Provisions for Late Filing Fees of ITR under Section 234F

Section 234F was added to the Income Tax Act through the finance bill 2017, though the provision came into effect from the assessment year 2018-19. This section addresses the penalties and late fees imposed on taxpayers who fail to file their Income Tax Returns on or before the due date or within the stipulated timeframe. It was introduced to promote transparency in taxation and set stricter compliance criteria. To avoid paying hefty amounts of money as penalties and fees due to negligence, taxpayers need to know all the provisions described in Section 234(F). The article contains details on existing penalties, eligible parties, and the further scope of this particular section.

Applicability of Section 234F

The following entities are covered under this section

- Hindu Undivided Families

- Association of Persons (AOPs)

- Firms

- Companies

- Indian Citizens with Taxable Income

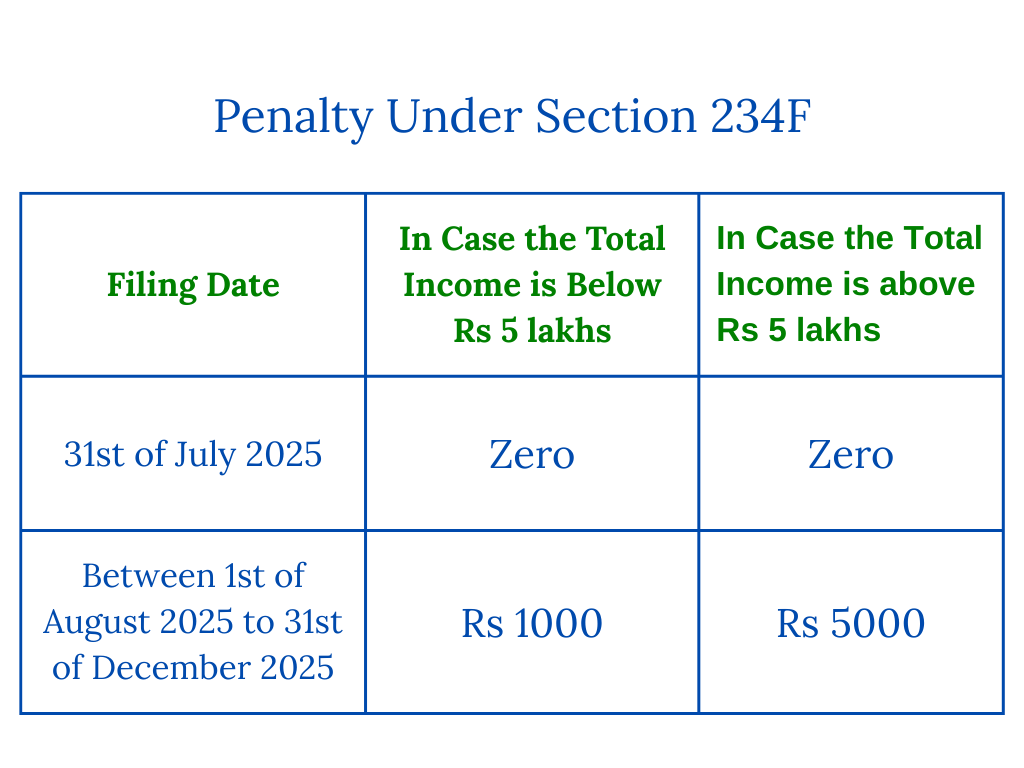

Penalties under Section 234F for late ITR Filing

A maximum penalty worth Rs 5000 is imposed on taxpayers who file their ITRs after the due deadline. The more the filing ITR is delayed, the higher the penalty amount gets.

For the financial year 2024-25, if taxpayers have filed their ITR before the 31st of July 2025 (30th of September 2025 for audit and 31st of October 2025 for transfer pricing cases), they have no penalties, as ITRs are filed in the stipulated timeframe.

In case the total income of taxpayers is not more than Rs 5 lakhs, they get some relief from the authorities as the penalty amount is reduced maximum of Rs 1000.

| Filing Date | In case the total income is below Rs 5 lakhs | In case the total income is above Rs 5 lakhs |

| 31st of July 2025 | Zero | Zero |

| Between 1st of August 2025 to 31st of December 2025 | Rs 1000 | Rs 5000 |

In case taxpayers have not filed the ITR till the 31st of December for a particular financial year, they are liable to pay Rs 10000 as the penalty. There is no penalty payable or imposed when the total income in a financial year is less than Rs 2.5 lakhs (the basic exemption limit under the old tax regime). Under the new regime, the basic exemption limit is Rs 4 lakhs.

Important ITR Filing Requirements

Under the following circumstances, you need to file an ITR

Age-specific criteria- if you are below 60 years of age and the total annual income is Rs 2.5 lakhs (under old tax regime) and Rs 4 lakhs under the new tax regime applicable from the assessment year 2026-27

- The basic exemption limit for senior citizens (aged between 60 and 80) under the old tax regime is Rs 3 lakhs

- And for super senior citizens (aged above 80 years) is Rs 5 lakhs in old tax regime

Under the new tax regime, the basic exemption limit for taxpayers aged below 60, senior citizens, and super senior citizens is Rs 4 lakhs, with no specific limits per age.

Tax rates are higher under the new tax regime, but there are various options available for deductions and exemptions. Whereas in the old tax regime, rates are comparatively low still exemptions and deductions are not much. You can choose prudently whether to stick to the old tax regime or switch to the new as per the case.

Bank Deposits- if bank deposit is higher than Rs 1 Cr

International Travel Expenses- If international travel expenses are higher than Rs 2 lakhs in the previous financial year

Professional Gross Receipts- if gross receipts from profession exceeds Rs 10 lakhs in the previous FY

TDS/TCS Receipts- if TDS/TCS receipts amount to more than Rs 25000 for taxpayers aged below 60 and Rs 50000 for senior citizens

High Savings Bank Deposits- if total deposits in one or multiple savings bank accounts exceed Rs 50 lakhs

Why Pay ITR Before the Due Date?

- If you have not filed your ITR before the stipulated due date, then you have to pay interest at the rate of 1% on the total payable tax amount as per section 234F. The interest will start from the date immediately after the due date

- In case you have to carry forward losses under head capital gains or losses in your business, you are unable to do that just because you have missed filing the ITR before the due date

- When you are to receive a refund from the government, then you have to make sure that you have filed your ITR before the due date to ensure securing smooth refunds

Get Started with TaxDunia

Section 234F of the income tax act deals with the penalties and fees paid on the late filing of ITR. To ensure smooth compliance, reach out to the team at TaxDunia. We will handle all your paperwork so that you can focus on the core business.