What are Unit Linked Insurance Plans (ULIPs)?

The Unit Linked Insurance Plans (ULIPs)serve two purposes: investment and insurance. The ULIPs aim to provide life coverage with an investment option. In such kind of investment, a portion of money goes for the life insurance while the rest is invested in a fund. Companies offer ULIPs to help investors build wealth while also covering their life insurance needs. Such plans can be utilized to create funds for retirement, children’s education, or another important event, as per the investor’s preference. It helps to claim deductions under Section 80C of the Income Tax Act of 1961.

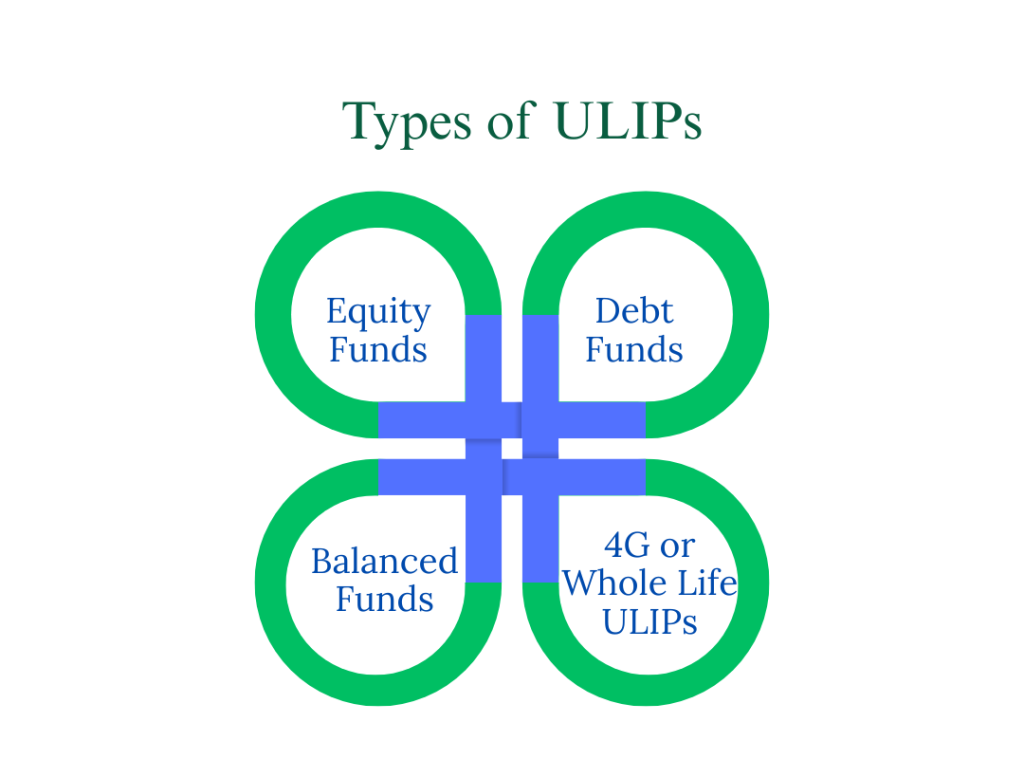

Types of ULIPs

ULIPs are products that come with a combination of a life insurance policy and an investment opportunity through a single plan. There can be the following types of a ULIP product

Equity Funds

Most of the funds go to equity or equity-oriented assets such as stocks of various companies.

Debt Funds

Most of funds are invested in debt instruments or money market instruments, government securities, bonds, and similar.

Balanced Funds

Where are premiums are invested in a combination of equity and debt market instruments.

4G or Whole Life ULIPs

Comparatively newer ULIP plans are available in the market. These plans carry lesser charges and newer features, such as the removal of return on mortality charges (ROMC) on maturity and premium allocation charges.

Lock-in Period for ULIPs

As the ULIPs are a combination of products that come with a life insurance policy and market-linked funds, 5 years is the minimum lock-in period for ULIPs, while as it is also a life insurance plan, it should be held for at least 15 years for optimum results.

Tax benefits of ULIP Investments

- ULIP premiums are eligible for tax deductions under Section 80C of the Income Tax Act. Recently, the government revised the benefit criteria, taxpayers can claim up to Rs 1.5Lakhs as deductions from the taxable income in a financial year on the amount paid in premiums.

- Additionally, the maturity amount is also subject to tax deductions under Section 10(10D) once the policy has matured and completed a specified lock-in period. Therefore, investing in unit-linked insurance plans not only insure the life of the policyholder but also secures their family and offers tax benefits.

Benefits of ULIPs for Policyholders

ULIP Type 1– In case of the unfortunate demise of the policyholder, the nominee receives either the assured sum value or the fund value, whichever is higher out of these two.

ULIP Type 2– In this case, the nominee receives the assured sum value plus the fund value.

Investing in ULIPs offers life cover, income tax benefits, and meet long-term financial goals. If you are looking for retirement planning, support child education, and create wealth, then going for ULIPS is one of the best options to invest your resources. Further, you can consult a chartered accountant based on your goals and risk appetite so that you can get the best returns with a secure investment.

Associated Cost in ULIPs

Investment in ULIPs has some associated costs, and these are mainly the following charges

Premium Allocation Charges

These charges are deducted in advance from the premium payment before the investment is apportioned into insurance and investment. Allocation charges are the expenses that the insurer incurred while selling the product to you.

Fund Management Charges

Fund management charges are capped at 1.35% by the IRDAI and deducted before the insurer arrives at the net asset value of the fund.

Mortality Charges

Levied by the insurer and depends on the insured person’s age, health condition, amount and duration of the life insurance policy sought.

Policy Administration Charges

Deducted for managing all administrative work.

Switching Charges

Charges are deducted if you switch investment funds in ULIPs.

Surrender Charges

Deducted for premature withdrawal.

Budget 2025 Changes in ULIPs

Finance Bill 2025 proposed that ULIPs not qualifying under Section 10(10D) will be taxed under capital gains head. And those qualifying under section 10(10D), meeting the following criteria

- Premiums must not be more than 10% of the sum assured for policies issued after April 1, 2012

- Also, the annual premium must remain below ₹2.5 lakhs

Will be exempted from tax.

Get Started with TaxDunia

If you are looking to make an investment in secure and reliable ULIPs and claim the legal tax deductions, then go no further and reach out to TaxDunia. Our team can plan a suitable policy for you that meets your financial goals while keeping your risk appetite in mind.