How to File GSTR 9 on the GST Portal?

To consolidate annual returns, taxpayers who have already filed GSTR 1 and GSTR 3B can file GSTR 9. GSTR 9 is used to report the outward and inward supplies made and received during a financial year. Every taxpayer or business must file the annual return through GSTR 9 except those whose annual turnover is less than Rs 2 Cr; for such a business, it is optional to file.

The system auto-populates some of the details in this annual return from GSTR 1 and GSTR 3B. Keep up with the article to learn how to file the GSTR 9 on the GST Portal online.

What Details Are Auto-Populated in GSTR 9?

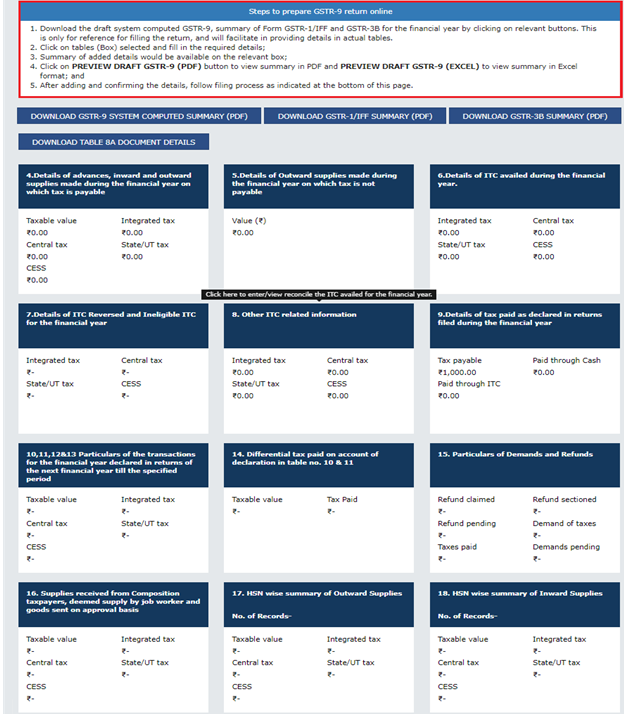

Details from GSTR 1 and GSTR 3B are auto-populated in the annual return GSTR 9. Table 6A is auto-populated from the GSTR 3B, while Table 8A is auto-filled based on the details on GSTR 2B. These auto-populated details are not editable; therefore, do not make any errors. All the following details are available in ZIP format on the GST Portal once you have logged in to the website

- GSTR 3B summary for all tax periods

- GSTR 1/iFF summary for all tax periods

- Table 8A document details of form GSTR 2A

What Details to Report Through GSTR 9?

- Details of advances, inward and outward supplies made during a financial year on which tax is payable in Table 4

- Outward supply details on which tax is not payable in Table 5

- ITC availed during a financial year in Table 6

- Details of ITC reversed and ineligible ITC and other related information in Tables 7 & 8A

- Tax paid as declared in returns filed in Table 9

- Details of the previous financial year’s transactions reported in the next financial year in Tables 10, 11, 12, & 13

- Differential tax paid on account of declaration in Tables 10 & 11

- Demands and refunds in Table 15

- Supplies received from composition taxpayers, deemed supply by job workers, and goods sent on an approval basis in Table 16

- HSN-wise summary of outward and inward supplies in Tables 17 and 18

- Late fee if applicable and liabilities in Table 19

Step-by-Step Guide for GSTR 9

Step 1

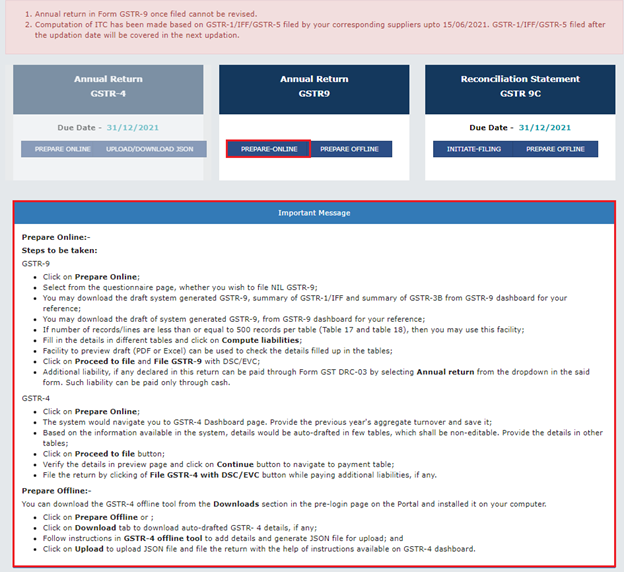

Go to the GST Portal and log in with the credentials. Click on the “Returns Dashboard” and select “Annual Return” then select the financial year and file annual returns. You can file the return either offline or online.

Step 2

Now to provide the above-mentioned information, click on the respective tiles and keep editing the data as per the documents. GSTR 1 and GSTR 3B details auto-populate when details of advances and outward and inward supplies, when tax is payable, are required.

If the current details vary +/- 20% from the auto-populated, then a confirmation message will pop up on the screen. If you agree with the auto-computed data, continue filing if not then edit it.

Taxpayers can download the GSTR 9 in Excel or PDF format to prepare it. Make the changes if required and regenerate the draft.

Step 3

There is an option available on the computer screen when you are filing the returns to compute the liabilities. Before proceeding further pay the late fee if you have made delay filing the annual return and clear other liabilities.

You can clear the liabilities and late fees from the balance available in the electronic cash ledger. If the cash ledger lacks balance, then the taxpayer can pay the remaining liabilities from other payment modes such as net banking or by creating a challan.

Until the liabilities are cleared and late fees are paid off, a taxpayer cannot proceed further to file the GSTR 9 annual returns.

Step 4

Before filing the form finally, review the return and check if all the details you have filled and auto-populated are correct and match the current data. Once submitted, the file is not editable therefore review it before final submission.

Select the authorized signatory check box and continue with filing the annual return either with DSC or EVC as per the case.

Once submitted, taxpayers will receive an Acknowledgment Reference Number on the registered mobile number and mail ID.

Taxpayers can choose to file DRC-03 to make payment for any additional liabilities. Once GSTR 9 is submitted, you cannot revise the return.

Get Started with TaxDunia

Filing returns and meeting the compliances are quite time-consuming. Taxpayers may end up wasting a lot of time due to the rigorous process of filing. To avoid all this chaos and ensure a smooth flow in day-to-day business activities, choose TaxDunia as your reliable partner. Our highly educated and experienced team is a call away to provide you with personalized solutions.