What is GST?

GST Overview and Key Concepts

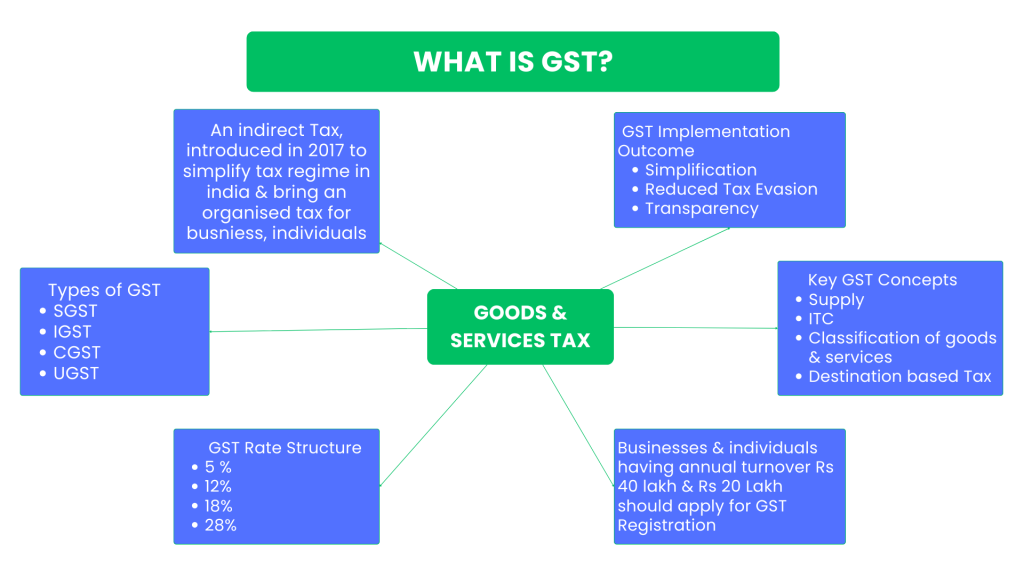

The Goods and Services Tax (GST) is an indirect tax system in the country that aims to facilitate the seamless taxation of goods and services. India implemented the GST in 2017 with the purpose of creating one unified market by replacing all the various state and central taxes with one single tax. This not only simplifies the tax structure but also increases compliance and transparency.

Overview of GST

The “One Nation, One Tax” principle is the foundation upon which GST is built. It abolishes the pre-existing cascading effect of taxes levied at successive stages of production and distribution. This ensures that there is a collection of taxes only on value addition every time, which brings relief to the final consumer by removing a significant amount of his tax burden. Many such indirect taxes such as the VAT, central excise duty, and service tax are subsumed in this framework of taxation under the GST.

These are the major outcomes of the GST implementation process:

1. Simplification: All the taxes are brought under GST, and tax compliance is straightforward for the businesses as less paperwork is involved while filing.

2. Transparency: The uniform nature of GST explains to the taxpayers exactly what it is being paid because of the transparent nature of its tax structure.

3. Reduced Tax Evasion: Business entities are made to regularly maintain proper books of accounts and file returns, so there is increased accountability with less tax evasion.

4. Boost in Economic Activity: GST will ensure easy movement of goods between states and establish a national market, thus stimulating economic activities and growth.

Key Concepts of GST

Effective compliance and management require a proper understanding of the key concepts of GST:

1. Input Tax Credit (ITC): The one major feature of GST is that it provides ITC. Credit can be claimed for all the tax paid on purchases of goods and services used for purposes of business activities. Credit can be absorbed against GST payable on his sales; it ensures that, at every stage of value addition, tax is applied to only the addition of value.

2. Supply: The idea of supply is the base of GST. It consists of all types of supplies such as sales, transfers, barter, exchange, and disposing of goods and services. If a transaction is classified as a supply, then it generates GST liability.

3. Destination-Based Taxation: GST is a destination-based tax, meaning that it applies at the destination rather than at the source. This means that where goods and services are consumed, revenue will be raised for the state and equitably distributed revenue.

4. Registration: Any business which has its turnover over a certain limit, has to get itself registered for GST. With such registration, the business is issued with a GST Identification Number (GSTIN), and can thereby collect tax and avail Input Tax Credits.

5. Compliance: In GST, a return has to be filed in a periodical manner, with correct records of sales as well as purchases. It helps the smooth functioning of tax systems and ITC availing.

6. Classification of Goods and Services: In GST, goods and services fall into different categories with various tax rates. This affects the tax burden on the consumer and business as a whole

Types of GST

Type of GST | Full Form | Applicable Area | Collection Authority | Nature of Transaction | Key Features |

CGST | Central Goods and Services Tax | Intra-state (within a state) | Central Government | Goods and services sold within the same state | Collected by the central government; shared with states; and used for central revenues. |

SGST | State Goods and Services Tax | Intra-state (within a state) | State Government | Goods and services sold within the same state | Collected by the state government; retained by the state; the same rate as CGST. |

IGST | Integrated Goods and Services Tax | Inter-state (between states) | Central Government | Goods and services sold across state borders | Collected by the central government; facilitates seamless inter-state trade; allows for ITC across states. |

UTGST | Union Territory Goods and Services Tax | Union Territories | Central Government | Goods and services sold within Union Territories | Similar to SGST; applicable in Union Territories without a legislative assembly; retained by the central government. |

GST Rates classification: Goods vs. Services

Goods and Services Tax (GST) applies a consistent rate structure that varies according to the nature of the goods and services. Therefore, it is crucial that businesses and consumers know their classifications because these classify tax rates and compliance obligations.

