How to File GSTR 8 on the GST Portal

Every e-commerce operator who makes supplies and collects TCS has to file the GSTR 8 monthly. In the tax period when no TCS is collected and no supplies recorded, the operator need not compulsorily file the return. File the form with utmost caution as it is amended only when the supplier has not taken any action yet or removed the record due to errors. This is a complete guide for you to learn how to file the GSTR 8 on the online GST portal by yourself.

Step-by-Step Guide to File GSTR 8

Step 1

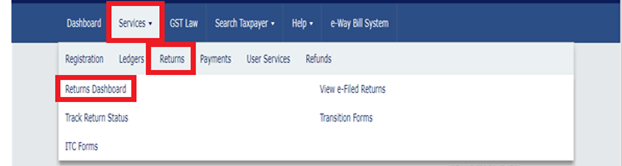

Go to the GST portal and log in with valid credentials to the portal, from the returns dashboard, prepare the return online or offline

Step 2

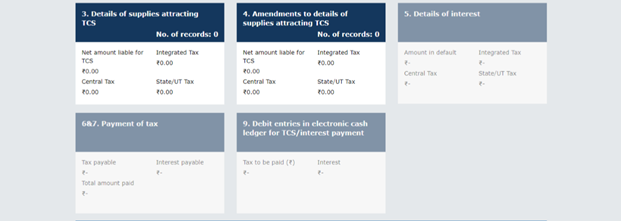

From the below tiles choose one by one and keep filing the information on

- Details of supplies attracting TCS

- Amendments to details of supplies attracting TCS

- Details of interest if applicable

- Payment of tax

Step 3

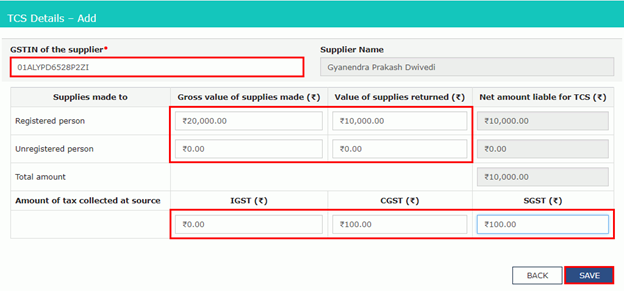

Enter the respective details on the following tile to proceed further

Step 4

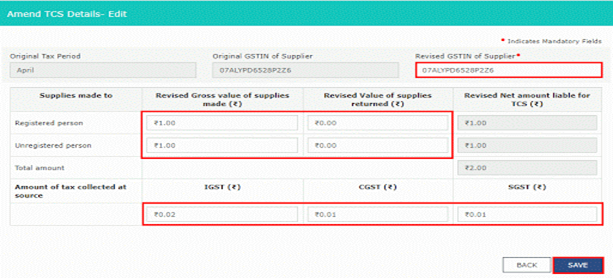

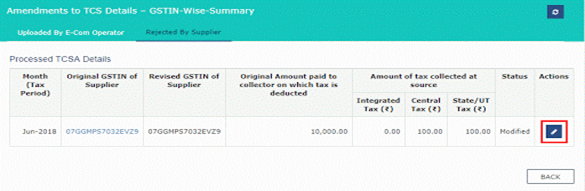

In the following section, you can enter “amendment to details of supplies attracting TCS”. Such details can be amended in two scenarios.

- When the records uploaded by the e-commerce operator have been incorrect for the earlier tax period

- When the supplier has rejected certain transactions or he has modified

Step 5

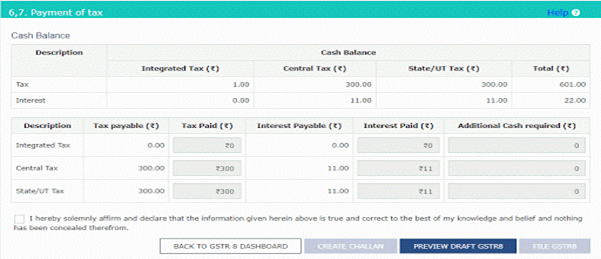

Once you have completed the 3rd and 4th tile, requirements in the 5th and 6th will appear for interest payable and payment of tax. A delay in the payment of TCS liability attracts interest.

Ensure that you have verified the form before submitting it to the portal. Applicants can use either a digital signature certificate for an authorized signatory or an electronic verification code.

It takes a lot of time to submit GST and ITR returns on the respective government portals. TaxDunia offers online services related to taxation and finance. Our team has more than 15 years of experience in the Indian marketplace and has dealt with both old and new tax regimes. We file ITR and GST returns at affordable rates. Reach out to us today to start availing services.