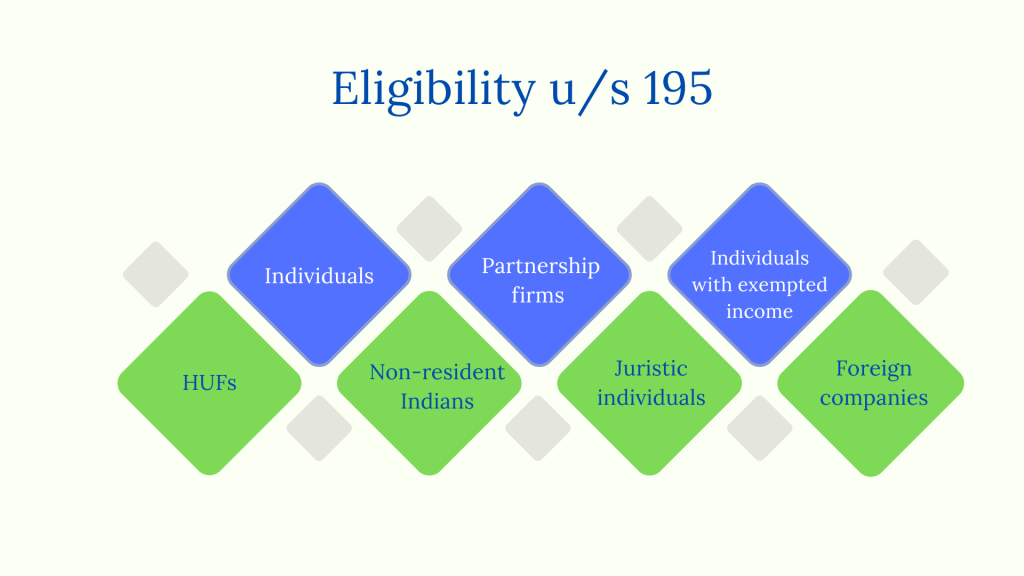

Who can deduct TDS u/s 195?

The following entities are considered for TDS deductions under the aforesaid section of the Income Tax Act

- Individuals

- HUFs

- Partnership firms

- Non-resident Indians

- Individuals with exempted income in India

- Juristic individuals

- Foreign companies

Rates of TDS for NRIs

The rates of TDS largely depend on the source of income and therefore vary a lot. The rates below attract additional surcharge and education cess at the rate of 4% in case of deduction as per the relevant finance act. The following are some of the rates on different sources of income

| Type of Income | TDS Rates |

| Payments, income, or transactions arising from investments | 20% |

| Interest to be paid on the sum of money availed in a foreign currency | 20% |

| Income accrued from long-term capital gains | 10% |

| Income accrued from capital gains acquired in the long term under section 115E | 10% |

| Long term capital gains form listed shares and securities referred to in section 112A | 12.5% |

| Other sources of long-term capital gains | 20% |

| Earnings generated from capital gains acquired in the short term (section 111A) | 15% |

| Earnings from technical services paid by an Indian citizen or the government | 10% |

| Earnings from the royalty paid by an Indian citizen or the government | 10% |

| Income from royalties earned from sources other than an Indian resident or the government | 10% |

| Income from other sources and winnings from card games, lotteries, crossword puzzles, and other games of any sort, horse races, and online games | 30% |

Though it is to be noted that the deduction rates are determined in one of the following ways. The lesser of these two is deducted to benefit the payee.

- Rates as per the Finance Act of the given year

- Rates contained in the Double Taxation Avoidance Agreement (DTAA) between India and the country of residence of such non-resident. No additional surcharge or education Cess is applicable in case of DTAA

There is no threshold limit for TDS deduction as per section 195, provided that the payment made to a non-resident is considered taxable in India.

How to Deduct TDS u/s Section 195?

Follow the steps to deduct TDS on the payments made to non-residents

- Anyone making the payment to the NRI must have to obtain a TAN (Tax Deduction and Collection Account Number) as mandated under section 203A

- The Deductor also has to have the PAN of the NRI as well

- The TDS is to be deducted at the time of making the payment

- And the deducted amount is to be deducted through a challan on or before the 7th of the next month in which the TDS is deducted

- Or the TDS can be deposited online or through the banks authorized by the government or the department

- After the TDS deposition, Form 27Q has to be filed by the buyer

Quarterly dates for TDS filing

| Quarter | Due Date for Filing |

| Q1 April to June | 30th July |

| Q2 July to September | 31st October |

| Q3 October to December | 31st January |

| Q4 January to March | 31st May |

After the buyer has deducted the TDS, they have to issue a TDS certificate or tax deduction certificate in form 16A to the NRI. And it is to be issued to the seller within 15 days from the due date of TDS returns for the quarter.

Consequences for Not Complying u/s 195

If the buyer does not deduct the TDS or it is deducted but not submitted to the authorities, the parties must bear several negative consequences.

- Expenditure will be disallowed, and will be allowed only in the year of such payment if TDS is not deducted or submitted

- In case of failure of submission, though deducted, the payer will be charged interest at the rate of 1.5% on the total amount from the date of deduction to the deposit date

Reach out to TaxDunia to file your TDS returns and avoid such negative consequences. They pose a significant harm to your business. Utilize our customized services and ensure a continued and consistent growth for your business.