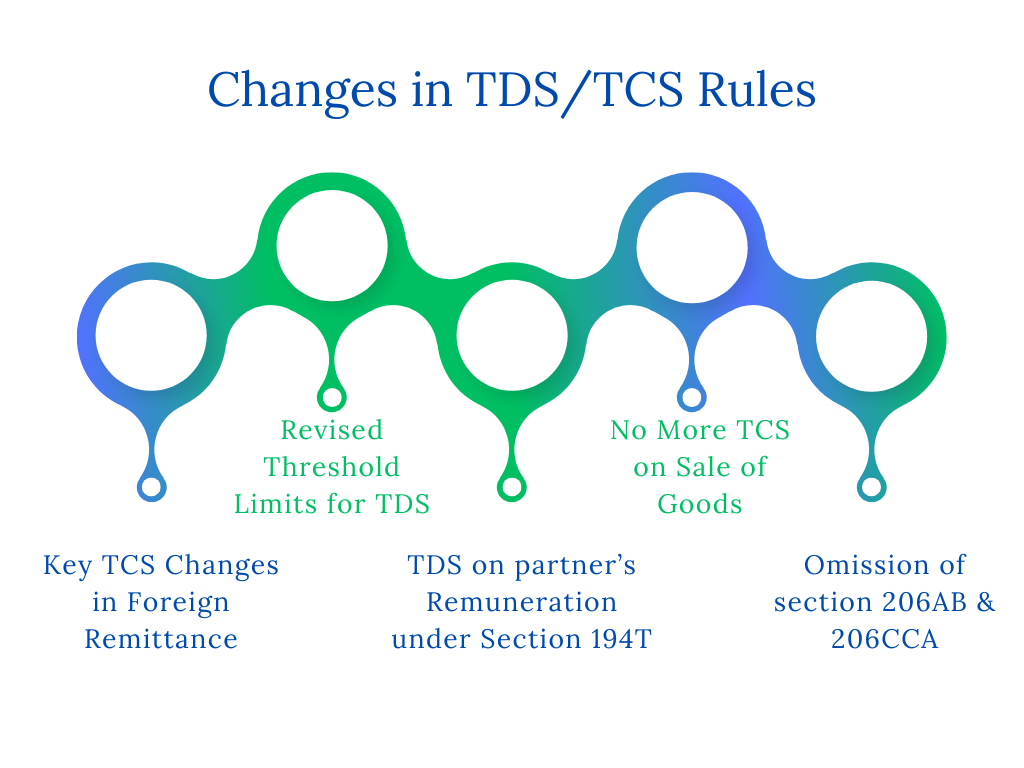

Latest TDS/TCS Changes: Effective from 1st April 2025

The Union Government announced significant changes to TDS and TCS in the 2025 budget. These changes highlight the importance of tax deducted at source and tax collected at source as these are the inseparable parts of the Indian Taxation. TDS/TCS contributes largely to up the revenue for the government and majorly influence the public policies. Therefore, the authorities implemented landmark changes so that compliance could be made smoother. This article discusses the Latest TDS/TCS Changes from 1st April 2025, including the higher threshold limits, removal of TCS under certain circumstances, and introduction of new provisions. File your TDS/TCS Returns now with TaxDunia.

Key TCS Changes in Foreign Remittance

The Liberalized Remittance Scheme (LRS) allows resident individuals, including minors, to freely remit up to USD 2,50,000 each financial year. It means Indian residents are allowed to send up to USD 2,50,000 abroad annually. TCS or tax collected at the source is a percentage collected on outward remittances made under the LRS scheme, which is reflected in Form 26AS. The threshold for collecting TCS on foreign remittances under the LRS has been increased to INR 10 lakh from INR 7 lakh under the previous tax regime.

In the 2025 budget, TCS on remittances for education purposes when made using a loan from a specified financial institution has been removed. Section 206C(1G) will be ineffective from the 1st of April 2025. The section covers TCS rates applicable to educational loans. The table below reflects the revised TCS Rates on foreign remittances from India.

| Outward Remittance Purpose | TCS Rates |

| LRS for education loan from financial institution | 0% |

| LRS for education fees other than bank-financed loans | 5% of amount above INR 10L |

| LRS for medical treatment | 5% of amount above INR 10L |

| LRS for other purposes | 20% of amount above INR 10L |

| Overseas tour program purchase | 5% of amount up to INR 10L 20% of amount above INR 10L |

Revised Threshold Limits for TDS

| Section No. | Old Threshold for TDS (₹) | Revised Threshold for TDS (₹) |

| 193- interest on securities | Nil | 10,000 |

| 194- Dividend for an individual shareholder | 5000 | 10,000 |

| 194A- interest other than interest on securities | 50,000 for senior citizens40,000 when payer is bank, cooperative society & post office 5000 in other cases | 1,00,000 for senior citizens 50,000 when payer is bank cooperative society & post office 10,000 in other cases |

| 194B- winnings from lottery, crossword puzzle 194BB- winnings from horse race | 10,000 per annum | 10,000 per transaction |

| 194D- Insurance commission 194G- income by way of commission, prize etc., on lottery tickets 194H- commission or brokerage | 15000 | 20,000 |

| 194J- fee for professional or technical services | 30,000 | 50,000 |

| 194K- income in respect of units of a mutual fund | 5000 | 10,000 |

| 194LA- income by way of enhanced compensation | 2,50,000 | 5,00,000 |

| 194LBC | 25% if payee- individual or HUF & 30% otherwise | 10% |

No More TCS on Sale of Goods

There will be no more TCS on the sale of goods from the 1st of April 2025 under section 206C(1H). Under this section, a seller had to collect TCS on the sale of goods if the total value of sold goods exceeded Rs 50L, which was in contrast to section 194Q, where the buyer also had to deduct TDS on the purchase of goods on the same condition.

This will be made ineffective from the 1st of April 2025.

TDS on partner’s Remuneration under Section 194T

Section 194T was introduced in the 2024 budget, and it will come into effect on the 1st of April 2025. Under section 194T, firms and LLPs are to deduct TDS at the rate of 10% for the payment made to its partners. The payment has to be above Rs 20,000 in a financial year in the form of commissions, remuneration, bonuses, salary, or interest to partners.

Also the other milestone in the field of TDS/TCS is the omission of sections 206AB & 206CCA. These sections require businesses to deduct or collect tax at usually higher rates on payments made to non-ITR filers in the last year. These sections will be ineffective from the 1st of April 2025, making compliance easy, as businesses do not need to identify such non-filers before deducting or collecting the taxes.

Get Started with TaxDunia

To get the latest updates, stay in touch with TaxDunia. We aim to simplify the taxes and amply the growth of businesses. Make it your one-stop destination to get the real time updates and comprehensive support throughout.