ITR-Updated: Key Details, Filing Procedure, and Latest Changes

In 2022, the Union Government of India introduced the concept of an updated income tax return (ITR-U). It aims to facilitate taxpayers who have missed or forgotten to file their ITRs for the relevant financial year in the current assessment year. Taxpayers should note that it is an updated return form means it cannot replace the revised form of ITR. It can be utilized in cases of missed or forgotten ITRs, not in cases of requiring removal, omissions, or income disclosures on the taxpayer’s behalf. This article reflects on the ITR-U, key details, filing procedure, and latest changes announced in the 2025 budget. File your ITR now with TaxDunia.

What is ITR-U?

The ones who have missed or forgotten to file their ITR can file the income tax returns in updated form so that they can avoid legal consequences and penalties. To bring transparency in taxation, the government introduced this form and allowed extra time so that more and more taxpayers can take part.

The ITR-U consists of two parts, A and B. Part A generally reports personal information such as PAN, name, Aadhaar, assessment year of the taxpayer, while part B contains details about the sources of income and deductions claimed or utilized. Assets or liabilities worth exceeding Rs 50Lakhs are to be reported in part B of the ITR-U.

Who is Eligible for ITR-U?

ITR-U can only be filed by those who either have missed filing the original ITR or forgotten though updates in ITR-U are possible, and under the following circumstances, you can make the updates in ITR-U.

- Income is not declared correctly

- Opted for the wrong head of income

- Paid tax at the wrong rate

- To reduce the carried forward losses or unabsorbed depreciation or tax credit under section 115JB/115JC

- ITR-U can only be filed once in an assessment year

Under the following conditions, taxpayers cannot file ITR-U

- The updated return is filed already

- For filing nil return or loss return

- To claim or increase the refund amount

- When a taxpayer has already filed an ITR

- When income tax authorities have seized books, documents, or assets under section 132A

- When there is no additional tax outgo as the tax liabilities are adjusted with TDS credit/losses