GST Rate Structure

GST rates are categorized into different slabs; this is because the government wants the affordability and revenue generation to be balanced. So, the major rate slabs of GST in India include:

1. 0% Rate: This category includes basic goods and services such as unprocessed food items, healthcare, and educational services. The point is that these necessities need to be affordable for each consumer.

2. 5% Rate: This rate applies to goods of mass consumption like household goods, foodstuffs, and basic services. The low rate is meant to help these basic items reach more consumers.

3. 12% Rate: It comprises processed food, some capital goods, and some services. These are products that are not necessary but do have large-scale consumption.

4. 18% Rate: This is the common rate, and it applies to most commodities and services, including consumers’ products and professional services. This is the maximum rate at which GST can be charged.

5. 28% Rate: The slab is for luxurious commodities and services. This includes luxury cars, cigarettes, and luxury hospitality in a five-star hotel. The government expects that this rate would generate more taxes for them since they fall into the category of luxuries and non-essential.

Classification of Commodities and Services

The commodities and services are classified differently under the GST regime with different considerations and corresponding tax rates applicable to each one.

Commodities

Goods refer to tangible goods and wares which can be physically felt and stored. In a continuation, GST classifies the category of goods in more ways based on its character and usage:

Staple Goods: Foods and other things essential in life are subject to lower rates or are entirely not taxed under GST.

Durable Goods: It includes electronic products, etc, which are often more charged.

Consumer Goods: Consumer goods are items to be used in daily life, such as clothing and household items, and fall at different GST slabs depending on their classification under GST.

The classification of goods comes directly under the GST rate. While basic food falls into the bracket of 0%, luxury items, such as high-end watches, fall into the 28% slab.

Services

Services are those activities that yield value but do not result in the ownership of a physical product. Some examples of services are consulting services, transportation services, and hospitality services. Due to its intangible nature, the classification of services under GST could be more complicated.

Taxable Services: Most services are taxable, and the GST rate applicable will depend on the type of service. For example, restaurant services might be taxed at 5% or 18% depending on their classification.

Exempt Services: Some services, like educational and healthcare services, are exempt from GST for easy access.

GST Registration: Who needs it and how to apply

Goods and Services Tax registration is a crucial step for Indian businesses, as it grants them a unique Goods and Services Tax Identification Number (GSTIN) and allows them to collect taxes and avail input tax credits. Knowing who needs GST registration and how to apply is essential for compliance and effective business operations.

Who Needs GST Registration?

- Turnover Limits: All businesses with an aggregate turnover above the prescribed limit need to register for GST. To date, this limit has been ₹20 lakhs for most states and ₹10 lakhs for special category states (Northeastern states and Jammu & Kashmir). This limit has its total consideration of all taxable supplies without considering the supply that’s exempted from GST.

- Inter-State Supply: All businesses that are engaged in the inter-state supply of goods and services have to register themselves under GST, irrespective of their turnover. This may include selling products or providing services across state borders.

- E-commerce Operators: All e-commerce operators will be required to register themselves under GST. This includes all platform providers and sellers utilizing such platforms.

- Casual Taxable Persons: Persons or businesses supplying occasional or seasonal goods or services in a state in which they are not registered must register themselves under GST. Generally, it is so for traders selling goods at fairs or exhibitions.

- Non-Resident Taxable Persons: Non-residents supplying goods or services in India have to get registered under GST irrespective of the turnover.

- Agency, Input Service Distributor, and Trade carried on by any person under his business in someone else’s name falls under other categories of business. All require registration.

Advantages of GST Registration

- Legal Identification: The only identification a business gets under the law is through registration. Hence, the business will operate in the bounds of GST laws.

- Input Tax Credit: Only if the business is registered under GST will it be able to claim input tax on the amount paid for purchases which will reduce the total tax liability.

- Enhanced Credibility: GST registration improves a business’s credibility so it can be involved in any government contract and get itself regularized.

- Advantages of Streamlining Compliance: Registered businesses shall be permitted to have their compliance processes streamlined like no return filing.

Procedure for Registration Under GST

The process of GST registration is very simple and is easy to follow. Now, let’s find out how to do it step-by-step:

- Login to GST Portal: Use the official GST website, www.gst.gov.in, to apply.

- Submit Application Form: Fill in form GST REG-01 by providing the following: business name, type of business, PAN number, and the state in which the business is conducted.

- Upload Documents Required: Prepare and upload all relevant documents:

- Business registration proof (such as partnership deed, certificate of incorporation)

- PAN of the business

- Proof of identity and address of the proprietor or partners

- Bank account statement or canceled cheque

- Proof of business address (such as utility bill, lease agreement)

- Submit the Application: Once all details are filled in and documents uploaded, apply.

- ARN obtained: Once the application form is submitted, then an Application Reference Number is received. The same Application Reference Number can be checked in order to know if an application is being approved or not.

- Verification and Approval: This will be verified by taxing authorities. If the applicant’s information is accurate and proper, then one shall get the GSTIN after a few days of application. In case there is a dispute, then one might be asked again to submit some additional documents as well.

- Issue GSTIN: After such registration, the businesses concerned will be issued a GSTIN which they can avail of for collecting and paying of GST.

Conclusion

For businesses to comply with this GST framework and enjoy its provisions, registration under GST shall be considered an important aspect. If one knows exactly who has to register under GST and how to get registered, it becomes pretty easy to allow businesses the time to focus on other growth and operations while all the regulatory requirements are upheld.

Get Started with TaxDunia Today

TaxDunia is your one-stop solution for tax and financial services, tailored to meet the needs of both individuals and businesses. With services like GST filing, income tax returns, bookkeeping, and compliance management, TaxDunia simplifies complex financial tasks.