Guidelines for Filing Income Tax Return-2

Income tax return filing is an important responsibility for taxpayers in India. This file applies to individuals having income from sources other than business. This blog gives a complete picture of who is to file ITR-2 and how to file it online on the portal.

Types of ITR Forms

There are seven main types of ITR forms to be filed by taxpayers, each applicable based on the nature and amount of income:

| ITR Form | Applicability |

| ITR-1 (Sahaj) | Individuals with income up to ₹50 lakh |

| ITR-2 | Individuals with income from salary, house property, capital gains, and foreign income. |

| ITR-3 | People with income from business. |

| ITR-4 (Sugam) | Individuals, HUFs, and firms with income up to ₹50 lakh from business. |

| ITR-5 | Firms, LLPs, AOPs, BOIs, and other entities. |

| ITR-6 | Companies. |

| ITR-7 | Trusts, political parties, and other specified entities. |

Purpose of ITR

The main aim of submitting an ITR is to:

- Report Income: Notify the government of every source of income.

- Claim Deductions: Notify for deductions and allowances to decrease tax payable income.

- Pay Taxes: Pay tax owed or request a refund in case of payment of more than the taxable amount.

Who Should File an ITR-2?

ITR-2 can be used for individuals and HUFs for whom the following sources are a part of the income:

- Salary/Pension: Income arising as a result of employment or pensions.

- House Property: Rental income from houses, including more than one house.

- Capital Gains: Gains from the sale of investments or houses, including long-term and short-term gains.

- Other Sources: Winnings from lotteries, betting on racehorses, and other games of chance.

- Agricultural Income: Receipts over Rs 5,000 from agricultural pursuits.

- Foreign Income/Assets: Income received overseas or foreign assets.

- Resident Not Ordinarily Resident (RNOR) or Non-Resident: Status that determines tax liability depending on residence.

Documents Needed for ITR-2 Filing

You will require the following documents for filing ITR-2:

- Form 16: Your employer’s form that states salary income and TDS.

- Form 16A: For interest income TDS from fixed deposits or savings.

- Form 26AS: For TDS deduction on different income sources.

- Rent Receipts: For HRA or deduction.

- Capital Gains Statements: For calculating capital gains from shares or securities.

- Bank Documents: Passbook or FDRs for interest income.

- Property Income Documents: Tenant information, local taxes paid, and interest on borrowed funds.

- Loss Documents: For losses of the current or preceding years.

- Tax Saving Investment Proofs: For deductions under sections such as 80C, 80D, and 80G.

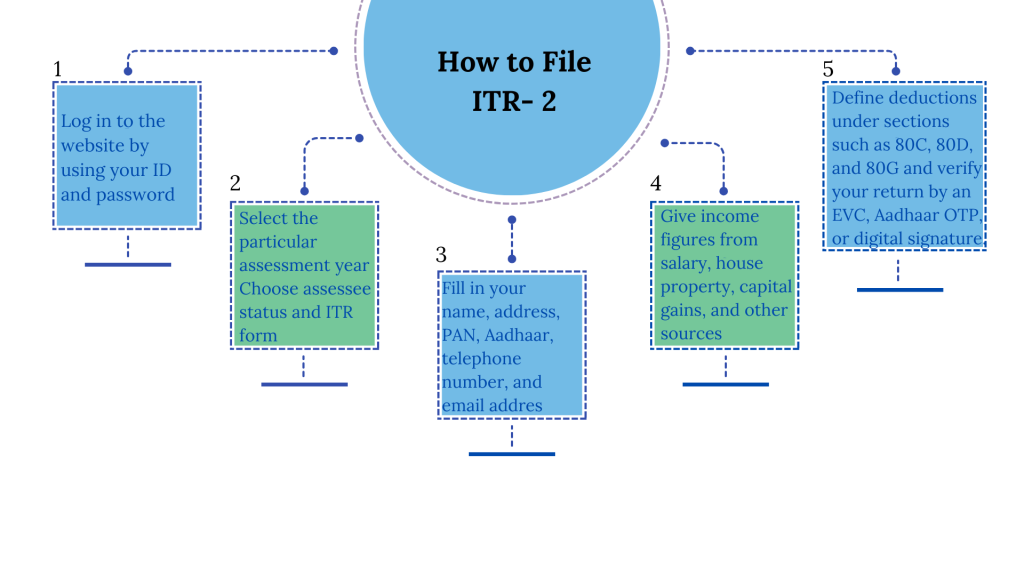

Step-by-Step Guide to Filing ITR-2 Online For Assessment Year 2025-2026

- Step 1: Log In

Go to the official Income Tax India website and log in with your ID and password.

- Step 2: Select Year

Select the year of assessment (2025-2026) and choose ‘Online’ as your filing method.

- Step 3: Choose Assessee Status and ITR Form

Choose your status as an individual or HUF and select the ITR-2 form.

- Step 4: Fill in General Information

Fill in your name, address, PAN, Aadhaar, telephone number, and email address.

- Step 5: Fill Income Details

Give income figures from salary, house property, capital gains, and other sources. Fill out relevant schedules, such as Schedule S, HP, CG, and OS.

- Step 6: Claim Deductions and Compute Tax Liability

Define deductions under sections such as 80C, 80D, and 80G. Your tax liability will be calculated automatically by the form.

- Step 7: Validate and Verify

Validate your form according to the criteria of the income tax website. Verify your return by an EVC, Aadhaar OTP, or digital signature.

- Step 8: Get Acknowledgement

When your verification is successful, you will get an acknowledgment receipt by email.

New Features in ITR-2 for AY 2025-2026

- Schedule VDA: Reporting income from Virtual Digital Assets (cryptocurrencies).

- Relief u/s 89A: Relief to residents earning from foreign retirement benefits.

- Section 10(12C): Exemption of payments from the Agniveer Corpus Fund.

- Schedule SI: New item for income from Virtual Digital Assets.

- Section 80 CCH: Deduction to Central Government employees donating to the Agniveer Corpus Fund.

Get Started with TaxDunia

Submission of ITR-2 demands detailed care and follow-through on the steps given here. Having the requisite documents at hand and precise filling out of the form will make the exercise smoother. Reach out to TaxDunia to meet your compliance and file your ITR from the comfort of your home.