Updated Time Limit for ITR-U

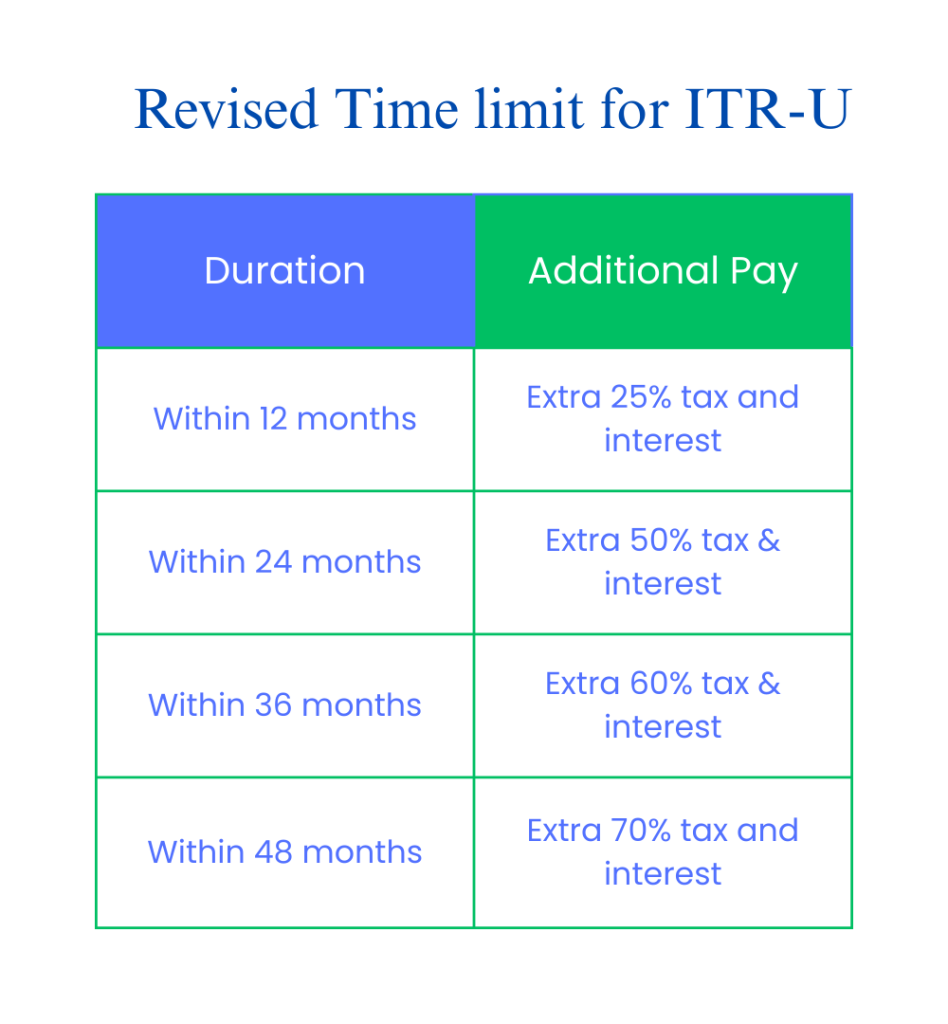

From the 1st of April 2025, the time limit to file an ITR-U is 48 months from the end of an assessment year. Till the 31st of March 2025, the time limit was 24 months, but the government revised the time limit to aid the taxpayers.

Skipping filing ITR-U years after year attracts extra interest depending on the time a taxpayer chooses to file. It means if the ITR-U is filed within the first year after completion of the assessment year, then there will be an additional 25% tax on the original tax amount, 50% extra if delayed for two years, and so on.

| Duration | Additional Pay |

| Within 12 months | Extra 25% tax and interest |

| Within 24 months | Extra 50% tax & interest |

| Within 36 months | Extra 60% tax & interest |

| Within 48 months | Extra 70% tax and interest |

How to File form ITR-U?

To get the ITR-U, a taxpayer has to follow the below-mentioned guidelines.

- Enter personal credentials such as name, address, mobile number, and more

- Enter the Aadhaar number and link it with your PAN if not already done yet

- Select your original, belated, or revised ITR form among others and enter the acknowledgment number if it was filed under section 139(1) and the date in part C of the form

- The taxpayer has to select the reasons for filing the updated return

Part B

- Provide details of additional earnings in each head of income

- Enter the income declared in the last return

- Total income amount found in Part B-TI of the selected ITR forms

- If any amount payable and refundable is found in Part B-TT of the ITR form

- The tax payable amount as per the last return

- Enter the amount claimed as a refund in the last return, including the interest amount on such refunds

- Late fees if the last return was filed late

- Aggregate liability on the additional income

- Additional tax liability on updated income (25% to 70%)

- If the tax already paid under section 140B of the ITR-U results in a tax payable amount, pay it as a self-assessment tax

How to Compute Tax for ITR-U?

You may wonder how to calculate the tax payable in ITR-U. Do not worry about it, as below is mentioned the method by following which you can calculate the tax payable by yourself.

Total Income Tax Liability= Tax Payable+ Interest+ Late-Filing Fees+ Additional Tax

Net Tax Liability= Total Income Tax liability- TDS/TCS/Advance/Tax Relief

It must be noted that ITR-U is different from the revised ITR. Later revisions in ITR is not an ITR-U but a separate return form only filed in cases of missed or forgotten ITR.

Get Started with TaxDunia

If taxpayers do not have any tax liability or have nil returns, they cannot file an ITR-U. Taxpayers cannot claim refunds or carry forward extra capital losses in ITR-U. Reach out to TaxDunia to get personalized advice for businesses and start-ups. Our team of dedicated professionals helps you meet smooth compliance and offers you a customized approach for the growth of your business.