HUF or Hindu Undivided Family

HUF, or Hindu Undivided Family, is a legal and tax entity in India. Hindu, Jain, Buddhist, and Sikh families can pool their assets to form a HUF and save more on taxes. It basically reflects the concept of a joint family, which includes members from different generations and paying taxes as a separate legal entity. HUFs own a separate PAN card and file their income tax returns independently of their members. HUF is considered one of the most effective ways to save taxes for joint families. This article highlights all the details on HUFs and taxability for the legal entities.

Who is an HUF?

- A separate legal entity that files ITR independently of their members

- Headed by a “Karta” (a member of the family)

- HUF assets include gifts, ancestral property, proceeds from the sale of joint family property, and property that’s acquired through a will

- Hindu, Jain, Sikh, and Buddhist families

- Husbands, wives, children, offspring, or spouses eligible for inclusion into HUF (members either born in the family or included through marriage)

- And these members are coparceners

Daughters as coparceners were added on the 6th of September 2005, and they have the right to partition. A daughter of a coparcener will become a coparcener herself in the same manner as the son.

How HUFs are Taxed?

An HUF pays the taxes at the same rates as an individual, and its members can take out an insurance policy. It has a separate PAN card and files returns separately and can claim deductions under Section 80 and other exemptions.

HUF can make investments, and these are taxable in the hands of the HUF. They are eligible to pay salary to its members if they are contributing to its functioning. The salary expenses can be deducted from the income of the HUF. Refer to the table below to understand it better

| Parameter | Ria’s Income before HUF formation ₹ | Ria’s income after the formation of HUF ₹ | HUF income of ₹ |

| Salary | 40,00,000 | 40,00,000 | – |

| Rent from house property | 10,00,000 | – | 10,00,000 |

| Deduction on house rent (30%) | 3,00,000 | – | 3,00,000 |

| House rent income | 7,00,000 | – | 7,00,000 |

| Total taxable income | 47,00,000 | 40,00,000 | 7,00,000 |

| Deductions under section 80C | 1,50,000 | 1,50,000 | 1,50,000 |

| Net taxable | 45,50,000 | 38,50,000 | 5,50,000 |

| Tax payable | 10,55,000 | 8,45,000 | Nil |

Tax is calculated based on the income tax slabs applicable till the assessment year 2025-26. The amount of payable tax may vary when calculated based on the latest tax regime.

Now, the difference is evident when a taxpayer chooses to pay tax as an individual versus under a Hindu Undivided Family (HUF). Paying taxes under HUF saves a lot of taxes; therefore, switch to HUF if you meet the eligibility criteria of being an HUF.

Residential Status

- Resident- an HUF is a resident of India if the affairs are controlled or managed wholly or partially in India

- Non-resident- if the control or management is situated wholly outside India

Resident and ordinarily resident

The Karta of the resident HUF has been in India for at least 2 years out of the 10 years preceding the financial year and has been a resident in India for 730 days or more during the 7 previous years preceding the relevant financial year.

If both of the above conditions are not met, then the Karta would be a resident but not an ordinarily resident.

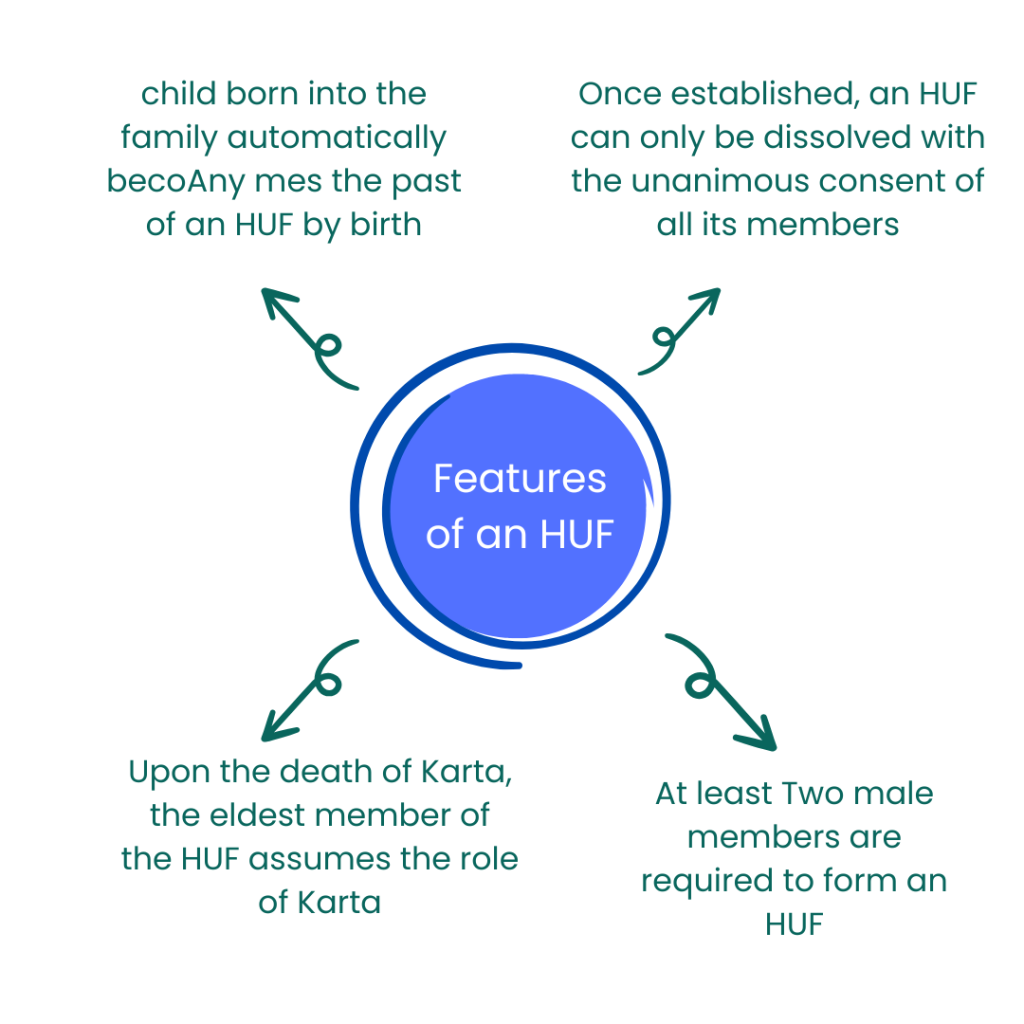

Features of HUF

- Any child born into the family automatically becomes the past of an HUF by birth

- Once established, an HUF can only be dissolved with the unanimous consent of all its members, and after dissolution, all assets are distributed among its members

- Upon the death of Karta, the eldest member of the HUF assumes the role of Karta

- At least two male members are required to form an HUF

- Karta holds unlimited liability while the coparceners have limited liability according to their shares

Get Started with TaxDunia

HUF benefits taxpayers as it minimizes the payable tax amount. However, in today’s times, these kind of legal entities are losing their importance due to the rise in nuclear family formation. Once an HUF is formed, ITRs have to be filed until the partition takes place. Reach out to TaxDunia to get personalized tax solutions. Our team of tax experts will help in determining whether you should go for HUF formation and go individual as a taxpayer. Get optimum advice for outstanding business growth.