What is GST Registration Certificate?

Businesses having an annual turnover of above Rs 20 lakhs for businesses dealing with services (Rs 40 lakhs exclusive to businesses dealing with goods ) must obtain a GST registration certificate and attach at the front of the office space. They recieve this certificate after successful registration on the GST Portal. Both securing the registration and attaching it at the front of office premises are regulated by the legal laws of Goods and Services Tax. There is no annual turnover limit for e-commerce businesses therefore they must secure it before starting the operations.

Validity of the GST Certificate

In General cases, the GST Registration Certificate becomes valid from the date when acquiring it becomes an obligation if they submit the application within 30 days from the day when liability arises. If they did not submit the application within the 30 days, then it will be applicable from the date of issuance.

There is no time limit for the registration expiry if it is issued to the regular taxpayers. It remains valid as long as it is surrendered or canceled for the regular taxpayers. For a casual taxable perons, it is valid for 90 days though it can be renewed after the end of its validity period.

Effective Date for the GST Registration

The effective date for the GST registrtion is the one when the person becomes liable to register or crosses the trheshold limit mandated by the GST. Therefore, an application for the registration must be submitted within 30 days from the date when they become liable or surpasses the limit.

How to Download GST Certificate Online From GST Portal?

The GST Registration Certificate is issued by the government of India, and taxpayers can download it from the GST’s official website. Businesses having a specific annual turnover and crossing pre-defined limits have to get a registration certificate to avoid being penalized.

Continue through the post to learn the details on How to Download the GST Registration Certificate Online. The GST Certificate contains the GST Identification Number and is issued in form GST REG-06. The certificate is available on the official portal of the website as the authorities do not provide physical copies to the registered taxpayers.

Step-by-Step Guide to Download GST Certificate From GST Portal

Step 1

- Login to the GST Portal

- Then go to the “services” and click on the “use service” menu then select the “view/download certificate” option

Step 2

- Then appears GST REG 06 form, download the GST Certificate to give your business a legal identity and meet all legal compliances

- Save the document in PDF format for future use. You can take a printout of the certificate and attach it to the primary place of business

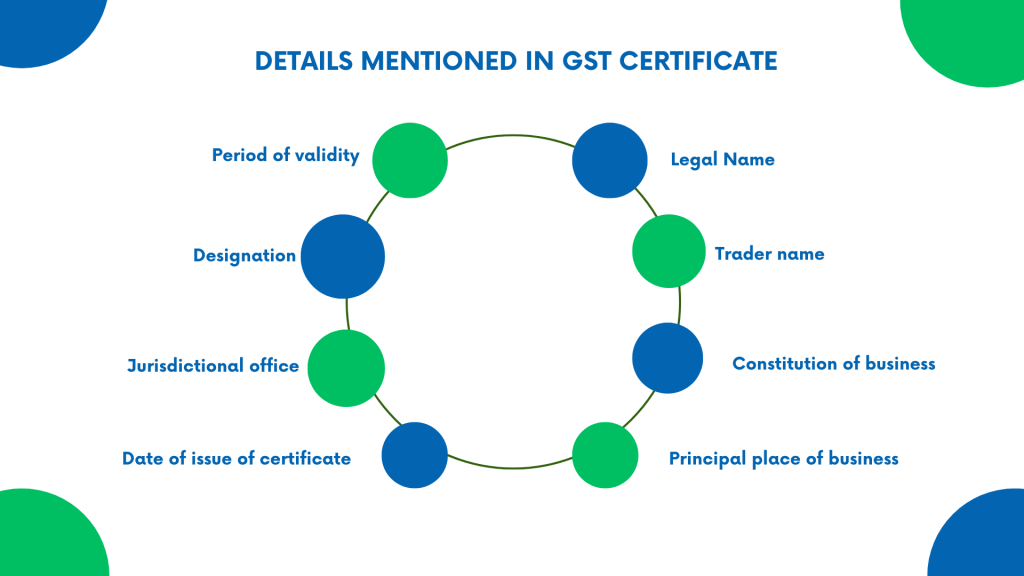

Details Mentioned in GST Certificate

- Legal name

- Trader name

- Constitution of business

- Principal place of business

- Period of validity

- Type of registration

- Designation

- Jurisdictional office

- Date of issue of certificate

What are possible Changes You can Make in GST Certificate?

When you are applying for a certificate, you must have to provide several business details for authentication purposes. However, in case, these details might change in the long run they must be updated in the certificate also. Here is the list of details that you can possibly change again or amend in the GST Certificate.

- Business Name changes on condition that it does not affect the PAN details

- Change in the principal business location

- In additional place of business

- Any changes made to annesure B (that may affect in charge of the enterprise, for example, addition of partmers, retirement of partners, or appointment of new directors, etc.)

- Contact details or mail addresses

Get Started with TaxDunia

If you are having any difficulty in downloading or obtaining your GST Certificate, though you have already applied successfully, reach out to the team of TaxDunia. We offer personalized solutions to our clients so that the specific and unique needs of our clients are met with ease in a time-bound manner. Our expert team will do the required paperwork for you while you can focus on the growth of an emerging or established business, unlocking the untapped potential. Let us start today to get the best results in future.